Date: 27/09/2022

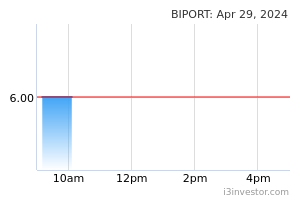

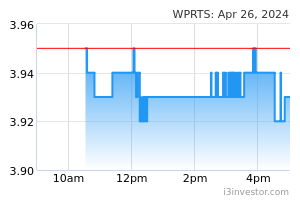

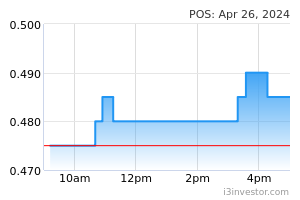

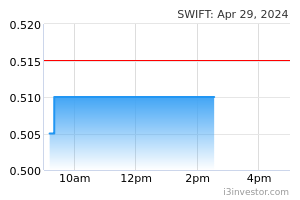

We maintain our NEUTRAL call on the sector and remain cautious on seaport operators in general, buffeted by a weak outlook for global trade. The World Trade Organisation (WTO) recently downgraded its global trade growth forecast for 2022 to 3% (from 4.7%), while remaining cautious for 2023 at 3.4%. However, we see a bright spot in the logistics sector locally given that: (i) it is primarily driven by domestic demand, and (ii) it is also backed by a mega trend of growth in domestic ecommerce. Industry experts project the local e-commerce gross merchandise volume to grow at a compounded annual growth rate (CAGR) of 11% from 2022 to 2027, while its size could reach RM1.65t by 2025 from RM1t currently. Our sector top picks are BIPORT (OP; TP: RM5.90) given its ability to weather macro challenges and SWIFT (OP; TP: RM1.01) for growth potential of its warehousing business expansion riding on domestic e-commerce market. Challenging outlook for global trade. We remain cautious on seaport operators in general, buffeted by a weak outlook for global trade. The WTO recently downgraded its global trade growth forecast for2022 to3% (from 4.7%), while remaining cautious for 2023 at 3.4%. A recession in Europe is almost a foregone conclusion given the protracted Russia-Ukraine war, resulting in an energy crisis. Meanwhile, there is no sign of China coming out of the pandemic anytime soon given Beijing’s ineffective zero-Covid policy which is prolonging global supply chain disruptions. Globally, consumer confidence and spending are likely to take a beating on sustained elevated inflation, rising interest rates and as households deplete their pandemic relief funds. However, we believe BIPORT will be able to weather these macro challenges better thanks to: (i) its stable operation in the handling of LNG cargoes, (ii) a potential hike in tariffs of Bintulu Port as well as (iii) the long-term growth potential of Samalaju Industrial Port’s hinterland in Samalaju, Sarawak driven by the growing investment in heavy industries. Logistics to ride on e-commerce boom. However, we see a bright spot in the logistics sector locally given that: (i) it is primarily driven by domestic demand, and (ii) it is also backed by a mega trend of growth in domestic ecommerce. Industry experts project local e-commerce gross merchandise volume to grow at a CAGR of 11% from 2022 to 2027, while its size could reach RM1.65t by 2025 from RM1t currently. The booming e-commerce will spur demand for distribution hubs and warehouses to enable: (i) just-in-time (JIT) delivery, (ii) reshoring/nearshoring to bring manufacturers closer to end-customers,(iii) efficient automation system including interconnectivity with the customer system, and(iv) warehouse decentralisation to reduce transportation costs and de-risk the supply chain. There is also a strong demand for cold-storage warehouses on the back of the proliferation of online grocery start-ups. On the back of a weaker global trade outlook, we cut our FY22F/FY23F earnings for WPRTS by 9% each, lower our TP by 4% to RM3.40 (WACC: 6.4%; TG: 2%) from RM3.55 but maintain our MARKET PERFORM call. Meanwhile, we downgrade POS to UNDERPERFORM (from MARKET PERFORM) with an unchanged DCF-derived TP of RM0.55 (WACC: 6.8%; TG: 0%) following a strong recovery in its share price which we believe is pre-mature. The conventional mail business of POS will continue to struggle to stay relevant in the digital age. It will also have to rethink the strategy for its courier business given that e-commerce players (such as Shopee and Lazada) are beefing up their in-house delivery services, as well as strengthening their tie-ups with certain logistics players. Our sector top picks are BIPORT (OP; TP: RM5.90) and SWIFT (OP; TP: RM1.01) We like BIPORT for: (i) its steady income stream from handling LNG cargoes for Malaysia LNG Sdn Bhd (which typically makes up close to 50% of its total profits), (ii) a potential step-up in earnings if Bintulu Port is granted a significant hike in its port tariffs, and (iii) the tremendous growth potential of Samalaju Industrial Port backed by rising investment in heavy industries in Samalaju Industrial Park. We like SWIFT for its: (i) its leading position in the Malaysian haulage business commanding close to 10% market share, (ii) above peers’ pre-tax profit margin of 10% compared to industry average of 4% with its integrated offerings and cost-service advantage, and (iii) growth potential of its warehousing business expansion riding on the domestic e-commerce market. Source: Kenanga Research - 27 Sept 2022 More articles on Kenanga Research & Investment >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|