|

| |

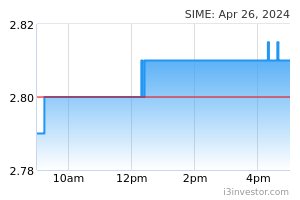

OverviewFinancial Highlight

Headlines

Business Background Sime Darby Bhd is a Malaysian investment holding company. The company organises itself into five segments, based on business type: plantation, property, motors, industrial, and logistics. Motors, the largest contributor to revenue, has investments in assembly, import, distribution, and retail businesses representing several major automotive manufacturers. Property, the largest contributor to profit, is involved in property development, property investment, and asset management. Plantation, the second- largest contributor to both revenue and profit, operates plantations to produce palm oil. The industrial segment sells and rents new and used Caterpillar heavy equipment. Logistics operates ports and logistics services in China. Sime Darby derives the majority of revenue domestically.

moneyontheway @attaaack, is your one lot equivalant to 1000 units? if so. then the amount is RM651000. great. 10/10/2023 3:30 PM Dehcomic01 If you are looking for auto companies to invest in, would you consider Sime? Looking at the overall performance of the Bursa auto companies, I would say that it does not stand out. The best performer in terms of the past 10 years ROE is BAUTO 03/11/2023 8:25 AM DividendGuy67 I sold all at 2.38. Bought 8 months ago at 2.15. Collected dividends. Total returns in 8 months including dividends, net of all expenses is 14%. Solid returns. I decided to let all of it go because there are better stocks out there and so decide to take profits at swing high and move on. 06/11/2023 11:09 PM DividendGuy67 Technicians will tell you that the fake breakdown in May-July below 2.1 and subsequent recovery means that the resistance at 2.4 will break on the upside, maybe above 2.5. However, I am happy with 14% return for this boring stock over 8 months, so, I decided to exit with a high probability profit, build cash and wait for the next drop in numerous other stocks. 06/11/2023 11:13 PM DividendGuy67 FWIW, my portfolio made new high again today. Very nice to see this happening. 06/11/2023 11:13 PM Chipee I think rotation play for expectation on recession by EPF. Sime rid of hospital (healthcare) which is resilient during recession and into cars (UMW) which is discretionary and bad during recession. hhhiii123 Epf dump so much but share price on fire, hehe 28/12/2023 9:39 AM alenac alenac Sime bad buy of perodua & toyota. Can make money on ICE but sunset in a few years when EV volume will start to expand. By Mid-2024 the acceleration toward EV will gain momentum with multiple Chinese brands establishing footholds locally. Chipee I think rotation play for expectation on recession by EPF. Sime rid of hospital (healthcare) which is resilient during recession and into cars (UMW) which is discretionary and bad during recession. 0 seconds ago 08/01/2024 11:32 AM kahfui1221 Next catalyst https://www.thestar.com.my/business/business-news/2024/01/18/sime-darby-propertys-great-deals-campaign-achieves-rm11bil-sales-booking 18/01/2024 3:20 PM wongchin I guess its too undervalue n epf suddenly rush in to buy. Hopefully tomorrow another good day 20/02/2024 6:36 PM taurus67 Their quarterly profit increased by more than 5 times. Yet, maintain last year's interim dividend. 21/02/2024 3:08 PM iscmob Date: 2024-02-09 Firm: KENANGA Stock: SIME ... Recall, the all-cash deal (RM5.8b) to acquire UMW is financed by Sukuk Murabahah (RM3b) and sales proceeds from the disposal of its healthcare business which was completed in Dec 2023 (RM2.8b). Post-business integration, SIME’s net debt and net gearing will increase from RM3,995m to RM5,877 and 0.2x to 0.4x, respectively (which includes UMW’s net cash position at RM1,118m). Subsequently, SIME plans to pare down its debt through: (i) the disposal of Malaysia Vision Valley land in Labu, Negeri Sembilan (RM2,959m), and (ii) the disposal of Komatsu and UMW’s Serendah land. --- perhaps SIME has large debt to clear and decided to give 1 cent lower dividend compared to 2023 first div. 21/02/2024 3:33 PM Mabel Date Open Price Target Price Upside/Downside Price Call Source News 27/02/2024 2.62 0.93 -1.69 (64.50%) BUY CIMB Price Target News 26/02/2024 2.65 0.91 -1.74 (65.66%) BUY TA Price Target News 26/02/2024 2.65 0.89 -1.76 (66.42%) BUY BIMB Price Target News 26/02/2024 2.65 0.95 -1.70 (64.15%) BUY AmInvest Can someone explain why the TP is so low? 14/03/2024 3:38 PM Mabel ksongking @Mabel Wrongly tagged to Sime Property 18/03/2024 1:49 PM Thank you Ksongking for your clarification. Meow 19/03/2024 10:47 AM | |