Date: 17/11/2022

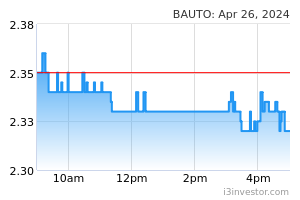

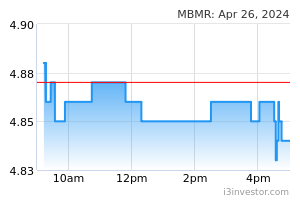

10MCY22 TIV of 577,902 units (+51%) beat our expectation as the delivery of selected models (i.e. Perodua & Toyota) picked up momentum on the easing of parts shortages. Nonetheless, the production of most other models remained sub-optimum as the shortages of chips and components persisted. We raise our CY22 and CY23 TIV assumptions by 5% each to 680k units (+34%) and 690k units (+2%), respectively. Consequently, we raise our FY22-23F earnings and TPs for MBMR and UMW. An encouraging sign to note is that despite the strong TIV in Oct 2022, the industry order backlogs remained unchanged at 350k, indicating strong new bookings despite the absence of any tax waiver. Our sector top picks are MBMR (OP; TP: RM4.45) given its market leader position in national marques and BAUTO (OP; TP: RM2.30) for its positioning in the premium mid-market segment. Maintain OVERWEIGHT. October 2022 TIV at 61,002 units (-10% MoM, -6% YoY). The October 2022 TIV came in above our expectation at 89% of our full-year forecast as the delivery of selected models (i.e. Perodua & Toyota) picked up momentum on the easing of parts shortages. Nonetheless, the production of most other models remained sub-optimum as the shortages of chips and components persisted on continued disruptions to the supply chain due to intermittent lockdowns in China. Having said that, the Oct 2022 TIV already surpassed that of Oct 2019 (pre-pandemic) by 13%. We raise our CY22 TIV assumption by 5% to 680k units (+34%) from 650k units, and CY23 TIV assumption similarly by 5% to 690k units (+2%) from 660k units. Consequently, we raise our FY22-23F earnings for both MBMR and UMW by 8% and 4%. We raise our TP for MBMR by 3% to RM4.45 (from RM4.30). Similarly, we raise our TP for UMW by 3% to RM4.80 (from RM4.65). An encouraging sign to note is that despite the strong TIV in Oct 2022, the industry order backlogs remained unchanged at 350k, indicating strong new bookings despite the absence of any tax waiver. A detailed analysis of the passenger vehicles segment (-9% MoM, -6% YoY): Toyota (+9% MoM, +6% YoY)’s sales were mostly from its exceptional top models namely all-new Toyota Vios, Yaris, Corolla Cross and Toyota Hilux. Based on sales projection, Toyota currently has 30k backlog orders (by 3-6 months). Toyota may go beyond their target of 80,000 units for 2022 and most of its CKD auto components are sourced locally (c.90% localisation for certain models). Perodua (+5% MoM, -7% YoY) was driven by the all-new Perodua Alza which gathered massive booking backlogs of 40k units with waiting time of more than 12 months and with equally strong sales of MyVi and Ativa, and supported by Axia, Myvi, and Bezza. Based on sales projection, Perodua currently has more than 200k backlog orders (by up to 12 months for Alza, 6 months for Ativa/Myvi, and up to 3 months for others). Perodua guided that they will go beyond their target of 247,800 units for 2022 and most of its auto components are sourced locally (95% localisation). Mazda (-3% MoM, -14% YoY) came short on delivery of its Mazda CX-30 CBU volume, but was cushioned by the sustained volume from CX-5 and CX-8. Mazda CX-30 local production (CKD) is expected to be rolled out within 4QCY22. Based on sales projection, Mazda currently have 8k backlog orders (by 3-5 months). Nissan (-11% MoM, -38% YoY) is losing out on the fresh all-new vehicles launching race. Currently, Nissan depends on the facelifted version of Nissan Serena S-Hybrid, Navara, and Almera Turbo and has 2k backlog orders (by 1-2 months). Proton (-14% MoM, -2% YoY)’s sales were mainly driven by the all-new X70 and X50 (5,348 SUV units sold making up 37% of sales), and supported by the face-lifted Persona, Iriz, Exora and Saga (collectively known as PIES). Based on sales projection, Proton currently has 65k backlog orders (by up to 12 months for X50 and by 4 months for other models). Honda (-19% MoM, -9% YoY) was driven by City, Civic and BR-V with exceptional response seen for the all-new HR-V which was launched on 14 July 2022. Overall, it is still affected by inventory shortages especially for the newer models. Based on sales projection, Honda currently has 25k backlog orders (by 2-4 months). Maintain OVERWEIGHT with a higher 2022 TIV target of 680k units (+34%) and 2023 TIV target of 690k units (+2%). We raise both our 2022 and 2023 TIV target by 5% to 680k units (+34%) from 650k units, and to 690k units (+2%) from 660k units, respectively - on the path to record the highest TIV in history. Both of our targets are still above the Malaysian Automotive Association (MAA)’s target of 630k units (+24%) and 636k units (+1%), respectively. The last highest TIV was recorded in 2015 at 666,674 units prior to the introduction of goods & services tax (GST). Our revision is premised on faster delivery of backlog orders with the easing of parts supply shortage for certain models (i.e. Perodua and Toyota). To ensure consumers keep coming back to their showrooms, automakers are putting onto the market newer models that also command better margins (see page 4). Currently, vehicles order backlogs are reaching the tune of some 350k units. Not all of these, particularly new models with a waiting period of beyond 12 months (such as Perodua Alza), will be delivered and registered before end-March 2023 to enjoy the Sales & Service Tax exemption (despite the bookings being made prior to end-June 2022). This means TIV will not fall off the cliff after March 2023. Additionally, there will be launches of new battery electric vehicles (BEVs) that will still enjoy SST exemption and other EV facilities incentives up to 2024 for CBU and 2025 for CKD, underpinning the TIV. Our sector top picks are MBMR (OP; TP: RM4.45) and BAUTO (OP; TP: RM2.30). We like MBMR for its: (i) strategy to focus on affordably priced Perodua vehicles amidst the high inflationary environment with more than 200k units of booking backlogs, (ii) highly sought-after Tier-1 OEM auto parts manufacturing line, and (iii) position in capitalising on both fronts for Perodua through its 22.58% stake and role as the largest Perodua dealership. On the other hand, we like BAUTO for: (i) its premium midmarket Mazda brand that offers the best of both worlds, i.e. products that appeal to the middle-income group and yet command more superior margins than its peers in the mid-market segment, (ii) beneficiary of strengthening of the MYR against JPY, and (iii) its attractive dividend yield of about 5%. Source: Kenanga Research - 17 Nov 2022 More articles on Kenanga Research & Investment >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|