|

| |

OverviewFinancial Highlight

Headlines

Business Background Ancom Bhd is an is an investment holding company. The company through its subsidiaries is engaged in the manufacture, trade, and sale of agricultural and industrial chemical products. It also provides out-of-home advertising media services, IT services and sales of computer hardware and software. Ancom derives most of its revenue from Malaysia.

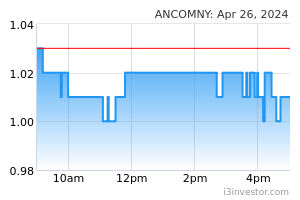

wallstreetrookieNEW Siew Ka Wei is richer than Ong Choo Meng. The battle of Malaysian billionaires 08/02/2023 9:41 AM SpencerW Heavy exercise of ESOS for new Ancom shares in the last 2 weeks. Preparing for the next up-cycle. 31/03/2023 1:35 PM klkk Quarterly result due for announcement soon, by the way of the recent price movements is it expecting a bad result? 06/04/2023 10:24 AM tyyapty ANCOMNY has been down trending from its peak at RM1.26 in early February. Selling pressure has been on-going for the past 5 months. Nevertheless, a minor rebound was expected from its support formed at RM0.94. In view of the upcoming 3Q quarter result announcement next week, and indicators showing bullish momentum, prevailing rebound momentum is expected to persist. 04/07/2023 2:35 PM U1818 https://www.nst.com.my/business/2023/07/931772/ancom-nylex-posts-net-profit-rm182mil-q4 “。。。。。。we have obtained the certificate of completion and compliance (CCC) for our new agrichem production facility in Klang, in which the development progress for one of our new active ingredients (AI) has been very encouraging and is on track for commercial production by the end of 2023. ” 17/07/2023 6:02 PM skyinvestor saw this video about Ancom Nylex stock, good one https://youtu.be/qLDv_ynTMvE 18/07/2023 10:45 AM ZoeZoe QR coming and a lot of activity on Director share buy back, is this any indication of good profits? 04/01/2024 2:48 PM omega008 honestly what is wrong with this stock .. only seems to go down with no bad news 04/03/2024 2:38 PM ZoeZoe if you notice there has been some warrant conversion today! not sure if they are related! 04/03/2024 2:53 PM omega008 man i dont know whats going on with this company ... ESOS, dividends in specie, and warrants ... Ancom tanking its own shares ... goodbye glory days of ancom 06/03/2024 10:46 AM ZoeZoe Anyone collecting at cheap sale price? I tot 1.05 was the support, but now looks like 0.990? 06/03/2024 3:10 PM 167697 The market wants to go where it wants to go. It wants to find the major bottom see weekly and daily chart and draw the bottom line. Higher low. So I think it is uptrend from now 0.97. I maybe wrong but this is my opinion only 06/04/2024 1:20 PM 167697 It is also coincides appoximately with new product. Maybe the company directors and shareholders were buying shares earlier at higher prices because they did not know “the market wants to go where it wants to go” because the price is dictated by big boys. We are small retailers. WE have to think like big boys the institutions 06/04/2024 1:26 PM 167697 Remember gamestock USA. The retailers gangup to beat the hedgefunds the big boys. We are small boys 06/04/2024 1:33 PM 167697 If it gets cheaper I will also buy and the company will buy more and other people will buy. Those sellers will be afraid to miss out on profits. GOOOOOD product at cheap prices….just buy! Like buying a diamond at 0.97 06/04/2024 2:38 PM 167697 If say the price drop to 0.90 and i buy some more and the company is confident about its products (Looks like the company is confident) and buy even more. Should the price in future shoots up to 1.20 the company is laughing as they profit from the share and we retailers are laughing. The sellers will be regretting 06/04/2024 2:51 PM 167697 If sellers stop selling now and the price goes up from here because of a good product then everyone is happy including the previous sellers who are buying again and company and current retailers. In the end the market wants to go where it wants to go. 06/04/2024 3:00 PM 167697 GAMESTOCK WAS A BAD PRODUCT. ANCOMNY has a good new product and the biggest fertiliser company in SEA and selling overseas as well to Brazil (the Amazon of agriculture) 06/04/2024 3:09 PM 167697 Looks like double bottom has been reached aided by company buying more shares. Hopefully can go up from here. Fingers crossed 09/04/2024 8:14 PM 167697 As of 2024-04-17, the Intrinsic Value of Ancom Nylex Bhd (ANCOMNY.KL) is 1.61 MYR. This ANCOMNY.KL valuation is based on the model Discounted Cash Flows (Growth Exit 5Y). With the current market price of 0.99 MYR, the upside of Ancom Nylex Bhd is 62.6%. The range of the Intrinsic Value is 1.35 - 1.97 MYR. 17/04/2024 10:21 PM jenabchen123 1.50..... Not a bad return to buy some and lock up waiting for the run 18/04/2024 8:21 PM | |