Date: 20/12/2022

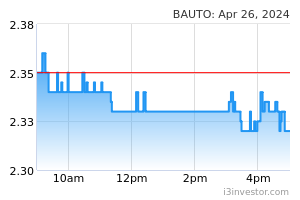

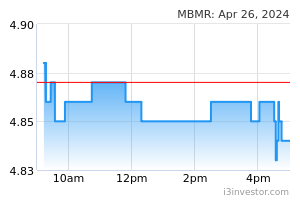

11MCY22 TIV of 642,306 units (+45%) came within our expectation. Vehicle deliveries picked up momentum in November on the easing of parts shortages for certain models (i.e. Perodua and Toyota), and also boosted by year-end promotional activities. Nonetheless, the production capacity of several other models remained sub-optimum as the shortages of chips and components persisted on continued disruptions to the supply chain due to intermittent lockdowns in China. An encouraging sign to note is that the industry order backlogs remained unchanged at 350k for the second month in a row, indicating that deliveries had been fully replenished with new bookings despite the absence of any tax waiver. Our sector top picks are MBMR (OP; TP: RM4.45) given its market leader position in national marques and BAUTO (OP; TP: RM2.65) for its positioning in the premium mid-market segment. Maintain OVERWEIGHT. 11MCY22 total industry volume (TIV) came in at 642,306 units (+45%) while November 2022 TIV was at 64,404 units (+6% MoM, +7% YoY). 11MCY22 TIV came within our expectation. Vehicle deliveries picked up momentum in November on the easing of parts shortages for certain models (i.e. Perodua and Toyota), and also boosted by year-end promotional activities. Nonetheless, the production capacity of several other models remained sub-optimum as the shortages of chips and components persisted on continued disruptions to the supply chain due to intermittent lockdowns in China. Meanwhile, December TIV could be slightly affected by the seasonal flood season, especially in the east coast of Malaysia. An encouraging sign to note is that the industry order backlogs remained unchanged at 350k for the second month in a row, indicating that deliveries had been fully replenished with new bookings, despite the absence of any tax waiver A detailed analysis of the passenger vehicle segment (+6% MoM, +7% YoY): Mazda (+24% MoM, -9% YoY) recovered on the final delivery of its Mazda CX-30 CBU volume before switching toward local production (CKD) which is expected to be rolled out in 1QCY23. Overall volume continued to be driven by the CX-5 and CX-8. Based on sales projection, Mazda currently has 10k backlogged orders (3−5 months). Toyota’s (+15% MoM, +17% YoY) sales were mostly from its exceptional top models, namely the all-new Vios, Yaris, Corolla Cross and Hilux. Based on sales projection, Toyota currently has 30k backlogged orders (3−6 months). Toyota may go beyond its target of 80,000 units for 2022, and most of its CKD auto components are sourced locally (c.90% localisation for certain models). Honda (+12% MoM, -14% YoY) was driven by the City, Civic and BR-V with exceptional response seen for the all-new HR-V which was launched on 14 July 2022. Overall, it is still affected by inventory shortages, especially for the newer models. Based on sales projection, Honda currently has 25k backlogged orders (2−4 months). Perodua’s (+11% MoM, +41% YoY) sales were propelled by the all-new Perodua Alza which gathered massive booking backlogs of 40k units with waiting time of more than 12 months, with equally strong sales of the MyVi and Ativa, and supported by the Axia, Myvi, and Bezza. Based on sales projection, Perodua currently has more than 200k backlogged orders (by up to 12 months for the Alza, 6 months for the Ativa/Myvi, and up to 3 months for others). Perodua guided that it will go beyond its target of 247,800 units for 2022. Meanwhile, most of its auto components are sourced locally (95% localisation). Nissan (-3% MoM, -42% YoY) is losing out on the all-new vehicles launching race. Currently, Nissan depends on the face-lifted Nissan Serena S-Hybrid, Navara, and Almera Turbo with 2k backlogged orders (1−2 months). Proton’s (-12% MoM, -21% YoY) sales were mainly driven by the all-new X70 and X50 (4,751 SUV units sold, making up 43% of sales), and supported by the face-lifted Persona, Iriz, Exora and Saga (collectively known as PIES). Based on sales projection, Proton currently has 65k backlogged orders (up to 12 months for the X50 and by 4 months for other models). Maintain OVERWEIGHT with 2022 TIV target of 680k units (+34%) and 2023 TIV target of 690k units (+2%). We project a TIV of 690k units in 2023 (+2% vs. an estimated 680k for 2022), which is more upbeat than the forecast of 630k for 2022 and 636k for 2023 by the MAA. We believe the odds are in favour of the MAA raising its number along the way. Vehicle sales in 2023 will be underpinned by the continued delivery of order backlogs to the tune of 350k units (as at end-Oct 2022), which was unchanged compared to three months ago, indicating that deliveries had been replenished with strong new bookings, especially for attractive new models (see next page) even in the absence the SST exemption. Additionally, vehicle sales will be supported by launches of new battery electric vehicles (BEVs) which will enjoy the SST exemption and other incentives for EVs up to 2023 for CBU and 2025 for CKD. We believe vehicle sales will remain robust in 2023 supported by: (i) the reopening of the economy; (ii) financial assistance to the low-income group and subsidies on fuels, electricity and selected food items to keep the cost of living in check; (iii) a relatively stable job market; and (iv) healthy household balance sheets of the M40 group. Our sector top picks are MBMR and BAUTO. We like MBMR for: (i) its strong earnings visibility backed by an order backlog of Perodua vehicles of 200k units; (ii) it being a good proxy to the mass-market Perodua brand given that it is the largest dealer of Perodua vehicles in Malaysia as well as its 22.58% stake in Perusahaan Otomobil Kedua Sdn Bhd, the producer of Perodua vehicles; and (iii) its enviable Tier-1 OEM auto parts manufacturing certification. We like BAUTO for: (i) its premium mid-market Mazda brand that offers the best of both worlds, i.e. products that appeal to the middle-income group and yet command more superior margins than its peers in the mid-market segment; (ii) it being a beneficiary of strengthening of the MYR against the JPY; and (iii) its attractive dividend yield of about 6%. Source: Kenanga Research - 20 Dec 2022 More articles on Kenanga Research & Investment >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|