Date: 12/01/2023

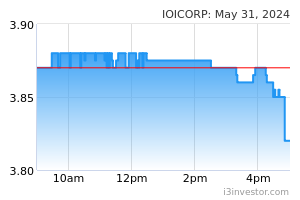

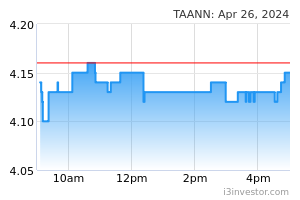

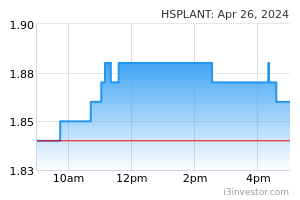

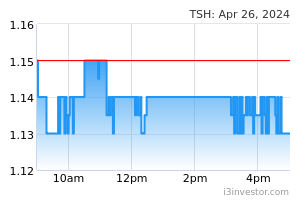

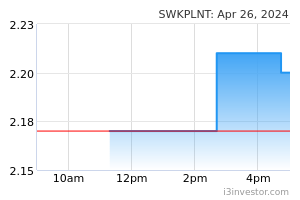

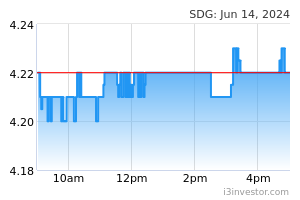

KUALA LUMPUR (Jan 11): Research houses have maintained their ‘neutral’ recommendation on the plantation sector for 2023, with crude palm oil (CPO) prices ranging between RM3,500 and RM4,000 for most parts of the year. CGS-CIMB in a note on Wednesday predicted that CPO prices would stay firm at RM3,800 to RM4,500 per tonne at the start of 1Q2023 due to several factors including the ongoing drought in Argentina which led to severe soybean crop losses, the ongoing La Nina and potential El-Nino, and the lower sunflower seed production from Ukraine due to ongoing war with Russia. “We expect CPO prices to soften from 2Q23F onwards as palm oil output recovers with the entry of more foreign workers, while slower global growth could curb demand,” it said. In 2022, Malaysia’s total palm oil output grew 2% to 18.45 million tonnes, as the rising mature palm oil area more than offset lower CPO yields (-1.6% to 3.05 tonnes per hectare) due to shortages of foreign workers. Malaysia’s palm oil exports grew at a slower rate of 1% to 15.7m tonnes due to higher CPO prices. “Overall, 2022 was a good year for Malaysian palm oil producers as the record-high CPO prices (+15% to RM5,087 per tonne) more than offset rising costs of production (higher labour and fertiliser costs),” it said. Nonetheless, the house warned that costs of production may stay high due to the full-year impact of minimum wage and higher fertiliser costs in 2023. Kenanga Research said edible oil prices have eased after mid-2022 on higher supply but demand, which has been subdued by Covid since 2020, is likely to recover in 2023. Inventory levels are thus expected to stay range-bound for much of 2023. "Therefore, palm oil prices should stay relatively firm, and we maintain 2023- 2024 CPO price forecast at RM3,800-3,500 per metric tonne. “Rising production cost is a concern as labour, fertiliser and energy costs have increased. Improving worker availability in Malaysia should mitigate some of the unit cost inflation as better 2023-24 FFB (fresh fruit bunches) output is anticipated. All in all, we expect margins to stay subdued with the possibility of upside capped somewhat,” it said. Meanwhile Public Bank Investment Research has projected that based on their CPO prices assumption of RM3,800 per metric tonne, there will be a 43% decline in plantation earnings. “The first half of 2023 results are expected to be relatively weak given the slow hiring process, elevated production cost due to a sharp decline in palm kernel credit, and weaker CPO selling prices,” said the research firm. Stockpile on a downtrendHong Leong Investment Bank (HLIB), which maintained its 2023-2024 CPO price assumptions of RM4,000 per metric tonne and RM3,800 per metric tonne, said stockpiles will likely remain on downtrend in the next few months, on the back of seasonally low production cycle, CPO’s wide discount against soybean oil and China’s economy reopening, upcoming increase in biodiesel admixture and change in domestic market obligation in Indonesia. MIDF Research estimated the discount parity between Malaysian and Indonesian CPO prices is US$154.9 per metric tonne or RM536.8 per metric tonne, with a three-year average of US$204.6 per metric while Indonesian prices were traded discount to Malaysia due to the extension of US$0 per metric tonne of export levies. “Overall, we expect Malaysian local delivery prices to be lower in CY2023, ranging between RM3,000 and RM4,000, on expectations of normalisation closing stocks of 2.0-2.1 million tonnes,” says MIDF. Malaysia's palm oil stockpile ended 2022 at 2.19 million metric tonnes (Mt), the highest level since 2017, with the closing stockpiles being higher than 1.61 million tonnes in 2021. “We believe the Malaysian palm oil stockpiles have peaked and gradually consolidated in the first quarter calendar year 2023 (1QCY2023) in anticipation of low cycle months,” according to MIDF. However, palm oil stocks fell by 4% for a second month due to seasonal floods in some estates, followed by lower exports and domestic consumption, offset by lower production. Nevertheless, palm oil output has improved by 2% year-on-year to 18.5 million metric tonnes with an average crude palm oil (CPO) price of RM5,126 per metric tonne, but month-on-month production fell by 3.7% in December 2022. CPO production ended the year at 1.62 million tonnes, higher than 1.45 million tonnes in 2021 due to higher contributions from most states except Terengganu, according to MIDF. MIDF also added that palm oil export volumes in December stood at 1.47 million tonnes as traders seek more Malaysian palm oil due to price competitiveness against soya bean oil. CPO price hinges on external factorsIn regard to external challenges, RHB expected Indonesia’s policies to continue to play a big part in the price direction in 2023. “Indonesia has reduced its domestic export quota to 1:6, from 1:8 as of Jan 1 as a preventive measure against the potential increase in domestic cooking oil prices as demand general rises during Ramadan and Aidil Fitri,” said RHB. “While this should be positive for prices — we do not expect actual export volumes to be impacted significantly, as it will be a low crop season in 1Q.” Indonesia has also delayed its B35 biodiesel mandate start date to February 1, despite the total allocation for 2023 remains at 13.15 million kL or 12.9 million tonnes. Additionally, China and India have favoured Indonesian palm oil, signifying through their higher December 2022 stock levels despite declining Malaysia’s exports. “China’s stock levels rose to 52% above historical levels from 37% in November 2022 supported by restocking activities for the Lunar New Year festivities,” said RHB. “Meanwhile, India’s stock levels rose to 39% above historical levels from 14% in November 2022 due to importers taking advantage of lower import duty structure on refined palm oil before its expiry end-2022.” Stock picks are integrated players insulated from volatile CPO pricesMIDF maintains "buy" on both Sime Darby Plantation (target price: RM5.50) and Sarawak Plantation (target price: RM2.60). Public Bank’s top picks are Sarawak Plantation ("overweight", target price: RM3.32) and Ta Ann ("overweight", target price: RM5.16), while Kenanga’s pick are Kuala Lumpur Kepong Bhd ("outperform", target price: RM25.50), TSH Resources Bhd ("outperform", target price: RM1.35) and Hap Seng Plantations Holdings ("outperform", target price: RM2.50). CGS-CIMB has picked KLK ("add", target price: RM22.87), HSP ("add", target price: RM2.52) and Ta Ann ("add’" target price: RM4.34), while RHB continues to favour KLK ("buy", target price: RM27.85), IOI Corp ("buy", target price: RM4.50) and Wilmar International ("buy", target price: S$5.40). HongLeong Investment Bank prefers KLK ("buy", target price: RM25.19) and IOI ("buy", target price: RM4.16). Source: TheEdge - 12 Jan 2023 More articles on CEO Morning Brief >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|