|

| |

Overview

Financial HighlightHeadlinesBusiness Background Ta Ann Holdings Bhd is an investment holding company in Malaysia. The primary activities of the company include timber concession and harvesting, logs trading, sawmilling, forest plantation, forestry research and development, oil palm plantation, and crude palm oil mill. The company is organized into five divisions: Logging, Plywood, Sawmilling, Oil Palm, and Reforestation of which Oil Palm division contributes the majority of total revenue. Its geographic segments consist of Malaysia, Japan, India and other countries.

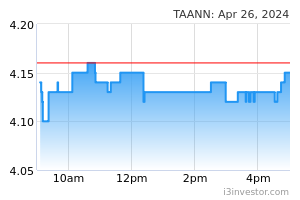

titan3322 IBs are always the culprits. For the call warrants you are left to die near expiry date. I am very certain of that ! 10/01/2024 11:19 AM diuleiloumei Reached 3.6 as I expected. Next north or south depend US FED sentiment 12/01/2024 12:48 AM DividendGuy67 Fuiyoh ... TAANN 3.75 close. +10 sen. Together with other stocks, helped made my portfolio reach new all time highs again. This is the 7th time this happened this month. Thank-you TAANN. 15/01/2024 9:40 PM titan3322 Sell ! Switch to undervalued property stocks. CPO Will average RM4K/tonne only. What profit are you expecting ? If it's bcoz the land some plantations have then might as well go direct to property stocks ! 16/01/2024 9:39 AM StartOfTheBull On 24 February 2022, Russia invaded Ukraine, FCPO shot up to above RM6,900 thereafter. Today, tension in Red Sea is causing disruption in food transit. Situation is more dire as drought in Central America has led to a drop in water levels in the Panama Canal, significantly reducing the amount of traffic able to cross the essential route. https://www.dailyexpress.com.my/news/227698/un-reports-42-drop-in-suez-traffic-following-houthi-attacks/ 26/01/2024 2:14 PM DividendGuy67 Can TAANN hit RM4? Today decent close +2.71% challenging resistance. Intraday looks like rejection and price might fall for a while but the overall attack since Mar 2023 low looks promising in the near future. The higher lows over past 12 months doesn't make it easy to accumulate. It means there's buyers each time these higher lows were revisited. Someone's accumulating. Good odds we'll be laughing anywhere in the next 1-12 months ... 15/02/2024 9:52 PM calvintaneng WHY WHEN CPO PRICES ARE HIGH UPSTREAM PALM OIL PLANTERS WILL DO FAR BETTER THAN DOWN STREAM PALM OIL COMPANIES, Calvin Tan https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-02-22-story-h-188275986-WHY_WHEN_CPO_PRICES_ARE_HIGH_UPSTREAM_PALM_OIL_PLANTERS_WILL_DO_FAR_BET 24/02/2024 5:20 PM calvintaneng Keep finger crossed Maybe a small dividend 28-Nov-2023 02-Jan-2024 DIVIDEND Second Interim Dividend RM 0.1500 24-May-2023 09-Jun-2023 DIVIDEND First Interim Dividend RM 0.1000 29-Nov-2022 30-Dec-2022 DIVIDEND Fourth Interim Dividend RM 0.1000 29-Aug-2022 13-Sep-2022 DIVIDEND Third Interim Dividend RM 0.1500 23-May-2022 03-Jun-2022 DIVIDEND Second Interim Dividend RM 0.1000 28-Feb-2022 15-Mar-2022 DIVIDEND First Interim Dividend RM 0.0500 22-Nov-2021 04-Jan-2022 DIVIDEND Second Interim Dividend RM 0.2000 09-Jul-2021 26-Jul-2021 DIVIDEND First Interim Dividend RM 0.1000 23-Mar-2021 06-Apr-2021 DIVIDEND Second Interim Dividend RM 0.0500 30-Nov-2020 29-Dec-2020 DIVIDEND First Interim Dividend RM 0.1000 28-Feb-2020 13-Mar-2020 DIVIDEND First Interim Dividend RM 0.0500 23-Nov-2018 06-Dec-2018 DIVIDEND Second interim dividend RM 0.05 24-May-2018 06-Jun-2018 DIVIDEND First Interim Dividend RM 0.05 28/02/2024 12:46 AM PureInvest Taann's NPAT is RM20,402K, after deducting Stock Write Off of RM9,782K and Fair Value of Biological Assets change of RM32,772K. Otherwise, the NPAT is favorable. Net Cash position is RM182,254K (Total Cash - Total Borrowings). Generally, this year 2023's Dividend paid is RM0.250/share is satisfactorily. Company announced today (28-02-24) to purchase back own shares. In view of the above, going into year 2024 with favorable CPO price of RM3,800K+/ton, we hope and assume Qtr 1 of year 2024 will be a much better financial performance by Taann, and we are long term investor, we are not bothered with these little discomforts. 28/02/2024 8:08 PM 5354_ Div=0 why RM 3.66? Swk Plantation(Ta Ann own 29.406%) better QR why only RM 2.1? 28/02/2024 9:21 PM calvintaneng YES TAANN GOOD See balance sheet Profit after tax .......Rm62,956,000 Less Stock written off (Rm9,782,000) This is one off Change in fair value of biological assets (Rm32,772,000) Above no loss at all. only paper depreciation. When TAANN revalue its Assets it will go back up From above WE SEE TAANN DID VERY WELL FROM NORMAL OPERATIONS 29/02/2024 1:46 AM PureInvest No worry as FCPO is still exceeding RM3,900.00/ton. Buy on dip for LT investment. 29/02/2024 9:34 AM enning22 KUALA LUMPUR: Indonesia's 2024 palm oil exports are seen at 29.50 million metric tonnes, down from 30.25 million tonnes last year, the Indonesia Palm Oil Association (GAPKI) said at an industry conference on Wednesday (March 6). Meanwhile, palm oil output in the world's biggest producer of the edible oil is expected to rise by 2.26% to 54.4 million tonnes, GAPKI official Fadhil Hasan said, while domestic consumption is seen higher due to demand for biodiesel feedstock. Indonesia's end-2024 palm oil stock is estimated at 5.25 million tonnes. "There is a possibility of the new incoming government increasing B35 to B40," Fadhil said, referring to Indonesia's mandatory bio-content mix that currently stands at 35% of biodiesel. This could take place in the second half this year, he said. "One of the programmes by the candidate likely to be elected is intention to raise to B50, but that is maybe for after 2025," he added. Pollsters have said that Defence Minister Prabowo Subianto is the likely winner of the Feb 14 general election. The election committee has until March 20 to verify votes. Meanwhile, the impact of El Nino dry weather pattern last year has turned out to be insignificant on 2024 production as it hit mostly Java and southern regions of Sumatra, which are not palm oil producing centres, Fadhil said. - Reuters 06/03/2024 5:03 PM wallstreetrookieNEW Calvin, I hope you have the funds to literally go all in on all plantation companies because it's all north from here onwards 07/03/2024 11:26 AM wallstreetrookieNEW Jtiasa > Ta-ann. But if both goes up, then that would be perfect 07/03/2024 2:38 PM ChloeTai Congratulation! Calvintaneng, your Jtiasa and Taann rally today while other stocks remain flat after their quarter results.These so called fundamantally stocks will only go up 1 week in the month of their quarter results. 07/03/2024 6:12 PM calvintaneng IF PALM OIL COMPANIES WILL GIVE OUT CONSISTENTLY HIGH DIVIDENDS: THEIR SHARE PRICES WILL RISE LIKE KLK, UTD PLANT OR INNOPRISE PLANT, Calvin Tan https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-03-08-story-h-186603663-IF_PALM_OIL_COMPANIES_WILL_GIVE_OUT_CONSISTENTLY_HIGH_DIVIDENDS_THEIR_S 08/03/2024 1:28 PM Mabel *Malaysia Plantations* *The unsung heroes of the nation (and the world)* 11 March marks the 4th anniversary of COVID-19 pandemic. We pay tribute to the plantation sector that has contributed immensely during the pandemic. While not undermining the sacrifices by the front-liners and others in the fight against COVID-19, this sector has played its part in ensuring food security, job security, and health security not just for the nation but the world over. Despite rising cost challenges and falling output, the sector still made huge monetary contribution of >MYR23b over the past 4 years in various forms of direct and indirect taxes, and contributions. *>MYR23b in “social” contribution to the grateful for* Between 2020 and 2023, the plantation sector has contributed approx. MYR6.1b in windfall profit levy, MYR3.7b in export duties, MYR1.3b in MPOB CESS (see Fig.1), MYR0.2b in Prosperity Taxes, >MYR6b in Sabah and Sarawak Sales Taxes (our back-of-the-envelope estimates), and easily >MYR6b in corporate income taxes and individual taxes (by the smallholders) to the Malaysian government . The sector is said to be among the highest tax contributor in terms of total taxes (including windfall profit levy, export duties, CESS, and Sabah and Sarawak Sales Taxes, in addition to corporate taxes). Monies collected by the government were channelled to (among others) nation building and running of many social programmes including free COVID vaccinations given to the people and cash handouts given to the needy during the pandemic. *Food & health security roles often taken for granted* Palm oil holds more than 50% market share in the global vegetable oils trade. Hence, its continuous availability is crucial to global food security as well as health security. Throughout the pandemic, palm oil exports never stopped as the government allowed palm oil cultivation to proceed. Besides food use, the continuous availability of palm oil and palm products also meant there was the much-needed ingredients to make personal cares and cleaning products such hand wash, soap, laundry detergents, hand sanitisers, etc that the world desperately needed in its fight against the highly infectious COVID-19 virus. *Job security for the locals as well as guest workers* Many people lost their jobs at the start of the pandemic and had to draw down their hard-earned life savings to make ends meet. Prior to the pandemic, the sector has a strong workforce of 437,400 in Malaysia comprising local and guest workers. During the pandemic, the plantation sector was among the few granted special approval by the government to operate. Social distancing at workplace was inherent in the estates given that one worker typically covers more than 10 hectares of estates, providing a naturally safe working environment. Workers were even given free COVID vaccinations by their employers. At the height of the pandemic, outsiders had limited access to the staffs’ housing quarters and estate operations to ensure the safety of their workers and families. While country borders were mostly closed initially, guest workers remained employed throughout and were paid decent wages (plus incentives) that allowed them to repatriate the much-needed income to provide for their families back home (presumably equally affected by the pandemic). Well Done Guys! 11/03/2024 10:49 AM calvintaneng Very happy evening all We have selected RSawit to replace Bplant in Top 10 Palm oil Picks RSAWIT (5113) A Palm Oil Turnaround Due to High Cpo over Rm4,100 MT Plus Very Very Undervalue Assets that are Easy to Liquidate for High Profits, Calvin Tan https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-03-13-story-h-186459631-RSAWIT_5113_A_Palm_Oil_Turnaround_Due_to_High_Cpo_over_Rm4_100_MT_Plus_ 13/03/2024 10:18 PM calvintaneng CPO so high price is just like Mau Sang Wang durian now so expensive! https://www.youtube.com/watch?v=0_ySoCpqyGs pure upstream doing best 14/03/2024 4:19 PM Save Divergence is happening, Taann wanted to test support to correct oversold technical. 14/03/2024 5:13 PM KingKoil Taann will be rally like CPO price https://theedgemalaysia.com/node/705361 21/03/2024 8:36 AM enning22 INDONESIAN Government Advocates for Biodiesel Mandate Up to B-40 Level\ https://jakartaglobe.id/business/government-advocates-for-biodiesel-mandate-up-to-b40-level 01/04/2024 11:41 AM DividendGuy67 I already collected at 3.26 average (excluding dividends). Nothing to do now but just sit tight and enjoy! 01/04/2024 10:38 PM Save Let's watch if Taann can break out from 4.10. On cargo surveyors' data, shipments of Malaysian palm oil products for March seen rising between 20.5% and 29.2% compared to February, according to Intertek Testing Services and AmSpec Agri Malaysia. Palm oil future close@4392, 2nd day higher than 4320, let see if can sustain tomorrow. If flag pattern breakout confirmed, with roughly measurement of 1st leg (4300-3840=460), 2nd leg potential uptrend can be 4150+460=4610. 02/04/2024 10:01 PM Save Finally Taann finished 4.10, turn support. Waiting breakout from 4.15, watching profit grow..... 04/04/2024 11:23 AM Save FCPO: On cargo surveyors' data, shipments of Malaysian palm oil products for March likely jump between 11.77% and 29.2%, said Intertek Testing Services, AmSpec Agri, and SGS. Meanwhile, Reuters estimated stockpiles likely fall by 6.65% mom to an 8-month low of 1.79 million tons at the end of March. 05/04/2024 3:21 PM pushparaj With the expected shortfall, CPO prices might go higher. Upstream player TAAN, would be a beneficiary. Price movement quite stable 05/04/2024 7:19 PM DividendGuy67 Yes, closed 4.29, +4.13%. Thanks to TAANN and 22 other green stocks to offset 12 red stocks, my portfolio made new all time high again today. Thank-you Mr Market! 08/04/2024 11:18 PM serbatipu Iran already started the show. Would the rusia Ukraine history repeated again ? 14/04/2024 9:03 AM Save Malaysia palm oil stock level fell 10%............ Malaysian palm oil futures were below MYR 4,280 per tonne, falling for the second session after hitting MYT 4,360 last week due to weakness in rival edible oil on the Chicago Board and a fall in palm olein on the Dalian. A drop in crude oil prices also weighed sentiment, as bets grew that the ongoing Middle East conflict would be contained. Traders were also cautious as the Eid al-Fitr festive buying nears its end. At the same time, they anticipated crucial economic data from key buyer China, including Q1 GDP figures and March industrial output and retail sales. Limiting the downside momentum was fresh data from the industry regulator showing Malaysia's palm oil stocks at the end of March fell 10.68% mom to an 8-month low of 1.71 million metric tons. Crude palm oil production gained 10.57%, while palm oil exports climbed 28.61%. On cargo surveyor data, shipments of Malaysian palm oil products for April 1-15 rose about 9.0% from the same period in March, Intertek Testing Services said. 15/04/2024 2:30 PM | | ||||||||||||||||||||||||||||||||||||