Date: 31/01/2023

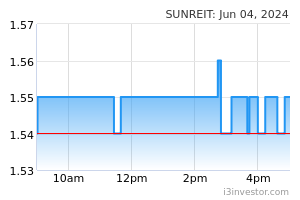

EconomyUS: Fed’s Wall Street clash sets stage for Powell’s hawkish message. FOMC is worried that markets may be missing its rate message. Jerome Powell and Wall Street are headed for another face-off this week as the Federal Reserve seeks to slow its inflation fighting campaign without signalling a readiness to stop. Despite 2022’s slew of interest-rate hikes from Chair Powell and colleagues, financial conditions are the loosest since last Feb as investors bet fading inflation will allow the central bank to soon cease raising borrowing costs and then cut them later this year. (Bloomberg) EU: Eurozone economic sentiment at 7-month high. Eurozone economic confidence strengthened to a seven-month high in Jan as there were strong improvements across all sectors except construction. The economic confidence index rose to 99.9 in Jan from revised 97.1 in the previous month. Sentiment improved for the third consecutive month to hit the highest level since last June, when the reading was 103.1. The increase in overall confidence reflected strong gains in industry, services, retail trade and consumer sentiment, while morale declined in construction. (RTT) EU: German economy contracts in 4Q. The German economy contracted at the end of the year, damping the possibility of the euro area skirting a technical recession. GDP logged an unexpected quarterly fall of 0.2%, reversing the revised 0.5% expansion in the 3Q. GDP was forecast to remain flat. Bundesbank had earlier projected the largest euro area economy to roughly stagnate in the fourth quarter. (RTT) EU: Italy producer price inflation rises to 31.7%, non-EU trade surplus grows. Italy's PPI accelerated at the end of the year, largely driven by rises in electricity supply prices on the domestic market. Separate official data showed that the trade surplus with non-EU countries rose in Dec, as exports grew more rapidly than imports. The PPI climbed 31.7% YoY in Dec, faster than the 29.4% rise in Nov. (RTT) South Korea: Dec factory output drops, missed forecasts. South Korea’s industrial output fell in Dec more sharply than expected and logged its worst annual performance in over 2-1/2 years, government data showed. The country’s factory output fell 2.9% in Dec from a month earlier, on a seasonally adjusted basis, compared with a 0.6% gain in Nov and a 0.2% fall tipped in a Reuters survey, according to Statistics Korea. (Reuters) Taiwan: Consumer confidence improves slightly on stronger expectations. Taiwan's consumer sentiment strengthened for the first time in five months, albeit modestly, at the start of the year, led by the improvement in the households' perception of the general economic outlook. The consumer confidence index rose to 59.73 from 59.12 in Dec. Among the six sub-indicators of the survey, five increased and one declined. (RTT) Malaysia: Producer price inflation rises to 3.5%. Malaysia's PPI accelerated in Dec after easing in the previous month. Producer prices rose 3.5% YoY in Dec, following a 3.2 increase in Nov. In Oct, the inflation rate was 4.0%. Among sectors, manufacturing prices grew the most, by 6.1% annually in Dec, followed by a 3.8% gain in the water supply segment. (RTT) MarketsSunway REIT (Neutral, TP: RM1.55): Stays upbeat amid improving retail, hotel performance. Sunway Real Estate Investment Trust (REIT) is keeping a positive outlook for its 2023 financial year, underpinned by stable domestic economic growth, growth in the retail sector and further recovery in the hotel segment. It said its optimism was further backed by full-year income contribution from Sunway Carnival Mall (New Wing) and Sunway Resort Hotel in 2023. Sunway REIT CEO Datuk Jeffrey Ng said the REIT is closely monitoring inflationary and interest rate trends despite tapering inflation in recent months. (StarBiz) Pasdec: Inks JV agreement to develop land in Kuantan . Pasdec Holdings has entered into a joint-venture agreement with Sedimi Property Development SB (SPDSB) to develop land at Bandar Indera Mahkota, Kuantan in Pahang. The group said the project would be developed in two phases, comprising 157 units of single storey terrace houses in Phase 1 and 80 units of single-storey semi detached houses in Phase 2. (Bernama) YTL Power International: YTL PowerSeraya, TNB Genco to export 100MW of electricity to Singapore . YTL Power International’s wholly-owned subsidiary, YTL PowerSeraya Pte Limited and TNB Power Generation SB (TNB Genco), a wholly owned subsidiary of Tenaga Nasional Bhd (TNB) have teamed up to export and import 100 megawatts (MW) of electricity to Singapore via the newly upgraded interconnector. YTL said it is the first time electricity from Malaysia would be supplied to Singapore on a commercial basis, adhering to the Malaysian Energy Commission’s guide for cross-border electricity sales (CBES Guide). (StarBiz) Serba Dinamik: Applies to stay winding-up order pending appeal. Serba Dinamik Holdings Bhd has filed a motion for a stay of the winding-up petition order granted by the High Court on Jan 10, pending its appeal to the Court of Appeal. Similar applications have been filed by Serba Dinamik’s subsidiaries Serba Dinamik SB, Serba Dinamik International Ltd and Serba Dinamik Group Bhd. A case management of the appeal was held on Monday, while hearing of the stay applications has been fixed for Feb 3. (The Edge) Zecon: Terminate partnership for mixed development in Kuching . Zecon and PR1MA Corp Malaysia have mutually terminated a partnership to jointly develop a mixed development project in Kuching, Sarawak. Following the termination, Zecon will be buying back the project from PR1MA for RM63.6m, which includes the land cost. The group had in 2014 disposed of the 54.16-acre land to PR1MA for RM46m, before entering into a joint development agreement in 2015 and Heads of Agreement in 2016 to jointly develop the project. (The Edge) Vestland: Unit bags RM63m construction contract . Vestland has received a letter of award from Rimbun Merdu SB worth RM63.2m. The award would entail VRSB undertaking the main building and associated works for one block of 33-storey serviced apartments and related facilities in Seksyen 41, Jalan Dewan Sultan Sulaiman 1, Kuala Lumpur. The company said that the works would include the supply of labour/workers, materials, tools, equipment and machinery for the construction, completion and maintenance of the main building and associated works. (Bernama) Market UpdateThe FBM KLCI might open lower today after US stocks slipped, with investors hunkering down ahead of the Federal Reserve’s policy decision on Wednesday, when the central bank is expected to raise interest rates to their highest since the 2008 financial crisis. Wall Street’s benchmark S&P 500 finished 1.3% lower on Monday, while the tech-heavy Nasdaq Composite dropped 2%. The Fed is expected to raise interest rates by a quarter of a percentage point, continuing to scale back the size of its increases. Early data have shown that the US central bank’s aggressive efforts to combat inflation are bearing fruit, but chair Jay Powell could yet buck expectations that the Fed will stop raising rates and cut them later in the year. In Europe, the region-wide Stoxx Europe 600 traded 0.2% lower after fresh data showed a surprise 0.2% drop in fourth-quarter German gross domestic product, just as Spain’s inflation rate rose 5.8% in the year to January, up from 5.5% in December. The UK’s FTSE 100 finished the session up 0.3%. Back home, the FBM KLCI ended in positive territory on late bargain-hunting, with support in the broader market primarily seen for small-cap energy as well as transportation and logistics stocks. At the closing bell, the benchmark index had gained 1.84 points to 1,499.39, from last Friday's close at 1,497.55. In the region, Hong Kong’s Hang Seng index fell 2.7%, dragged lower by a 6% decline for Alibaba. China’s CSI 300 gained roughly 0.5%. Source: PublicInvest Research - 31 Jan 2023 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||

|