Date: 03/11/2022

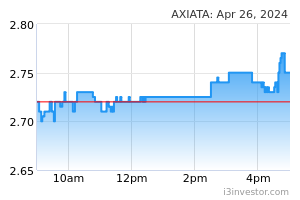

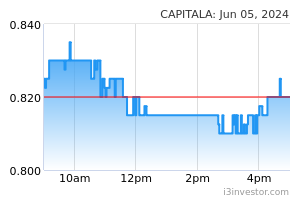

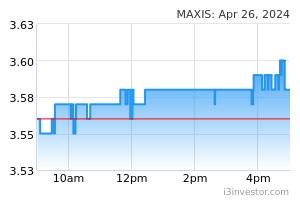

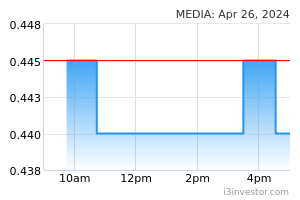

EconomyGlobal: Growth across Asean manufacturing sector softens. Growth softened across Asean manufacturing firms after ending the third quarter strongly, according to the latest S&P Global PMI survey data. In the S&P Global Market Intelligence data released, S&P Global said at 51.6 in Oct, down from 53.5 in Sept, the headline PMI signalled the slowest improvement in operating conditions across the region since the current series of expansion began in Oct 2021. A majority of the Asean constituents recorded an improvement across their manufacturing sector during Oct, with the exception of Myanmar and Malaysia. (The Edge) US: Fed approves 0.75% hike. The Federal Reserve approved a fourth consecutive three-quarter point interest rate increase and signalled a potential change in how it will approach monetary policy to bring down inflation. In a well-telegraphed move that markets had been expecting for weeks, the central bank raised its short-term borrowing rate by 0.75 percentage point to a target range of 3.75%-4%, the highest level since Jan 2008. The move continued the most aggressive pace of monetary policy tightening since the early 1980s, the last time inflation ran this high. The rate increase comes as recent inflation readings show prices remain near 40-year highs. (CNBC) US: Private sector employment jumps by 239,000 jobs in Oct, more than expected. Private sector employment in the US increased by more than expected in the month of Oct, according to a report released by payroll processor ADP. ADP said private sector employment jumped by 239,000 jobs in Oct after climbing by a downwardly revised 192,000 jobs in Sept. Economists had expected private sector employment to advance by 195,000 jobs compared to the addition of 208,000 jobs originally reported for the previous month. The bigger than expected increase in private sector employment reflected a surge in employment in the leisure and hospitality sector, which added 210,000 jobs. (RTT) EU: German unemployment rises less than expected. German unemployment increased less-than-expected in Oct, data published by the Federal Labor Agency revealed. The number of unemployed climbed 8,000 in Oct, following a revised increase of 13,000 in Sept. Unemployment was forecast to rise by 15,000. The unemployment rate remained unchanged at 5.5% in Oct, in line with expectations. The consequences of the economic uncertainties are visible, Federal Labor Agency head Andrea Nahles said. More companies are preparing for possible short-time work and reducing their demand for new staff. (RTT) EU: New car orders in France fell 11.5% in Oct. New car orders in France fell again in Oct, according to data published by the French carmarkers’ committee CCFA. There was an 11.5% drop in new car orders, the indicator published on the CCFA website showed, despite an increase in orders taken at the Paris Motor Show in Oct and following a 1.3% fall in Sept. New car registrations in France have risen for three consecutive months, with a 5.45% increase for Oct, according to Plateforme automobile (PFA) data published, reflecting deliveries of previously accumulated orders. (Reuters) South Korea: Inflation jumps 5.7% on year in Oct. Overall consumer prices in South Korea were up 5.7% on year in Oct, Statistics Korea said. That exceeded expectations for an increase of 5.6%, which would have been unchanged from the Sept reading. On a monthly basis, inflation added 0.3% - unchanged from the Sept reading but above forecasts for a 0.2% gain. Core CPI, which excludes the volatile costs for food prices, was up 4.2% on year - up from 4.1% in the previous month. (RTT) Australia: Service sector falls into contraction. The services sector in Australia slipped into contraction territory in Oct, the latest survey from S&P Global showed with a services PMI score of 49.3. That's down from 50.6 in Sept, and it falls beneath the boob-or-bust line of 50 that separates expansion from contraction. Total new business fell in Oct, underpinned by a decline in demand. Anecdotal evidence suggested that weaker market conditions and higher interest rates affected incoming new orders in Oct. The decline in new orders was also the quickest since Sept 2021. Composite demand contracted in Oct and at the fastest rate since Sept 2021 on the back of falling inflows of new business for services firms. (RTT) MarketsAxiata (Neutral, TP: RM3.60): Weighing options for Indonesian units. Axiata Group is exploring options for its Indonesia businesses including a merger between its broadband and mobile services in the country (The Edge) Comments: In Indonesia, Axiata effectively owns 58.3% of Link Net and 61.48% of XL Axiata. Link Net is a provider of cable television and high speed broadband internet services while XL Axiata is the country’s second-largest mobile operator. Following the acquisition of Link Net, which was completed in June 2022, Axiata is undertaking a mandatory tender offer to acquire the remaining equity stake in Link Net. Also note that XL Axiata holds a 20% stake in Link Net. Given the connection between Link Net and XL Axiata, a merger is possible but in our view, it may not be necessary as both companies are already in good positions to leverage on the sharing of backbone and transmission networks as well as extensive relationship with customers. However, a merger may help Axiata to streamline its listed assets in Indonesia. This consideration is still at an early stage and there is no certainty that Axiata will proceed with a transaction. We maintain our Neutral rating on Axiata. Capital A (Neutral, TP: RM0.69): Sells remaining 16.33% stake in AirAsia India to Tata affiliate for RM89m. Capital A announced it has sold all its remaining shares in AirAsia (India) Private Ltd (AAI) to Air India Ltd, an affiliate of Tata Sons Pte Ltd (TSL). The remaining shares represented 16.33% in AAI. AAAGL is expected to receive a gross proceeds of INR1.56bn (RM89.3m) from the stakes sale. (The Edge) Comments: The disposal of the remaining stake in AirAsia India and gross proceeds of RM89.3m is a welcome boost to the Group’s ongoing fundraising efforts. However, we remain wary over the Group’s PN17 status and its race against time to submit a convincing regularization plan within the next 2 months, though the Group may possibly apply for (and be granted) extensions to comply. We maintain our earnings estimates and Neutral call. Maxis (Neutral, TP: RM4.00): To seek shareholders’ nod to enter 5G access agreement with DNB. Maxis will seek the consent of its shareholders to enter into the 5G access agreement with Digital Nasional (DNB). The board believes it is mandatory for Maxis to seek shareholders’ approval given the nature of the access agreement and the substantial undertaking involved. (The Edge) Media Prima: Collaborates with China-based television network to co-produce programmes. Media Prima has announced it will collaborate with China-based television network Hunan Broadcasting System to co-produce programmes as well as broadcast Hunan-produced content on 8TV. This serves as a gateway for opportunities, technological exchange as well as entrepreneurial ventures for Chinese small and medium enterprises to set up their business here in Malaysia. (The Edge) Kelington Group: Bags two new contracts worth RM262m. The first contract is valued at approximately RM170m, to provide turnkey design and build services for a bulk liquid terminal in Port Klang, Malaysia. The contract will commence in Nov 2022 and is slated for completion by Oct 2024. The second contract, worth RM92m, is to undertake the material supply and installation of a bulk gas delivery system for a semiconductor plant in Beijing. It lasts 10 months, commencing in Nov 2022 and ending in Sep 2023. (BTimes) MARKET UPDATEThe FBM KLCI might open lower after US stocks sank on Wednesday after Federal Reserve chair Jay Powell cautioned that it was still “very premature” to think about pausing interest rate rises as the central bank delivered its fourth supersized increase in a row. Wall Street’s benchmark S&P 500 index ended the day 2.5% lower and the Nasdaq Composite fell 3.4% after a volatile afternoon of trading as investors struggled to digest the Fed’s messaging. Stocks initially jumped as policymakers appeared to hint they could soon slow the pace of future increases, but fell back as Powell spoke to journalists. In Europe, the regional Stoxx Europe 600 fell 0.3%. Back home, Bursa Malaysia reversed Tuesday's losses to close in positive territory on Wednesday in line with the strong performance on regional peers on hopes the US Federal Reserve will be less aggressive on the interest rates hike. At the closing bell, the FBM KLCI ticked up 5.69 points to 1,451.61 from Tuesday's close of 1,445.92. In the region, Chinese equities rose, consolidating gains made in the previous session as unsubstantiated rumours that the country was seeking to end its strict zero-Covid policy boosted investor sentiment. Hong Kong’s Hang Seng index was up 2.4%, while China’s CSI 300 added 1.2%. The two indices respectively closed 5.2% and 3.6% higher on Tuesday. Elsewhere in Asia, Japan’s Topix added 0.1%. Source: PublicInvest Research - 3 Nov 2022 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|