Date: 11/11/2022

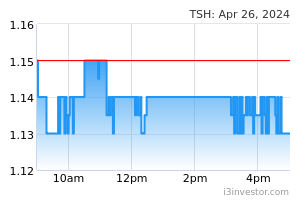

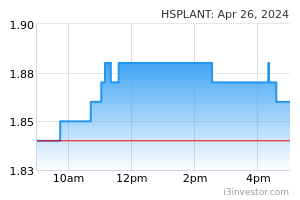

Overview: Malaysia’s Oct palm oil output of 1.814m MT is within Kenanga’s expectation of 1.79m MT and market’s 1.823m MT. Exports improved 6% MoM to 1.504m MT to match consensus forecast but was 8% below ours. However, imports were lower and domestic usage was higher than consensus estimate, thus inventory closed 5% below consensus but 8% above Kenanga’s. Average CPO price for Oct 2022 was RM3,682/MT (-1% MoM, -27% YoY) but has since firmed up to over RM4,000 per MT. For 2022/23 we continue to expect CPO prices of RM4,500/4,000 per MT. Maintain OVERWEIGHT: we continue to like the sector for its defensive cash flows and balance sheet especially amidst the ongoing uncertain economic outlook. Our large integrated pick is KLK while TSH offers long-term upstream growth opportunities. For income seekers, HSPLANT and BPLAN offer attractive dividend yields Overview: Oct inventory ended higher than historic levels on slow exports, affected by reportedly aggressive Indonesian selling since Aug to run down its inventory which should be normalising within a month or two. Nonetheless, Malaysia’s Oct exports to China continued to strengthen, 36% MoM, to 359K MT (+47% YoY). Exports to India also picked up 13% MoM from Sept and likewise sales to EU jumped 67% MoM. Overall exports were healthy despite stiff competition from Indonesia. Outlook: Oils and fats prices firmed up after 3QCY22 and should stay firm, buoyed by year-end festivities, winter demand with an early Chinese New Year (22 Jan 2023) as well. Demand from China is also expected to stay healthy and improve once the country reverts to a new post-Covid era. Maintain average CPO price assumptions of RM4,500/MT for 2022 and RM4,000 for 2023. Recommendation: The KL Plantation Index continues to hold better than the broader market driven by resilient food and fuel demand, asset-rich NTA and undemanding valuations. In view of the sector’s defensiveness amidst global economic uncertainties, it is maintained at OVERWEIGHT. Within the sector, we like those with the ability to expand upstream such as KLK (OP; TP: RM28.00) and TSH (OP; TP: RM1.80) or those with attractive dividend yields, the likes of HSPLNT (OP; TP: RM2.80) and BPLANT (OP; TP: RM0.95). Source: Kenanga Research - 11 Nov 2022 More articles on Kenanga Research & Investment >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|