|

| |

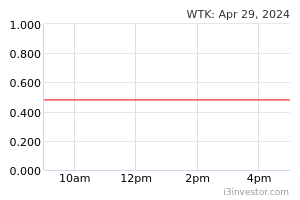

Overview

Financial HighlightHeadlines

Business Background WTK Holdings Bhd is engaged in investment holding and provision of management services. Business activity of the firm is functioned through Timber, Plantation, Trading, Manufacturing, Investment holding and others, and Oil and gas segments. The company derives the majority of revenue from Timber segment which is engaged in the extraction and sale of timber, manufacture, and sale of plywood, veneer and sawn timber. Geographically all the operation of the firm is functioned through Malaysia, however, the company also has its presence in the region of Malaysia, Japan, India, Taiwan, Singapore, Philippines and in other regions.

anthonytkh Domp, it’s a solid company. Spoke with their CFO before. Plennyo assets and cash. Tight shareholdings, however, may be a hurdle for share price movements 12/09/2022 5:37 PM dompeilee At least we know that the cash reported on the balance sheet is 100% legitimately there lol 28/10/2022 10:20 AM Johnmajor This counter is a serious underperformer. I hope the major shareholders and management are willing to put in serious effort to increase the value of this once great company. Minority shareholders are being neglected for being loyal to the company. 15/02/2023 10:41 AM stockraider The recent acquisition of Plantations by wtk are earning accretive loh! 15/02/2023 12:46 PM TakeProfits Stockraider ...You buy first...I buy later...wait and see...But you buy first 24/02/2023 1:19 AM Pinky @admin this SEE is spamming same content all over many oil palm topics Calvin taneng __ is your portion of TSH / YOUR T ONG S AMPAH H ANGUS ___ ON FORCED SELLING ORDERS OR WORST ___ YOU QUIETLY CUT LOSSES AND CABUT ______ 28/02/2023 10:28 PM Berlin WTK which diversified into palm oil plantation later than Jtiasa is trading at a very steep discount to NTA because its unprofitable timber division is dragging down performance. It could be the next great plantation buy for the (very) patient investor. 20/09/2023 12:29 PM Berlin Bought more for long term hold in the expectation new plantation acquisitions using cash hoard will be earnings accretive with higher future dividend payouts. Just too cheap to resist at 0.3 x book value and improving prospects. 20/09/2023 3:15 PM Dehcomic01 One of the ways I screen for companies is to compare their ROE trends with those of companies in the same sector that I have carried out detailed fundamental analysis. On such a basis, I found that WTK did worse than my 2 references - Eksons and Taann. https://www.youtube.com/watch?v=g1byo-eO4CM 18/10/2023 8:09 AM Berlin WTK would be worse off than similar timber/palm oil plantation companies on a historical ROE basis because of its loss making plywood operations. But it is undertaking business diversification albeit belatedly and if this pays off, may reward patient minority shareholders handsomely. In the meantime, eke out an existence on 1-1.5 sen dividend. 10/11/2023 9:01 AM Berlin WTK management resumes modest share buyback in the face of market weakness. Take out the small weak holders and hold up stock price. That's good. Shows faith in company's impending profit recovery. 14/12/2023 9:50 AM Berlin Laggard WTK attracts some buying interest this morning to push it comfortably over 50 sen. Now it's a battle to take out the stale bulls at each price level until quarterly results at month end show the worst is over. 19/02/2024 9:34 AM Berlin Quarter's loss caused by Rm25 m write down in biological assets in accordance with accounting rules as the timber business continues to bleed. Many small plywood operations have closed down in the last few years. Operating cash flow is still positive hence ability to pay 1.5 sen dividend. Looks like profit recovery may take more time if there is no turnaround in the timber sector. Plantation will become more dominant with the recent acquisitions. There are also valuable surplus properties that can be monetized and funds channeled to better earning assets. Still cheap on a P/B basis. 28/02/2024 8:51 AM dompeilee Averaged down more WTK for the first time since '22...goin' over 50,000 shrs for the 1st time ever! 12/03/2024 10:42 AM 1288Go Hi Dompeilee, Wtk is good but ? How long do we have to hold this one to double or triple in share price ? It's a Long term hold ? 14/03/2024 4:06 PM 1288Go https://www.klsescreener.com/v2/news/view/1060467/wtk-buys-plantation-firm-oil-palm-mill-in-sarawak-for-rm250-mil 18/03/2024 4:05 PM 1288Go In the article above, Notably, the two exercises are deemed as RPTs as WTK managing director and shareholder Datuk Seri Patrick Wong Haw Yeong is also the director of WTK Alpha, B.H.B and HMSB. WTK Alpha and HMSB entered into two agreements for the acquisitions on Thursday (Oct 27), WTK said in a stock exchange filing, adding that the total cash consideration of RM250 million will be settled through a combination of internally-generated funds and bank borrowings. Top management was Director in buying and selling companies. Is this a good thing to happen. Overpriced plantation ? 18/03/2024 4:09 PM 1288Go Wah dumpilee, You very 🤐 quiet one. Pop in and out very fast 😀 and then no sign of you. Your comments are needed! 21/03/2024 4:49 PM yfchong let's see maybe another 2 years to turn around after big big bang from oil exploration 06/04/2024 10:12 PM Berlin Perhaps some interest may trickle WTK's way when MKHOP gets successfully listed this month end and people realize WTK now controls 56k acres of plantation in Sarawak vs MKHOP's 45k in Kalimantan and is way undervalued. 08/04/2024 8:54 AM | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||