Date: 15/09/2022

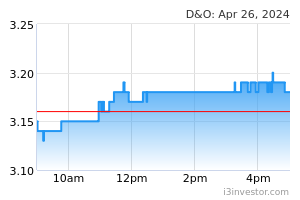

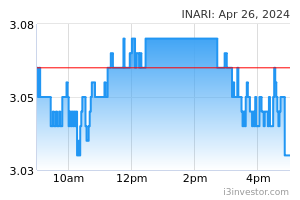

MIDF stays ‘positive’ on tech sector; D&O green and Inari are top picks KUALA LUMPUR (Sept 14): MIDF Research has maintained its “positive” view on the technology sector and said that while it recognises that the sector continues to be weighed down by rate rise pressures and other macroeconomic difficulties, it remains positive on the sector given that demand for EV, AI, and 5G related products remain intact and are critical enablers to ignite the digital economy worldwide. In a note on Wednesday, MIDF said artificial intelligence (AI), automotive electronics, augmented and virtual reality (AR/VR), and other developing technologies rely significantly on the semiconductor sector for computational power. “As a result, we reiterate our positive view on this industry, which is poised for exponential development as a result of its adoption and integration,” it said. Top picksMIDF said it continues to favour D&O Green Technologies Bhd (buy; TP: RM4.58), being one of the top 5 LED producers globally as the company is ideally positioned to benefit from the EV market’s accelerating expansion, due to its great product innovation, large client base, and increased LED consumption per car. “We also prefer Inari Amertron Bhd (buy; TP: RM3.53) because the group’s future as Malaysia’s largest outsourced semiconductor assembly and test (OSAT) provider remains intact. “Despite the lower projection on revenue from the smartphone segment in FY23, the management expects it will rebound again, supported by content value growth and new design wins such as RF double-sided moulding system-in-package (SIP) programme in next-generation smartphone models,” it said. MIDF said that coupled with Apple’s strategy to maintain the price for their latest iPhone 14 at US$799, the same amount that it initially charged for last year’s iPhone 13. “We opine that this strategy will assist Apple to remain robust in current inflationary environment, therefore benefitting Inari, which is in the supply chain for Apple’s smartphone manufacture,” it said. Source: TheEdge - 15 Sep 2022 More articles on CEO Morning Brief >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|