|

| |

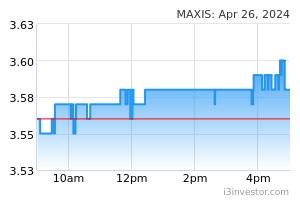

OverviewFinancial Highlight

Headlines

Business Background Maxis Bhd is a telecommunications provider. Its primary services include mobile, wireless, fixed, and enterprise services, with the majority of revenue generated from mobile and wireless. The company generates mobile revenue from prepaid and postpaid subscribers, with roughly an even split between both. Within enterprise services, Maxis provides traditional managed services in addition to mobile and fixed services. Additionally, the company owns fiber backhaul infrastructure. The company generates the vast majority of its revenue in Malaysia.

nicholas99 hugely invested. and now DNB no more.. Most likely maxis will get a deal with huawei.. and move ahead with 5g. its a buy call. 11/05/2023 9:48 AM jalapeno34 the real step change in value is when older networks are decommissioned (while maintaining ARPU), not when there is investment in a new infra like 5G 19/05/2023 2:19 PM speakup https://www.thestar.com.my/business/business-news/2023/05/20/maxis-well-positioned-for-next-phase-of-growth 21/05/2023 2:53 PM speakup where everybody? terasa sunyi disini. semua hidden investor? make some noise lah so it up 23/05/2023 9:35 PM DividendGuy67 Happy to have sold all earlier at 4.18. The dividend yield was getting a bit too low for me compared to stocks I'm eyeing now like BIMB. 07/06/2023 5:53 AM speakup https://www.thestar.com.my/business/business-news/2023/06/07/maxis-reiterates-commitment-to-sign-5g-access-agreement-with-dnb 07/06/2023 9:10 PM speakup Last Friday was chance to exit at high price. Those who took that opportunity laughing now 😂 19/06/2023 11:36 AM speakup https://theedgemalaysia.com/node/674623 maxis dah kena downgrade by maybank 13/07/2023 9:18 PM speakup https://soyacincau.com/2023/07/14/maxis-to-sign-5g-access-agreement-dnb-obtain-shareholder-approval/ Maybank is right, higher capex, lower dividend coming 15/07/2023 11:26 AM speakup https://www.thestar.com.my/news/nation/2023/08/07/malaysians-to-enjoy-cheaper-mobile-packages-this-month-says-fahmi Amboi bad news for maxis! Good thing speakup managed to exit at high price a month ago when someone push up the price last minute 08/08/2023 7:43 AM Balian de Ibelin for Digi To produce new SIM card, its all machines where you insert MyKad and press thumb print. the sim card comes out in seconds. there is no one queueing at the SIM card machine coz process just seconds. MAXIS sounds like medieval times medicine where you cut vein and flows out blood for flu cure. 22/08/2023 3:43 PM Balian de Ibelin Maybank change ATM / Visa card also like that, its all machines, insert MyKad and thumb print and new Visa card comes out in seconds. Again no one is queueing there for new Visa Card coz process is just seconds 22/08/2023 3:48 PM speakup Dulu 5sen dividend every quarter Sekarang 4sen every quarter Next time 3sen dividend every quarter 05/12/2023 3:24 PM speakup Maxis Bhd announced that its unit will make a final settlement of RM73 million in relation to additional assessments with penalties imposed by the Inland Revenue Board, two years after it was given the assessments for the 2016-2020 period of RM477 million. Maxis to pay RM73 mil to resolve tax assessments with Inland Revenue Board 30/12/2023 1:37 PM speakup Tak percaya? Baca ni https://www.hmetro.com.my/bisnes/2021/03/686988/mokhzani-mahathir-kini-pengerusi-maxis 22/01/2024 10:05 PM speakup https://www.freemalaysiatoday.com/category/highlight/2024/02/05/maxis-investigating-alleged-cybersecurity-breach/ one bad news after another. first kena fined rm73mil by LHDN! then chairman mokhzani kena Macc investigation! now kena data breach! habis this company! 06/02/2024 7:34 AM speakup https://theedgemalaysia.com/node/704423 sure or not? how come get so many scam calls? 13/03/2024 9:23 PM dompeilee Sooooo relieved to be OUT of this stock which I originally bought 8 lots of in 2022 for the dividends...all SOLD above $4 last year!🤗 25/03/2024 9:35 AM speakup https://www.freemalaysiatoday.com/category/business/2024/04/17/maxis-invests-rm813mil-to-enhance-mobile-network/ heavy capex + heavy Lhdn fine = low dividend = low share price 17/04/2024 9:39 PM | |