Date: 11/10/2022

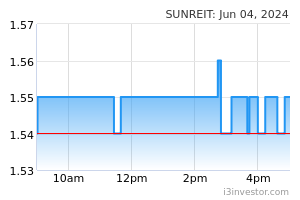

We reaffirm our NEUTRAL call on the MREITs sector. While there are selected bright spots in the industrial segment (which is seeing steady demand) and the retail space (in prime locations following a recovery from the pandemic’s effects), the broader sector is still plagued by persistent oversupply (particularly in the office space). Notwithstanding the challenging sector dynamics, value buys are surfacing following their recent share price weakness in reaction to rising interest rates. Based on unchanged target prices, our tactical stock picks are SUNREIT (OP; TP: RM1.60) and PAVREIT (OP; TP: RM1.42), offering potential total returns of 18.7% and 19.9%, respectively Challenging outlook persists. The recently released 1HCY22 Property Market Report by the National Property Information Centre (NAPIC) showed that the overhang story – especially in the office and retail segments – is still weighing on the Malaysia REITs (MREITs) sector fundamentals. According to the half-yearly report, as of end-June 2022, for the whole of Malaysia: (i) total purpose-built office space stood at 24.2m sq m with occupied space of 18.8m sq m, resulting in an occupancy rate of 77.7%, and (ii) overall retail space in shopping complexes was at 17.4m sq m of which 75.7% was occupied. More supply to come. There will be more supply coming onstream with the NAPIC report projecting: (i) an additional 1.5m sq m under construction and another 1.1m sq m from planned supply (where building plan approvals have been obtained), which add up to a combined 10.7% of existing supply of purpose-built office space, and (ii) 1.6m sq m (from construction in progress) and 0.3m sq m (from planned supply) of retail space in shopping complexes in the pipeline (translating to an incremental 10.9% of existing supply). And yet, post the knee-jerk recovery from Covid-triggered movement restrictions, the underlying demand for office and retail spaces will likely remain soft in view of the uncertain economic outlook (amid recession and prolonged inflation fears) as well as the downsizing of office space requirements (as some companies adopt the hybrid work from-home arrangement post-pandemic). On balance, this is expected to exert further downward pressure on overall occupancy rates for both the purpose built office space (which has been declining steadily to 77.7% in 1HCY22 from 82.8% in 1HCY18) and retail segment (down to 75.7% in 1HCY22 from 79.9% in 1HCY18) (Chart 1). MREITs on the slide as MGS yield trends higher. Following a previous climb from a trough of 2.40% in early August 2020 to a high of 4.50% in early May this year before retracing thereafter to 3.89% in the beginning of August, the 10-year Malaysian Government Securities (MGS) yield has resumed its upward trend lately to close at 4.39% last Friday (Chart 2). This is nearing our assumption of 4.5% for the 10-year MGS yield, a risk-free benchmark we use as a valuation reference to impute the corresponding yield spreads in deriving our individual target prices (Chart 3). In reaction to the rising 10-year MGS yield trend, share prices in MREITs have drifted lower as tracked by the Bursa REIT Index (down 5.9% since the start of August). NEUTRAL sector call. We are reiterating our NEUTRAL sector view. Broadly speaking, against a backdrop of persistent oversupply, MREITs with exposure in the right business segments (particularly in industrial and retail) and/or own property assets in prime locations (like the city centre) will continue to benefit from resilient rental income streams. Notwithstanding the challenging sector fundamentals, selected values are emerging following their recent share price weakness. While keeping our target prices, we are upgrading our stock call from Market Perform to Outperform for SUNREIT (OP; TP: RM1.60) and PAVREIT (OP; TP: RM1.42) as our tactical picks within the sector, offering potential total returns of 18.7% and 19.9%, respectively. Meanwhile, SENTRAL remains an Underperform with a TP of RM0.79 (its share price has fallen 13.4% since our downgrade on 22 August 2022). Risks to our call include: (i) risk-free rate eases/hikes, (ii) higher/lower-than-expected rental reversions, and (iii) higher/lower-than-expected occupancy rates. Source: Kenanga Research - 11 Oct 2022 More articles on Kenanga Research & Investment >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|