Date: 23/12/2022

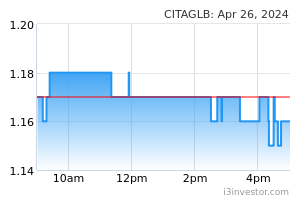

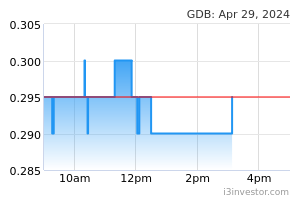

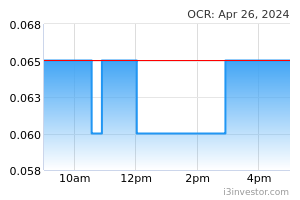

EconomyUS: Weekly jobless claims rise slightly, third-quarter GDP revised higher. The number of Americans filing new claims for unemployment benefits increased less than expected last week, pointing to a still tight labour market, while the economy rebounded faster than previously estimated in the third quarter. Initial claims for state unemployment benefits rose 2,000 to a seasonally adjusted 216,000 for the week ended Dec 17. (Reuters) EU: Italy producer price inflation rose on higher energy costs. Italy's producer price inflation accelerated in Nov, largely due to a surge in energy prices. The producer price index climbed 29.4% YoY in Nov, faster than the 27.7% rise in Oct. The upward trend in inflation was mainly driven by increases in gas supply prices on the domestic market, the statistical office said. Overall energy prices jumped 71.4% annually in Nov, and the increase in prices of consumer goods was 11.1%. Domestic market producer prices grew 35.7% in Nov compared to last year and those in the foreign market rose 10.6%. (RTT) UK: Economy shrinks more than estimated in Q3. The UK economy contracted more than initially estimated in the third quarter, due to the downward revisions to industrial and construction output. The decline in GDP was revised to -0.3% from - 0.2. The production-side breakdown showed that the marginal growth in services output was offset by declines in industrial production and construction. Services output grew 0.1%, which was revised up from flat output estimated previously. Industrial output shrank 2.5% versus the prior estimate of -1.5%. There was a fall in manufacturing output of 2.8%. (RTT) UK: Private sector downturn to deepen into 2023. Slowdown in the UK private sector is set to deepen going into the next year. The CBI growth indicator fell to -13% from -7% in Nov. Private sector activity has fallen for five consecutive rolling quarters. The faster fall at the end of the year was largely due to the decline in consumer services volumes and manufacturing output after a brief return to growth in Nov. Private sector activity is expected to fall at a faster pace in the next three months due to quicker declines in business and professional services and distribution. (RTT) Japan: Lifts growth forecast on better spending prospects. Japan's government upgraded its growth projections for the next fiscal year as rising wages are expected to prop up consumer spending. The real economic growth is seen at 1.5% in the fiscal year starting April 2023, up from the previous outlook of 1.1%. However, for the current fiscal year 2022, the growth outlook was trimmed to 1.7% from 2.0%. Inflation for the next fiscal year is forecast to slow to 1.7% from 3.0% in the current fiscal year ending next April. (RTT) Japan: Overall inflation climbs 3.8% on year in Nov. Overall consumer prices in Japan were up 3.8% on year in Nov. That was in line with expectations and up from 3.7% in Oct. On a seasonally adjusted monthly basis, overall inflation rose 0.2%, slowing considerably from 0.6% in the previous month. Core CPI, which excludes the volatile costs of food, accelerated 3.7% on year - also in line with forecasts and up from 3.6% in the previous month. (RTT) Indonesia: Bank Indonesia hikes BI rate to 5.50%. Indonesia's central bank raised its key interest rate by 25 basis points, in line with economists' expectations, Bank Indonesia Governor Perry Warjiyo announced in a press conference in Jakarta. The Board of Governors hiked the BI 7-day reverse repo rate to 5.50% from 5.25% following its two-day rate-setting session. In Nov, the central bank had raised interest rates by 50 basis points. The deposit facility rate was also raised by a quarter-point to 4.75% and the lending facility rate to 6.25%. (RTT) Taiwan: Jobless rate at 10-month low. Taiwan's unemployment rate fell further in Nov to the lowest in ten months, the Directorate General of Budget Accounting & Statistics showed. The jobless rate declined marginally to an unadjusted 3.61% in Nov from 3.64% in Oct. This was the lowest unemployment rate since Jan, when it was also 6.1%. In the corresponding month last year, the unemployment rate was 3.66%. The number of unemployed persons fell by 3,000 to 428,000 in Nov from 431,000 in the previous month. (RTT) MarketsTenaga Nasional (Outperform, TP: RM12.42): Signs MOU with local firms on alternative fuels for energy transition. TNB has inked a MOU with three firms to conduct studies on alternative fuel sources, generation and chains in the energy transition towards carbon neutrality by 2050. TNB signed the MOU with MNA Fuel Services SB (MNAF), Itochu Malaysia SB and Cement Industries of Malaysia (CIMA). (The Edge) Sports Toto (Outperform, TP: RM2.20): Subsidiary trims stake in REDtone Digital. Sports Toto said its 88.26%-owned subsidiary Berjaya Philippines Inc has reduced its shareholdings in REDtone Digital to realise part of its investments. Berjaya Philippines disposed of 9.6m shares or a 1.24% stake in REDtone Digital for RM4.8m based on the agreed price of 50 sen a share. (The Edge) Dufu Technology: Buys manufacturing plants in Penang. Dufu Technology Corp’s wholly owned unit, Dufusion SB, has entered into two sale and purchase agreements with Merbau Sejati SB to acquire manufacturing plants in Penang for RM45.37m in total. The properties, which has a combined land area of 21,732 sqm, comprise two units of single-storey detached factory with a doublestorey office building. (The Malaysian Reserve) Mudajaya Group: Unit to sell 76% stake in Bera Hydropower. Mudajaya Group’s wholly owned subsidiary Mudajaya Energy SB (MESB) has entered into a share sale agreement with Wazan Corporation SB (WCSB) to dispose of the entire 76% stake in Bera Hydropower SB (BHSB) for RM1. In a filing with Bursa Malaysia today, Mudajaya Group said upon completion of the disposal, BHSB would cease to be a subsidiary of MESB. (StarBiz) Citaglobal: Exits bauxite mining business. Citaglobal, formerly WZ Satu, is exiting its bauxite mining venture under SE Satu SB to focus on a portfolio of businesses that include civil engineering and construction, oil and gas, power generation, property development, manufacturing and renewable energy. It will divest its entire 49% stake in SE Satu to Spring Energy SB for RM4.8m. (The Edge) Serba Dinamik: Trading to be suspended on Friday for failing to submit annual report. Troubled oil and gas engineering firm Serba Dinamik Holdings is poised to see its shares suspended from trading on Friday (23 Dec) due to its failure to submit its annual report for the FY2022. The issuance of the annual report has been delayed as the board of directors are still working on resolving the outstanding audit fees issue with the external auditors. (The Edge) GDB: Lands RM247m contract to design and build logistic hub. GDB Holdings has secured a RM247m design-and-build contract to construct a logistic hub in the Bandar Bukit Raja 2 Industrial Park in Klang. The company has accepted a letter of award from SDPLOG 1 (MY Holdings) SB and established under the Sime Darby Property - LOGOS Property Industrial Development Fund 1 LP. (The Edge) OCR Group: OCR Land Holdings SB tops up YOLO Signature Suites 'socialtainment' project. OCR Group has topped up the YOLO Signature Suites of its RM284.9m GDV project in Bandar Sunway. OCR Land serves as the exclusive marketing partner of OCR Group. The low density 40-storey high-rise features 395 exclusive units in Bandar Sunway’s first "socialtainment" hotspot. (The Edge) MARKET UPDATEAsian markets are expected to display a weak performance today given the sell-off in the US and European markets overnight. The US Dow Jones dropped 348.99 points or 1.1% after falling as much as 803.05 points earlier in the session. S&P 500 declined 1.4% while the Nasdaq Composite was 2.2% lower. The selling was triggered by investors’ concern of further monetary tightening from central banks around the world that could push the economy into a recession. Tech shares were among the loss leaders. In Europe, stocks were also lower with investor sentiment souring after solid gains in the previous session. The Stoxx 600 closed 1.3% lower, with all sectors and major bourses in the red. Autos fell furthest, shedding 2.7%, as tech stocks dropped 2.6%. The FTSE, DAX and CAC were down 0.4%, 1.3% and 1% respectively. In Asia-Pacific markets, shares traded higher yesterday after being buoyed by optimism on Wall Street after upbeat earnings. The Hang Seng and Straits Times added 2.7% and 0.4% respectively but Shanghai Composite was 0.5% lower. Back home, the FBM KLCI closed marginally higher at 1,468.35, added 0.4%. Troubled oil and gas engineering firm Serba Dinamik Holdings Bhd is poised to see its shares suspended from trading today due to its failure to submit its annual report for the financial year ended June 30, 2022. Meanwhile, Gamuda Bhd via Gamuda Australia has bagged a major road transport project from the New South Wales government worth AUD1.03bn (RM3.03bn). Source: PublicInvest Research - 23 Dec 2022 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

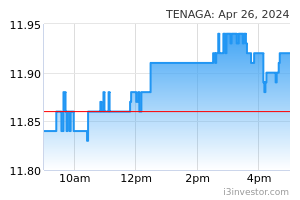

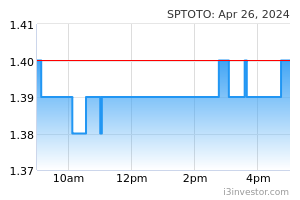

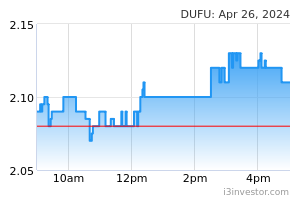

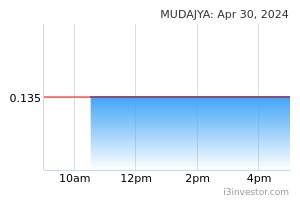

|