|

| |

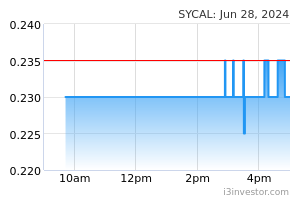

OverviewFinancial Highlight

HeadlinesNo recent Headlines for this stock. Business Background Sycal Ventures Bhd is an investment holding company primarily engaged in the construction industry. The company has three reportable segments: Construction, Property development and Manufacturing and Trading. Construction includes civil and building construction works. Property development is engaged in property development, property management, and consultancy. Manufacturing and trading consist of manufacturing and trading in ready-mix concrete and trading in building materials. The firm develops projects for government and private sector including low-rise and high-rise housing, infrastructure, landmark buildings, universities, hospitals and commercial developments. The group operates in Malaysia.

commonsense Since FY16, the company has only managed to deliver very small profit to its shareholder. 9m18 result only manged to record a profit of RM1.8mil. Even if the company manged to deliver a higher than average profit of RM2.5mil for the full FY18, at the current share price, it would have already been value at almost 30x PE. To think it can deliver a higher profit in FY19 might be a bit of a wishful thinking on the part of some investors especially given the depressing property market at the moment. If you are looking to diversify your portfolio outside of Sycal Ventures (due to its earnings uncertainties and relatively high valuation) I would recommend you to look at MBMR. MBMR is a direct proxy to Perodua via its 22.6% interest in the company. Valuation is cheap at only 6.9x PE (based on target FY18 profit of RM145mil. 9m profit is already RM106mil). PB is low at only 0.7x BV. 4Q18 results is expected to be higher than 3Q18 and last year's 4Q17. FY19 growth will be driven by the still high demand of the new Myvi and the newly launched SUV Aruz and also the newly revamp Alza in 2H19. The recent announcement of closure and potential disposal of the loss-making alloy wheel manufacturing business alone is expected to boost the company’s profit by an additional RM20mil. I am projecting a profit to shareholder of RM170 mil for FY19 which at the current price values MBMR at only 5.9x PE. Please go through the analyst reports (https://klse.i3investor.com/servlets/stk/pt/5983.jsp) and do your own analysis before making any decisions. There are 8 analysts in total covering the stock with most of them having a TP of above RM3 (all have a buy rating). The average TP for the 8 analysts is around RM3.50. Good luck. 29/01/2019 12:38 PM Investhor below is Mandarin version of article: https://klse.i3investor.com/blogs/InvesthorsHammer/201206.jsp 06/04/2019 8:02 AM thesteward This counter is truely overlooked such a high nta and making good profit trading so cheap . What a gem 29/04/2020 12:46 PM Peace99 hello, jaynetan, good to see you here! So, looks like this counter will be rewarding just like VSolar! 15/07/2020 9:50 PM jaynetan oh p99 meet you again here. nice sycal attracts me. buying some to try my luck 13/07/2020 10:45 AM 16/07/2020 12:42 AM jaynetan looks like vsolar but much differences , hope it helps me to retire early 16/07/2020 12:45 AM Peace99 Would be nice to retire early and healthy! Just wonder what you think of dolphin international as it is also doing right issues to acquire Uncle Don. Ex-date 23 July. It's quite active trading now. 16/07/2020 10:14 AM jaynetan market active many cash calls. to be cautious , i only prefer minimum risk which is in favor of me and able to shoulder the downside. i wait see . in the mean time, i prefer sycal with several self satisfaction reasaons, or shiok sendiri only. just a laugh 16/07/2020 10:51 AM Peace99 Would you mind to share your reasons for sycal? Just as a reference, as I should do my homework too! Cheers 16/07/2020 11:44 AM Peace99 Thanks, and iIndeed, the fund to be raised will be mainly used in the housing and condo projects which look good to me. I know of this ICPS thing just now and the share price now is about 3-5 sens higher than last week when the price was less than 20sen, so I lose out a bit, but this extra 3-5 sens when spread over the 15 ICPS is just about 0.3 sen/ICPS. With egm on 6 Aug means the ex-date will be soon. Conclusion: I will definitely buy too. 17/07/2020 10:45 PM Peace99 I am hopeful that these ICPS thing will bring the good profit just like the VSolar right issues:) 17/07/2020 10:48 PM jaynetan The rm 20 m subscription of icps by major share holders to be a good catalyst 20/07/2020 9:40 PM sweng88 hi Jaynetan, i understand abt RI, but i still dun understand abt ICPS, can you teach me, i also want to retire earlier thanks 20/07/2020 10:52 PM jaynetan a few types of loan stocks icps , rcps are two fo them icps, irredeemable convertible preference shares. 21/07/2020 5:13 AM Peace99 Sweng88 and all, Below is copied from Bursa Announcement. Pls check there for more details. The Proposed Rights Issue involves the issuance of up to 6,244,866,420 ICPS on the basis of 15 ICPS for 1 Share. Based on the Conversion Mode, the ICPS can be converted into new Shares at the Conversion Price in the following manner: (a) by surrendering for cancellation twenty (20) ICPS for conversion into one (1) new Share (“Conversion Ratio”) (“Conversion Mode 1”); or (b) by surrendering for cancellation one (1) ICPS together with a cash payment of RM0.19 for one (1) new Share (“Conversion Mode 2”). 28/07/2020 12:44 PM Peace99 Each ICPS costs 1 sen to subscribe. In short, if you choose Conversion MOde 2, you get 1 share by paying 1sen +19sen=20sen. Now the price is 26sen, so potentially major earning. Jaynetan, is this the main idea? 28/07/2020 12:50 PM BURSAMASTER https://klse.i3investor.com/blogs/Bursa_Master/2020-08-31-story-h1512603328-COULD_THIS_STOCK_BE_ANOTHER_TAKEOVER_EPISODE_OR_IS_IT_JUST_A_GUESSING_G.jsp 31/08/2020 10:09 AM BabyAce This stock actually got potential. Sudden breakout takut. Btw, I'm staying in one of the properties they built, really not bad actually. 31/08/2020 5:48 PM Peace99 Yes, although the icps stuff got postponed. Demand for housing seems moving up.... 13/12/2020 10:49 AM Peace99 @BabyAce Thanks for sharing Sycal properties not bad, giving us more confidence to hold. 13/12/2020 10:53 AM Peace99 ICPS called off, see announcement 30 march. It says the Perak project is making" net development proceeds of 24mil"....looks like it can do without the ICPS, that's why called off! Can expect share price up sooner or later? 01/04/2021 8:15 PM | |