Date: 20/12/2022

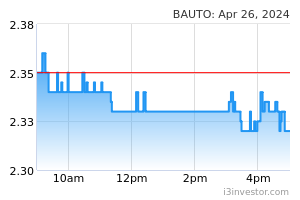

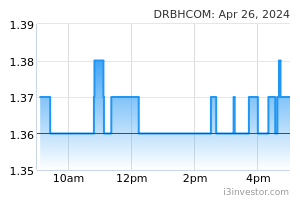

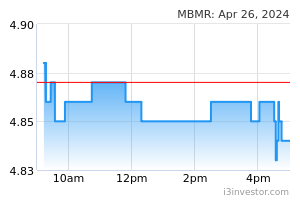

Nov 2022 TIV remained high at 64.4k units (not including BMW, Mini, Merc & Scania; amounting to c.2k units). It was a growth of +5.6% MoM and +11.8% YoY, driven by strong delivery of Perodua during the month. YTD TIV improved +44.8% YoY (642.3k units), mainly due to low base effect. We expect 2022 TIV to achieve a new record high of 700k units (+37.6% YoY), given the expected sustaining high sales volume in coming months, as OEMs accelerate productions, imports and deliveries to clear the high order backlogs. However, we remain NEUTRAL on the automotive sector as the accelerated sales in 2022 may lower down sales expectation into 2023. Top picks for the sector: DRB (BUY; RM2.24), MBMR (BUY; TP: RM5.00) and BAuto (BUY; TP: RM2.35) Malaysian Automotive Association (MAA) reported TIV for Nov 2022 at 64.4k units (not inclusive of BMW, Mini, Mercedes and Scania; amounting c.2k units), a growth of +5.6% MoM and +11.8% YoY, mainly driven by record Perodua sales. YTD TIV reported a substantial growth of +44.8% YoY to 642.3k units mainly due to low base effect, alongside an improved chip shortage situation. As highlighted previously, 2022 TIV may achieve a new record high. We expect TIV to achieve 700k units for 2022 (+37.6% YoY) given the high order deliveries in coming months as OEMs accelerate productions and imports to clear the huge order backlogs (driven by ending of SST exemptions which is still applicable for bookings made by 30 Jun 2022 and deliveries done by 31 Mar 2023) and reduce the waiting period. We believe current order backlogs for industry remains strong at over 250k units. Despite the expected strong TIV recovery until year end (backed by the high order backlogs), we still maintain our NEUTRAL rating on the sector, as we expect TIV to slowdown in 2023. We advise investors to accumulate MBMR (BUY; TP: RM5.00) and DRB (BUY; TP: RM2.24), as we expect the national OEMs to triumph over the longer term with potential growth from new export markets. We also like BAuto (BUY; TP: RM2.35) for its strong balance sheet with high order backlogs lasting for more than 6 months. Note: 1) April-Nov 2022, No Data Available for Peugeot and Kia. 2) Oct-Nov 2022, No Data Available for BMW, Mini, Mercedes and Scania. Perodua (UMW and MBMR) registered a new record high 28.6k units in Nov (+10.6% MoM, +23.7% YoY), as the national OEM continued to push production (also recorded new high 28.5k unit) to clear the high order backlogs. YTD growth was +50.0% (higher than industry’s +44.8% YoY) to 250.8k units, mainly due to low base effect on lockdown restrictions SPLY. Perodua retained its top position with market share at 39.0% YTD. CEO Datuk Seri Zainal guided the strong registration momentum to continue upwards in coming months. Given the strong momentum, Perodua may record a new record high of 280k units, surpassing its target 247.8k units for 2022. Proton (DRB) sales further weakened -12.4% MoM to 11.0k units in Nov, affected by supply issues. On YoY basis, it was a slight drop of -1.4%. Nevertheless, YTD sales has increased by +24.1% YoY to 121.7k units, behind market’s growth of +44.8% YoY, affected by supply chain issue during the first 5 months. Proton retained its second position with 18.9% market share YTD. Including export volume, YTD sales was 126.7k units (+26.0% YoY). Given current momentum, Proton is expected to achieve the lower end of its sales target of 136- 150k units (+18.6%-30.8% YoY). Proton is targeting to launch the new X90 SUV 7-seater in 2023 and also introduce its own EV model by 2027. Toyota (UMW) maintained its top position within the foreign segment with 10.4k units (+13.0% MoM; +67.0% YoY) in Nov. YTD sales was 89.7k units, +43.7% YoY (vs. market’s +44.8%) and the OEM’s market share was 14.0%. Toyota has already breached its sales target of 80k units, potentially achieving 100k units for 2022. Toyota has recently launched its new MPV Veloz (sister to the new Perodua Alza) at RM95k, with over 7k pre-launch bookings by mid-Oct. Other upcoming exciting new launches would be a new EV model, new Innova Hybrid, new Vios and new Yaris in 2023. Honda (DRB) sales rebounded +12.1% MoM sales to 6.6k units in Nov, but it was a drop of -25.4% YoY. YTD Honda sales increased +61.1% to 72.6k units, with 11.3% market share. Honda is targeting sales of 80k units for 2022, trailing behind Toyota within the foreign segment. Honda has recently launched its new Honda Civic e: HEV variant. For 2023, we expect Honda to introduce new WR-V, new CR-V and new BR-V. Nissan (TCM) sales deteriorated further to 0.8k units (-19.4% MoM; -50.9% YoY) in Nov. Nevertheless, YTD sales increased by +20.7% to 12.8k units with a market share of 2.0%. Sales remained weak as Nissan maintained its strategy to avoid stiff market competition, while leveraging onto its core models: Almera, Serena and Navara. Latest model launch was the Serena facelift with price ranging RM150-163k in Jul 2022 and Nissan is expected to launch a new attractive X-Trail SUV and potentially Almera facelift in 2023. Mazda (BAuto) sales sustained at 1.2k units (+18.7% MoM; -7.9% YoY) in Nov. YTD sales was up by +35.9% YoY to 12.9k units (2.0% market share), overtaking Nissan. We understand Mazda’s order backlogs can last more than 6 months, and management is guiding for an improving supply chain situation from Nov onwards. Upcoming new model launch include CX-30 CKD in 2023 with pricing RM127-155k. Source: Hong Leong Investment Bank Research - 20 Dec 2022 More articles on HLBank Research Highlights >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|