|

| |

OverviewFinancial Highlight

Headlines

Business Background Padini Holdings Bhd is a Malaysian investment holding company. The company and its subsidiaries are principally engaged in the retailing of garments industry. The group has five segments, these companies are the strategic business units of the Group. Vincci Ladies' Specialties Centre Sdn. Bhd, Padini Corporation Sdn. Bhd, Seed Corporation Sdn. Bhd, Yee Fong Hung (Malaysia) Sendirian Berhad, and Mikihouse Children's Wear Sdn. Bhd. Other operating segments comprise management services and investment holding. The business of the group is predominantly operated in Malaysia.

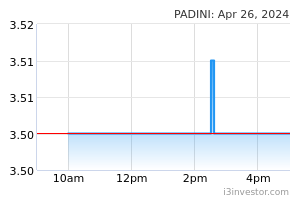

wallstreetrookieNEW Among five favourite stock for Manulife this year as below:- The top five holdings of the fund were Dayang Enterprise Holdings Bhd (3.6%), Bank Islam Malaysia Bhd (3.1%), Padini Holdings Bhd (3.1%), Velesto Energy Bhd (3%) and Genetec Technology Bhd (2.9%). 27/03/2023 3:13 PM Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥ Security LastPr PE DY% Divcts ROE ttm-marg PADINI (Retailers) 4.08 11.56 2.5 10 23.68 13.7 30/03/2023 4:10 PM Cakes Moon Padini is the defensive stock that you should include in portfolio!!! I buy in for long term gains!!! 03/04/2023 1:00 PM Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥ Its latest EPS is reaching those of its historical highest EPS. Latest dividend of 12.50 sen per share is encouraging. It is trading at fair PE of 17 and DY 3.17%. 12/05/2023 5:01 PM stockraider Time to sell loh! It best time mah! Already reach rich valuation loh....consumer demand on clothing is tapering loh! 13/05/2023 10:06 AM enigmatic [bamboo investing style] On sleepless nights like these, Padini is one share that won't give me sleepless nights. Simple yet beautiful stock returns. 16/05/2023 1:06 AM dragon328 Operating cashflows are even stronger at RM205.5 million in the first 9 months, annualised to RM274 million or 42 sen per share. Minus capex of RM19m for the year, free cashflows may amount to RM255 million a year or 39 sen per share. Hence Padini will be able to declare 12 sen dividend or higher for this year. 30/05/2023 12:35 PM dragon328 Padini growth prospects will be at overseas markets after it strengthens its market share in Malaysia with a total of 133 stores here. In comparison, it only has 5 stores in Thailand and 4 in Cambodia. The growth potential in Thailand and Cambodia is tremendous given the huge population there. But retails clothing business in Thailand is highly competitive, so Padini is still trying to figure out how to penetrate this market before it embarks on larger scale of expansion there. Comparatively, Cambodia is less competitive and offers more room for Padini to expand. Vietnam will be another country for possible expansion for Padini. 20/06/2023 8:54 AM Nepo very good explanation. if can penetrate Cambodia and Vietnam, then i believe share price will be triple more.. 20/06/2023 11:38 AM dragon328 In fact, there is still room for Padini to expand its presence locally. Now Padini stores are mainly in big cities and big shopping malls, hence only 133 stores currently in Malaysia. It has the potential to expand into 2nd and 3rd tier cities and towns, given its products are at affordable prices. Considering that Watson can have 700 pharmacy retail outlets in Malaysia, why not Padini? 21/06/2023 4:56 PM Nepo 在出席巴迪尼控股线上汇报会后,我们对巴迪尼未来前景维持乐观看法。 公司首3个季度的同店销售增长(SSSG),按年走高65%,但管理层透露,接下来的4、5月销售将与去年持平,归咎于高通胀与高利率环境,打击消费者情绪。 我们了解到,该公司计划未来在柬埔寨开设两家分店。同时,也积极探索在大马多开设5家新店,以及在泰国开设1至2家新店的可能。 管理层强调,泰国的服饰零售业仍然竞争激烈,但目前并没有关闭任何门店的计划,主要是因为当地部分门店已在今年某些月份开始录得盈利。 24/06/2023 5:32 AM HafizAjiad98 Bagus, kwsp kutip secara berturut-turut. Yakin Padini akan pecah Rm4 semula 10/08/2023 5:29 PM Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥ Padini FY ending 30.6.2023 EPS is at historical high level of 33.85 sen per share. DPS for this year 11.50 sen per share. YoY Revenue 1822m Gross Profit 718m GPM 39% PBT 296m PBTM 16.2% EPS 33.85 sen OPBCWC 419m Capex 26.4m Cash 605m ST Borrowings 3.9m NA per share RM1.58 ROE 21.4% Despite retailing being a very challenging sector, Padini seems to be the "king among local retailers", This company has given fantastic returns to those who invested in it from its earlier years, when its price per share was less than 50 sen (adjusted for capital changes to date.) Wealth is created by finding these companies and staying in them for the long term. 25/08/2023 9:13 PM Nepo MIDF RESEARCH (AUG 29): We attended Padini Holdings Bhd’s virtual briefing and remained optimistic about its FY24’s outlook. The salient highlights include Padini’s high inventory level in 4QFY23. The inventory for 4QFY23 was at RM433.2 million compared to RM137.3 million in 4QFY22. Management highlighted that the impact of slightly higher inventory is manageable, with an inventory turnover of around four months (143 days as at 4QFY23). In 4QFY23, same-store sales growth decreased by 2%, a notable contrast to the 41% same-store sales growth seen in 3QFY23. However, SSSG for the full year, 12MFY23, increased by 29%. Average basket size (ABS) remained relatively stable in 4QFY23, with the blended ABS at approximately RM100 per basket, similar to 4QFY22. Meanwhile, ABS for free-standing stores ranged from RM80 to RM90 in 4QFY23. Padini’s gross profit margin increased from 38.5% in 12MFY22 to 39.4% in 12MFY23. This was primarily due to price hikes on certain products over the years. Looking ahead, management aims to maintain the gross profit margin in the range of 38%-39% so as to stay competitive in pricing while retaining customers. 11/09/2023 10:15 PM Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥ PADINI Financial Information Learn how to use the financial indicators Market Capital (RM) : 2.599b EPS (cent) : 33.85 Business+ : Number of Share : 657.91m P/E Ratio : 11.67 YoY Score : TTM Revenue : 1.822B ROE : 21.42% QoQ Score : TTM Profit : 222.69M Dividend (cent) : 11.500 ^ Debt/Asset Ratio : TTM Profit Margin : 12.2% Dividend Yield : 2.91% Net Cash (RM) : CAGR - Revenue : 1.7% Dividend Policy : Net Cash/Share (RM) : CAGR - PAT : 4.6% Dividend Payout : Equity Growth : NTA (RM) : 1.580 P/B Ratio : 2.50 Free Cash Flow (cent) : 11/09/2023 10:32 PM Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥ My intrinsic value for Padini is RM 6.00 per share! 11/09/2023 10:35 PM Albukhary For me, PADINI performance is the best describe of Malaysia Retail Market. Although you see there are still many ppl in mall, but actually the spending power of all consumer has drop, many people just go mall to walk and enjoy aircond, when they eat, they order less food, when they shop, they shop lesser. For a normal office executive who earn RM5k salary, last time he used to buy G2000 or ZARA shirt (RM150 per shirt), eat Sushi at Rakuzen (2 pax around RM100). Now, he will shop at Online (unknown brand, cheaper RM79 but same quality with G2000), he eat at GO Noodle (2 pax around RM50). Below are the commentary of prospect from PADINI report :- Retail business in general remains challenging due to the deterioration in purchasing power arising potentially from the rising cost, trade tensions and rising inflation and interest rates. However, supply chain issues, material costs and freight charges seem to have stabilised although there may still be some further increases in the short term. Despite the potential challenges, we are optimistic in performing satisfactorily for the current financial year. Management will continue to provide value for money products and implementing measures to control costs, optimise working capital, preserve cash and streamline the operations to minimise any adverse impacts. 30/11/2023 1:28 PM SincereStock @Albukhary well insights imo, that's why when buying a stock we cannot simply focus on its EPS and sometime overvalue it due to it's branding, it is also important to looks at it's existing assets value. in case EPS cannot sustain or business go sunset still can liquidates the business and it's assets to be distributed to shareholders 30/11/2023 3:29 PM Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥ KUALA LUMPUR (Nov 30): Padini Holdings Bhd's net profit for the first quarter ended Sept 30, 2023 (1QFY2024) fell 45.4% to RM26.67 million, from RM48.86 million a year earlier, due to a drop in the gross profit margin from 39% to 36%. In a bourse filing on Thursday, the company said that in addition, the drop in profit before tax was also partly attributed to rising staff cost. It said revenue for the quarter rose to RM388.19 million, from RM379.09 million previously, due to an increase in sales volume. Earnings per share slipped to 4.05 sen from 7.43 sen. Padini declared an interim dividend of 2.5 sen per share to be paid on Dec 29. Reviewing its performance, Padini said the drop in net profit was partly due to a drop in the gross profit margin from 39% to 36%. “In addition, the drop in profit before tax was also partly attributed to the rising staff cost,” it said. On its prospects, Padini said the retail business in general remains challenging, due to the deterioration in purchasing power, arising potentially from rising cost, trade tensions, and rising inflation and interest rates. “However, supply chain issues, material costs and freight charges seem to have stabilised, although there may still be some further increases in the short term,” it said. At the midday break on Thursday, Padini had gained 0.26% or one sen to RM3.79, with 19,300 shares traded. 30/11/2023 6:34 PM Balian de Ibelin Gameover Downhill all the way profits drop 45% plus negative growth after inflation adjustment. Company is shrinking. Not Growing = Dying 01/12/2023 9:50 AM HafizAjiad98 pakai duit dividen dan masuk lagi jika ia turun ke Rm3.45- 3.50 sana 04/01/2024 11:28 AM | |