Date: 08/12/2022

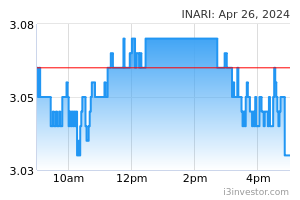

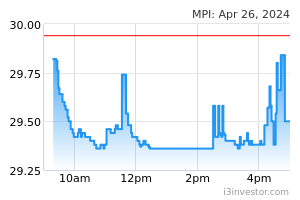

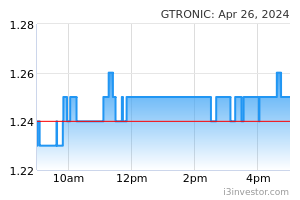

Another Challenging Month Sales The global semiconductor sales declined by 4.6% YoY and 0.3% MoM in October 2022 to USD46.9bn dragged by the slowdown from the Chinese (-16.2% YoY, -1.5% MoM) and the Asia Pacific/Others market (-10.2% YoY, -1.7% MoM). We believe the ease in sales from both the Chinese and Asia Pacific/ Others markets is primarily due to ongoing China’s strict COVID-19 policies which affect factories’ operations and production in China and created supply chain chaos for the neighbouring countries. Nevertheless, sales from other markets reported an improvement which led by the US (+11.3% YoY, +2.2% MoM), followed by European (+9.4% YoY, +0.2% MoM), and Japanese market (+3.8% YoY). WSTS Revised Down 2022F and 2023F Global Semiconductor Sales World Semiconductor Trade Statistics (WSTS) revised down its 2022F forecast for the global semiconductor sales to USD580bn from USD633bn, a single-digit growth of 4.4% (from 13.9% growth), with double-digit growth expected across all geographical regions including (US: +17% YoY, Europe: 12.6% YoY, Japan: +10% YoY) except Asia Pacific, which is projected to drop by 2%. Meanwhile, WSTS expects 2023F’s sales to decline by 4.1% to USD557bn owing to the slowdown in Asia Pacific market (-7.5% YoY). The lower growth forecast made by WSTS is due to the inflationary pressure globally which may affect consumer spending for electronics products. Remain Optimistic on Malaysia OSAT Though WSTS revised down the 2023 global semiconductor sales forecast due to various headwinds, we remain optimistic on Malaysia Outsourced Semiconductor and Testing (OSAT) outlook. The sector’s outlook will be driven by aggressive network migration to 5G, increase components for 5G smartphone, adoption of internet of Things (IoT), recovery in automotive segment, solid demand for electrical vehicles (EV), and data centre. Besides, we believe the advance technology, high-skilled research and development (R&D) team, management leadership, good relationship with customers, continuous plants expansion as well as diversified customer and product portfolio that OSATs companies under our coverage to be our competitive advantages against the global back-end players in maintaining healthy growth of earnings. Furthermore, semiconductor companies under coverage, Inari, Malaysia Pacific Industries (MPI), and Globetronics (GTB) have a strong fundamental with healthy balance sheets – cash rich, strong EBITDA margin and ROE level which are crucial to strive during these challenging times. OVERWEIGHT Call on the Sector We maintain an OVERWEIGHT call on the semiconductor, Technology sub-sector with a BUY call on Inari (TP: RM3.75), MPI (TP: RM33.51), and GTB (TP: RM1.33). Source: BIMB Securities Research - 8 Dec 2022 More articles on Bimb Research Highlights >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|