|

| |

OverviewFinancial Highlight

Headlines

Business Background V S Industry Bhd is engaged manufacturing, assembling and sale of electronic and electrical products and plastic moulded components and parts. It is an integrated Electronics Manufacturing Services (EMS) provider in the region. Their manufacturing services include plastic injection mould design and fabrication, a wide range of injection tonnage and finishing processes, large-scale production of printed circuit boards, automated assembly and final processes of packaging and logistics. Geographically the company is spread across Malaysia, United States of America, Europe, Indonesia and People’s Republic of China. Maximum revenue of the company is generated from Malaysia.

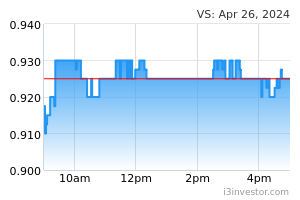

Adam92Rosli https://klse.i3investor.com/web/insider/detail/SBSH_581906_1166707757 22/03/2024 5:52 PM Fb1234567890 16. Current year prospects The elevated cost environment at macro level continues to exert pressure on performance, while internally, lower utilisation rate in tandem with softer orders has affected profitability. However, we are seeing encouraging signs emerging that signify a positive trajectory for our operations. Notably, orders from key customers are gradually rising again underpinned by normalization of inventory level and improving sentiments. In addition, the launching of new models by certain customers serve to sustain market interest as well. During the period of softer orders, the Group has been busy strengthening our market positioning and value proposition to customers by further enhancing in-house capabilities. We have now successfully developed several new processes that are ready for mass production in the near future. 27/03/2024 5:47 PM Fb1234567890 16. 本年度展望 宏观成本环境上升继续对业绩构成压力, 而在内部,利用率下降以及订单疲软影响了 盈利能力。然而,我们看到令人鼓舞的迹象正在出现,这意味着积极的 我们的运营轨迹。值得注意的是,重点客户订单逐渐增加 再次受到库存水平正常化和情绪改善的支撑。在 此外,某些客户推出新型号有助于维持市场兴趣 以及。 在订单疲软期间,集团一直忙于加强市场 通过进一步增强内部能力,为客户提供定位和价值主张。 我们现已成功开发出几种新工艺,可供批量生产 在不久的将来生产。 27/03/2024 5:48 PM Fb1234567890 16. Prospek tahun semasa Persekitaran kos yang tinggi di peringkat makro terus memberi tekanan ke atas prestasi, manakala secara dalaman, kadar penggunaan yang lebih rendah seiring dengan pesanan yang lebih lembut telah menjejaskan keuntungan. Walau bagaimanapun, kami melihat tanda-tanda menggalakkan yang muncul yang menandakan positif trajektori untuk operasi kami. Terutama, pesanan daripada pelanggan utama semakin meningkat secara beransur-ansur sekali lagi disokong oleh normalisasi tahap inventori dan sentimen yang bertambah baik. Dalam Selain itu, pelancaran model baharu oleh pelanggan tertentu berfungsi untuk mengekalkan minat pasaran juga. Dalam tempoh pesanan yang lebih lembut, Kumpulan telah sibuk mengukuhkan pasaran kami kedudukan dan cadangan nilai kepada pelanggan dengan meningkatkan lagi keupayaan dalaman. Kami kini telah berjaya membangunkan beberapa proses baharu yang sedia untuk massa pengeluaran dalam masa terdekat. 27/03/2024 5:53 PM ITreeinvestor tidak termasuk keuntungan forex 12.7 juta pendapatan teras meninggalkan 3 juta 27/03/2024 6:07 PM kokchengkai Itreeinvestor 马币继续在这个幅度上交易的话,VS ,SKPRES等美元计算的出口商将会每季度享受一定数目的外汇收入。这刚好时机填补了销量下跌的缺口。销量复苏后,马币又自然回升了,一切又正常发挥。 29/03/2024 3:15 PM Realrich Qr profit drop 50%. The customer order move to other countries. Next qr the result will be red making losses 29/03/2024 3:36 PM Rio2814 Now EPF is buying and price below rm1. If it goes up like other EMS company than they can make profit. 31/03/2024 12:59 PM Michael Kwok Vsi 88 cents Sell on strength Stiff resistance 94-96 cents not easy to break 1/4/24 12.10am 01/04/2024 12:10 AM Jonathan Keung Don't chase high only buy on dips. When everybody sells you act as an contarian 02/04/2024 12:08 PM fortunefire i plan to let go my tickets at 0.98 so whoever wants to take over please get ready 02/04/2024 5:50 PM Plantermen HLIB has down graded VSI outlook from positive to negative ° their biggest customer in the US is not restocking due to sluggish sales. VSI management has indicated for FY 25 to broaden its product offerings 04/04/2024 12:06 PM icecube interesting to see some analysts call "buy" while some recommend "sell". divergent view? form own opinion by reading the prospects section of the quarterly results report.. and one shall have better clarity. worst is over... 11/04/2024 8:30 PM Rio2814 Yupp, worst is over but its not reflected in the share price. Meaning opportunity to buy? 11/04/2024 11:07 PM icecube Wanted to say yes, opportunity to buy esp if price stabilize further. Coming 2 quarters’ results shld be better. Just that now .. broader equity market could be choppy ahead with the latest Iran-Israel conflict. Sigh.. so much geopolitical conflicts in recent years.. 14/04/2024 7:39 PM Jonathan Keung DJ drop another 200 points opening. Looks like another bad day tomorrow 16/04/2024 2:26 AM mf Dow Jones Dow Jones Industrial Average 37,735.11 -248.13 0.65% Nasdaq NASDAQ Composite 15,885.01 -290.07 1.79% 16/04/2024 6:08 AM Jonathan Keung War jittery hitting's all the markets .Looks like Israel gearing up a fight with Iran 16/04/2024 9:40 AM icecube market jittery indeed. profit taking across the board.. or could be cutting losses too. but companies with solid fundamentals shld prevail.. 16/04/2024 10:15 AM | |