|

| |

OverviewFinancial Highlight

Headlines

Business Background

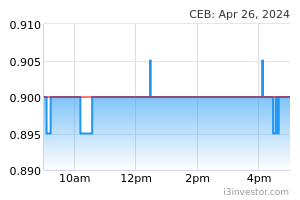

SourDosey Mr Yau was disposing...seems like can wait for this Cape to become cheaper then collect 20/04/2023 3:10 PM marcosl it staff augmentation services article - https://mlsdev.com/services/it-staff-augmentation 29/04/2023 3:44 AM Edwardong53 False break on 1 Sept and today candle (Black) longer than previous white candle on 1 Sept........ does not look good 04/09/2023 3:47 PM Waller https://theedgemalaysia.com/node/682976 Cape EMS Bhd is buying US-based electronic manufacturing services (EMS) player iConn Inc for US$16.5 million (RM76.6 million) in a bid to strengthen the group’s offerings and presence in the world's largest economy. 19/09/2023 2:27 PM aspenvit CAPE 4Q23 briefing keytakes (Zoom) Date: 27 Feb 2024 Management: Christina Tee (CEO), Kelvin Tan (CFO) and team 2023 financials overview - 2023 revenue +24% driven by wireless equipment and CE E-Cigg alongside new contribution from thermal devices. PAT +32% on favourable product mix. 4Q revenue +25% but PAT -38% due to underprovision of tax in previous quarters + additional operating cost related to die casting and new EV business. - Normalised PAT at RM57.8m after adjusting for IPO expenses RM4m, RM2m acquisition cost of iConn, and sales and lease back arrangement. Previously guided RM59m which included this RM7m of sales & leaseback arrangement, but now they did not proceed on this. - Revenue breakdown: 65% on industrial produce, CE at 32%, 3% from die casting. US 66%, Asia at 33%, EUR 2%. - Financial positions: RM170m of cash, 0.4x gearing ratio. - Orderbook of RM218m (RM33m from CE and RM185m from Industrial products) - Utilisation of proceeds: RM125m - the balance of unutilised proceeds Production capacity - 3 factories (Senai, Tebrau and Kempas 6) - Relocation cost Temenggung to Tebrau - 433k sqft now, on 34 EMS lines, and 770+ workers - Tebrau (100.6k sqft) for aluminium die, 10 new alu die cast and machinery purchase are in progress - Senai 226 (166.9k sqft), to house finished goods - Warehouse automated storage facilities Business updates - Mimosa – completed acquisition of Mimosa from Jio platforms. Penetrated into new market via this acquisition. Ex-India all by CAPE now, in India, 25% by Cape. - NextCentury (smart utility data collection) – penetrated into Australia market. Mexico in process to be certified. - Customer A – after acquisition, more opportunity here - K&Q (household applicances – vacuum) – anticipating an uptick in demand. Besides US, it is into Turkey now - New customer C – Leader in EV charging device and station. US based founded in 2007. - New customer S – packaging tracking vehicle – UK based providing tracking system for reusable packaging. Market segment from retail, post and parcel and logisitic companies - New customer M – amphibious craft of vehicle, based in NZ. Specialising in designing and manufacturing amphibious boats equipped with retractable, motorised wheels. Partnering with SEA CM to supply new contracts in at least next 5 years. - Into medical, sport equipment, EV charging systems as well - Vectrix mobility - 60% stake owned by by APE, Vectrix owns 40% - batt pack production will be ready by 2Q24. High flexibility of assembling modules up to 3k WH, in the voltage range from 7V to 150V. UK, EUR, JPN, SG and MY distribution ship partner has been identified. Current order on hand is at 1200 units, will be suppling directly from Taiwan maker. All batt pack will be self-supply by CAPE. Q&A - Customer A – additional 80% more capacity; device and pod will be the driver. 2023 revenue contribution was RM160m. Wanted to limit exposure from here, as in not >25%. - 2024: targeting minimally 30% revenue growth. Targeting NPM of 8-10%. Batt Pack manufacturing, K&Q, EV charger see good growth. - Customer T – radioactive tracking + chambers (consumable). - iConn – <USD30m orders by CAPE. - Vectrix – Yan Loong? CM from Taiwan - 3 new customers C, S and M on NPI now, and not part of the revenue growth target for 2024. - Jio reliance orders on cable –access points – 2 components whereby CAPE supplied 2m parts (30k per month). - Costs – some can be passed on Thanks From UOBKH’s DC 29/02/2024 11:40 AM aspenvit "For CEB, its order book remains strong at Rm217m and Revenue indeed up by 8% QoQ so I believe the drop in PAT is one off event." 29/02/2024 11:42 AM aspenvit "Btw for CEB my view is can consider holding it for another quarter because: 1. MD/Group CEO has bought 2m shares via open market during 27-28/2. 2. Chartwise the next support is 0.88. 3. Management provided the below guidances for FY2024 ie at least 30% growth in revenue and profit margin after tax ard 8-10%. So profit before tax of 60-70m for FY2024 is within reach. 4. They have engaged tax consultant to look into their tax reporting process. 🙏🙏" 29/02/2024 11:44 AM Michael Kwok Cape ems 90 cents Resistance 92 cents Possible will be in 70 cents range.if resistance cant break in before 19 march end. 15/3/24 10.18am 15/03/2024 10:16 AM 8dragon CEB is likely to move up to 1.10 level, this is a bargain price to collect. 21/03/2024 9:26 PM BursaKakis Cape EMS working to regain investor confidence https://theedgemalaysia.com/node/704942 27/03/2024 7:01 AM limitup4u why she sounds like the next qr is bad and ask us to hold it long term. 27/03/2024 9:32 AM 8dragon I'm quite persimistic the capability of a woman CEO in running a EMS company.... 05/04/2024 8:42 PM | |