Date: 25/01/2023

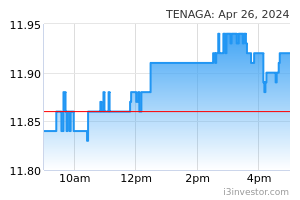

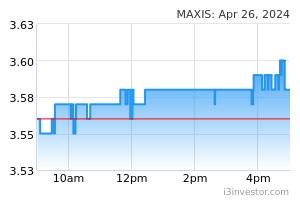

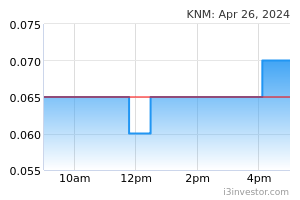

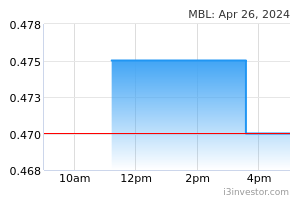

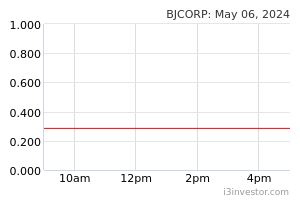

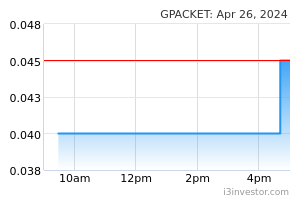

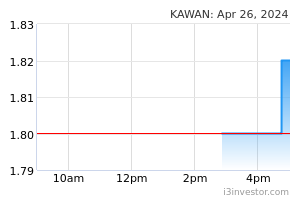

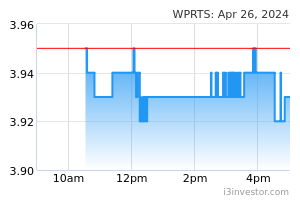

EconomyUS: Yellen reports new debt-limit accounting maneuver to Congress. Treasury Secretary Janet Yellen advised Congress that her department is deploying an additional accounting maneuver to avert breaching the federal debt limit. Yellen said in a letter to bipartisan congressional leaders that the Treasury will be altering the investments in a third government-run fund for retirees, after last week advising them of similar action for two others. (Bloomberg) US: Business equipment borrowings grow 9% in Dec. US companies borrowed 9% more in Dec to finance equipment investments compared with a year earlier, industry body Equipment Leasing and Finance Association (ELFA) said on Tuesday. The companies signed up for USD12.9bn in new loans, leases and lines of credit last month, compared with USD11.8bn a year earlier. Borrowings were up 6% from Jan 2022. ELFA, which reports economic activity for the nearly USD1trn equipment finance sector, said credit approvals totalled 76.6% in Dec, down from 77.7% in Nov. (Reuters) US: Business activity downturn eases slightly; Eurozone back to growth. The downturn in US business activity eased slightly in January even as it contracted for the seventh straight month while Eurozone business activity made a surprise return to modest growth, as two of the world’s major economies hope to avert recession this year. S&P Global said its flash US Composite PMI Output Index, which tracks the manufacturing and services sectors, rose to 46.6 this month from a final reading of 45.0 in Dec, the first moderation since Sept but still well below a key reading of 50 used to separate contraction and growth in the private sector. (Reuters) EU: German private sector downturn eases on cooling inflation, lower recession fears. Germany's private sector downturn softened to a stable footing at the start of the year amid a moderation in price pressures along with a renewed positive outlook on reducing recession risks and on-going strength in the job market. The flash composite output index rose to a seven-month high of 49.7 in Jan from 49.0 in Dec. The index was forecast to rise slightly to 49.6. (RTT) EU: Eurozone private sector expands for first time in 7 months. Eurozone private sector returned to growth at the start of the year after six consecutive months of contraction, raising hopes that the region might escape recession. The flash composite output index rose more-than-expected to 50.2 in Jan from 49.3 in Dec. The reading was forecast to climb to 49.8. The index improved for a third straight month, breaking the 50.0 no-change mark for the first time since last June. A steadying of the eurozone economy at the start of the years adds to evidence that the region might escape recession, Chris Williamson, chief business economist at S&P Global Market Intelligence said. (RTT) UK: Orders book balance falls, cost pressures ease. UK manufacturing output and orders remained stable in the three months to Jan, while average unit costs grew at the slowest pace since April 2021. Output volumes were almost stable in the quarter to Jan, with a weighted balance of -1% versus -9% in the three months to Dec. The survey showed that firms expect volumes to increase briskly in the next three months. Total order book balance fell further below normal to -17% from -6% in Oct, suggesting that output has held up in part due to manufacturers tackling backlogs of work. (RTT) Japan: BoJ defends yield curve control measures, intends to stick to ultra-easy monetary policy. BoJ Governor Haruhiko Kuroda on Friday defended the central bank’s decision to widen the trading band in its yield curve control program and committed to continuing the BOJ’s extremely accommodative expansionary monetary policy. Speaking during a panel session at the WEF in Davos, Switzerland, Kuroda said it was not wrong for the BOJ’s board to widen its tolerance range for the yield on its 10-year government bond from 25bps to 50bps last month. Since the move, 10-year JGB benchmark yields have exceeded the upper ceiling several times. (CNBC) MarketsTNB (Outperform, TP: RM12.42): Seals GBP72m refinancing package for its UK offshore wind investment. Tenaga Nasional Bhd (TNB) unit has secured a GBP72m refinance package from Mizuho Bank Ltd and National Westminster Bank Plc for offshore wind investment by Blyth Offshore Demonstrator Ltd (BODL). The financing facility which was sealed by its wholly-owned subsidiary Vantage RE Ltd that owns 49% in BODL, will have a 15-year tenure. (The Edge) Maxis (Neutral: TP: RM4.00): Postpones seeking shareholders' approval for 5G agreement with DNB. Maxis announced it will postpone seeking its shareholders' approval on the entry into a 5G access agreement (AA) with Digital Nasional (DNB). Maxis, the only major mobile network operator (MNO) which has yet to execute the AA for 5G service, said it would wait until the government had finalised the 5G implementation policy. (The Edge) KNM: Plans RM18.4m private placement for working capital, regularisation plan. KNM Group has proposed a private placement to raise as much as RM18.4m for working capital requirements and expenses related to the restructuring and formulation of its regularisation plan. The Practice Note 17 (PN17) outfit said the placement will entail the issuance of up to 367.6m new shares or 10% of its total share base of 3.7bn shares to third-party investors to be identified later, at an issue price to be determined later. (The Edge) Muar Ban Lee: Proposes one-for-two bonus issue of warrants. Muar Ban Lee Group has proposed a bonus issue of 113.8m warrants on the basis of one warrant for every two shares held. The warrants will carry a five-year tenure with an exercise price of 50 sen each. The exercise price is equivalent to 2.9% of the five-day volume weighted average market price of Muar Ban Lee as at Jan 17. (The Edge) BCorp: Founder Vincent Tan pares stake to 21.3%, inches closer to 19.6% end-Jan target. Berjaya Corp (BCorp) founder and major shareholder Tan Sri Vincent Tan Chee Yioun has pared his stake in the group to 21.3%, inching closer to his target of 19.6% by end-Jan. Over the past two weeks, Tan has offloaded 132m shares, which slashed his direct shareholding to 436.3m shares or a direct equity interest of 7.8%. (The Edge) Green Packet: Disposes unit Xendity for RM17.5m cash. Green Packet is selling its entire 100% stake in software development company Xendity SB to Innov8tif Holdings SB, for RM17.5m in cash. The loss-making digital solutions company said its original cost of investment into Xendity was RM28.4m in Feb 2021. (The Edge) Kawan Food: Forms 40:60 JV with Good2Nature. Kawan Food has formed a 40:60 joint venture with Good2Nature SB (G2N) to undertake the business of producing biocompost. G2N is currently engaged in organic agricultural activities for crops production, organic compost, and wholesale and trading of organic fertilizer and agrochemical products. (StarBiz) Westports: 4Q net profit rises 5% to RM235.0m, declares dividend 7.46 sen. Westports Holdings’ net profit rose 5.5% to RM235.0m for the 4QFY22 from RM222.9m a year earlier, due to investment tax allowance. (The Edge) MARKET UPDATEUS markets ended the day mixed overnight as the earnings reporting season continued to throw up uncertainties. Investors are still bracing for more high-profile corporate earnings amid fears of a recession. The likes of Tesla, Boeing, IBM and AT&T are among the companies slated to post numbers later today. On the day, the Dow Jones Industrial Average inched 0.3% higher though the S&P 500 and Nasdaq Composite slipped 0.1% and 0.3%. European bourses were mostly lower despite flash Purchasing Managers’ Index reading for the Eurozone showing a return to growth for the 20-member currency bloc, boosting hope that a recession may be avoided. Germany’s DAX and UK’s FTSE 100 fell 0.1% and 0.4% regardless, though France’s CAC 40 rose 0.3%. Most of Asia’s major markets remained close for the Lunar New Year Holidays (ie. China, Hong Kong, Taiwan, South Korea, Singapore, Malaysia). Japan’s Nikkei 225 took the lead with a 1.5% gain despite factory data showing a second straight month of contraction. Source: PublicInvest Research - 25 Jan 2023 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|