|

| |

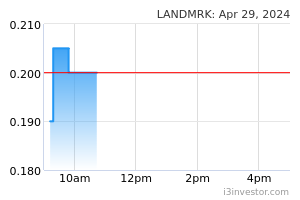

Overview

Financial HighlightHeadlines

Business Background Landmarks Bhd operates as an investment holding company. Along with its subsidiaries, the company is engaged in the Hospitality and wellness and Resort and destination development segment. In Hospitality and wellness segment it offers the provision of hotel management and wellness services. In Resort and destination development segment it is engaged in the development of resorts and properties. Its properties include The Canopi Resort, The Andaman Resort, and Treasure Bay Bintan. It operates in Malaysia and Indonesia and earns the majority of the revenue from Malaysia from its Hospitality and wellness segment.

stockraider Management must sell assets loh! In order to turnaround bcos too heavy fixed assets mah! 22/05/2023 8:21 AM RISK8888 may end up force to PN17 by Bursa? delisted from Bursa? or come up with a plan to revive the business? big Investor join the boat? how low can it go? market cap already below 100mil? asset worth billion? so what will happen next? 03/07/2023 9:12 PM ocbc https://theedgemalaysia.com/article/genting-gain-maiden-exposure-blumont-landmarks-asset-sale 12/09/2023 12:18 PM newbie9893 i am seeing that the buying momentum is pretty strong today, might limit up in afternoon section 01/12/2023 11:22 AM newbie9893 last chance to buy landmark@0.23, you won't be able to get this price in afternoon section 01/12/2023 12:29 PM newbie9893 last chance to buy landmark@0.245, you won't be able to get this price tomolo 07/12/2023 4:02 PM RiskRoverExpert tourist coming back? genting is one of the major shareholder too if not mistaken 27/12/2023 6:12 PM Solomon007 RiskRoverexpert, Genting no longer major shareholder. A person called Mark Wee is the major shareholder. Worth to note there is one indon ruling party strongman in the Board. Seasoned banker, Robin as well 28/12/2023 9:50 PM Woodswater https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3423261 29/02/2024 9:35 PM | | ||||||||||||||||||||||||||||||||||||||||||||