|

| |

Overview

Financial HighlightHeadlinesBusiness Background Globetronics Technology Bhd develops and manufactures integrated circuits, light-emitting diode components, encoders and sensors, quartz crystal products, timing devices, and related products. Sensors are the leading revenue contributor for the company. Globetronics builds its sensors and encoders for a variety of automation and industrial applications. Sales volume is also significantly dependent on revenue generated from quartz crystal and timing devices. These devices are used in a multitude of electronic products, such as mobile devices, GPS, and PCs. Sales are primarily in Asian markets, with the United States accounting for a significant share.

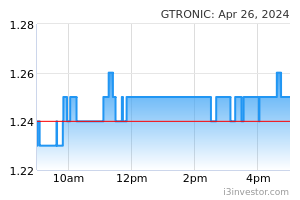

canbuyla can a group of MONEY GAME CRYPTO ppl manage such a big semicon co..? anyone can enlighten?? 17/02/2024 10:42 AM EatCoconutCanWin i saw FTZ globetronic plant near Intel being use as cafeteria for bangladesh construction meal and resting place. what i can conclude is the plant business getting hard and lesser order. 21/02/2024 10:41 AM nhbeen Hardly seen any turnaround for the business soon. Management's excuses on poor business performance are always the same. They should at least put forward some concrete plans to boost revenue and bottomline. Let's see what directions the new board members can bring. 21/02/2024 11:23 AM Tanleechoo The old board n mgt all r rich with esos ..???can’t think out of box .? Looking at pft continue to go south for the last 3 qtr .. 21/02/2024 11:32 AM Tanleechoo Well said …initially I thought old NG retired n new blood coming in give some…turn out he sell all his stake 21/02/2024 12:35 PM newlifenolie New Chairman is a Young Man, quite confident he can pull up some young blood talents to drive the company. 23/02/2024 8:51 AM nhbeen No doubt new chairman is young, but they are in different business fields. It will take a while for the new team to learn about the semiconductor industry. Whether they can make make it or not remains a question because technology changes too fast. Keep an eye on the next few quarters to derive some clues. 23/02/2024 1:25 PM NatsukoMishima Vstecs is a hidden gem that just started to skyrocket due to malaysia wants to be data center hub in SEA , they need a lot of servers , iot products , IT services support ! Vstecs np will hit 100million next year ! 01/03/2024 8:25 AM cooledhawk123654 intend to venture into different area of its specialty, can be either make it or lose it.....risk involved 04/03/2024 11:44 AM nhbeen @Tanleechoo. You are right. Execution is more important with the action plan in place. The new board comes from diverse experiences but new to semiconductor related industry. It takes time to pick up the crucial industrial experience and network. How fast they can put their plans into action is crucial. 05/03/2024 10:30 AM 家俊 LOL NATSUKOMISHIMA. funny leh you. dunno now who slapping his own face leh har? 06/03/2024 5:31 PM gooman https://www.thestar.com.my/business/business-news/2024/03/07/globetronics-inks-deal-with-indias-ksp 07/03/2024 6:36 PM Tanleechoo Which co in Malaysia so far do well in India.? Last time mudajaya ..n few fail badly .. 07/03/2024 7:52 PM Tanleechoo OMG! Let see how current board bring us to India for spicy curry !down 2.8% today ? 08/03/2024 4:54 PM nhbeen How GTronic venture into India could be fruitful yet to be seen. Many companies that invest in India ends up badly ultimately. 08/03/2024 5:03 PM 家俊 im sure NATSUKOMISHIMA this guy will ask yall buy and promise u a wonderland after buy 09/03/2024 10:31 PM ivanlau ---------- quote --------- Stock: [GTRONIC]: GLOBETRONICS TECHNOLOGY BHD 1 month ago | Report Abuse Back to basic, if based on forward eps 7 x 18 pe, the fair value only 1.26 , today closing 1.44, think about that........... --------- unquote ------- Today closing 1.37 !!! 10/03/2024 1:27 PM EngineeringProfit Can wait. Getting cheaper is more yummy ivanlau 1,315 posts Posted by ivanlau > 35 minutes ago | Report Abuse ---------- quote --------- Stock: [GTRONIC]: GLOBETRONICS TECHNOLOGY BHD 1 month ago | Report Abuse Back to basic, if based on forward eps 7 x 18 pe, the fair value only 1.26 , today closing 1.44, think about that........... --------- unquote ------- Today closing 1.37 !!! 10/03/2024 2:03 PM gooman Chipmakers searching for ‘China plus one’ are finding Malaysia https://www.straitstimes.com/business/chipmakers-searching-for-china-plus-1-are-finding-malaysia 13/03/2024 9:23 PM gooman Malaysia's semiconductor manufacturing flourishes in the face of U.S. and China's Chip War https://www.tomshardware.com/tech-industry/manufacturing/malaysias-semiconductor-manufacturing-flourishes-in-the-face-of-us-and-chinas-chip-war 13/03/2024 9:24 PM gooman US stocks, tech draw record inflows in latest week - Barclays LONDON, March 15 (Reuters) - Equity funds drew $56.4 billion of inflows in the latest week, driven by record inflows to both U.S. and technology funds, Barclays said in a note on Friday, citing data from EPFR. Globally, all equity sectors saw inflows, with tech attracting the most on record at $22 billion, while healthcare and financials drew inflows of around $7 billion each, Barclays said.. 18/03/2024 4:39 PM gooman Samsung Electronics of South Korea announced on March 20 that it expects to generate over $100 million in revenue this year from its advanced semiconductor packaging business. CEO Kyung Kye-hyun, at the annual shareholders' meeting, mentioned that the investment in this newly launched sector is expected to yield results in the latter half of the year. The company aims to achieve profits exceeding its market share in the semiconductor memory business, with a DRAM share of 45.5% in the last quarter of the previous year, according to TrendForce. Samsung is advancing in high-bandwidth memory (HBM) production to meet the growing demand driven by AI expansion and is likely to unveil the next-generation HBM4 in 2025, aiming for a comprehensive semiconductor service that meets customer needs by integrating memory, manufacturing, and design operations. 22/03/2024 9:43 AM Souljaboiiii Gtronic is serving mostly consumer electronics components. I guess that's why the current new CEO is trying hard to engage with more customers to divert from consumer to industrial usage semiconductors. You can clearly see that Gtronic focuses more on niche product in order to enjoy the high margin. Their capex has been sluggish since FY2019 until FY2022. In these years, their capex is ranging from 10-20million only. This is something that I don't like, they are not trying hard to put shareholders money into expanding the business. However, the capex upcycle has been resumed since FY2023, with 30 million which I think it's a good sign of new orders incoming. In FY2024, the CEO told the analyst that they are going to do 50 million in capex, which is something that I like. The new CEO is finally utilizing their cash flow to do something other than giving back all the money to the shareholders. 10/04/2024 4:40 PM Souljaboiiii They have mentioned multiple times in their quarterly report that they are engaging with new customers to get new orders. I trust what they said because most of the penang tech companies are very accountable and honest. Gtronic is trying hard to position themselves to benefit from the upcoming semiconductor uptrend. The only downside that I can see now is the new management. We need time to understand what's their thinking and whether or not they can be trusted to turnaround the business. 10/04/2024 4:47 PM Souljaboiiii Nevertheless, all the OSAT companies in Malaysia will benefit gao gao from this China-US tech war. More and more companies will approach our local players for order diversifying and eventually making our local champions to become more prosperous. I guess this is the new theme with almost no downside but huge upside that a contrarian investors can safely bet on. Remember, human will perform the best when they are in pressure. 10/04/2024 4:52 PM gooman How the US–China chip conflict is making way for new hubs like Malaysia and India https://kr-asia.com/how-the-us-china-chip-conflict-is-making-way-for-new-hubs-like-malaysia-and-india 13/04/2024 10:28 AM ivanlau -------- quote ------- Stock: [GTRONIC]: GLOBETRONICS TECHNOLOGY BHD 1 month ago | Report Abuse ---------- quote --------- Stock: [GTRONIC]: GLOBETRONICS TECHNOLOGY BHD 1 month ago | Report Abuse Back to basic, if based on forward eps 7 x 18 pe, the fair value only 1.26 , today closing 1.44, think about that........... --------- unquote ------- Today closing 1.37 !!! --------- unquote -------- Today closing 1.29 !!! 16/04/2024 11:03 PM Souljaboiiii The new shareholders are here to make money. When the share price plunges to RM1, APB will suffer 50% paper lost. 18/04/2024 4:51 PM | | ||||||||||||||||||||||||||||||||||||