Date: 01/09/2022

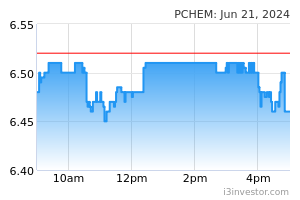

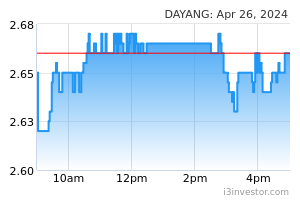

Read-through of Petronas’ 1HFY22 results shows stronger earnings (+179% YoY), thanks to the higher oil prices, with capex spending also higher at RM18.9b (+49% YoY), reflective of the ongoing recovery of activity levels. That said, with Petronas guiding full year capex of RM60b, we are anticipating a pick-up of capex investments in 2HFY22. While Petronas has also doubled its dividend commitment to RM50b, we do not find this overly surprising given its strong earnings outlook backed by its healthy net-cash position of RM103b – highest since 2018. As such, we still feel that this should not hamper the group’s capex spending ability. We maintain OVERWEIGHT on the sector. Stronger 1HFY22 thanks to higher oil prices. Petronas group saw its 1HFY22 core PATAMI of RM44b more than doubled YoY (from RM16b in 1HFY21), largely due to favourable average realised prices for all products. As reference, Brent crude oil price averaged at USD104/barrel in 1HFY22, versus USD67/barrel in 1HFY21. Capex in line with recovery of activities; Petronas doubles dividend commitments. Petronas incurred a capex of RM18.9b in 1HFY22 – representing a 49% jump YoY. This is reflective of an overall recovery as activity levels are normalising in a post pandemic era. That said, we still believe capex spending will pick up faster in 2HFY22 in order to meet Petronas’ capex guidance of RM60b for the full year. Meanwhile, Petronas has also doubled its dividend commitment for 2022 to RM50b, from RM25b previously, after having considered a request from the government. This will be the highest dividend pay-out by Petronas since 2019 when it paid a total of RM54b in dividends. This is not too surprising, considering Petronas is set to post record profits in FY22 (barring any major crash in oil prices in 2HFY22), coupled with its current strong net-cash position of RM103b – the highest since 2018. As such, we are not too concerned by this, as we feel that the increased dividend commitments should not hamper Petronas’ capex spending ability. Activity levels to continue picking up in the second half of the year. With an anticipated further ramp-up in capex by Petronas in 2HFY22, we are expecting the upcoming quarters to see a continued recovery trajectory in local activity levels. Earlier in our read-through of Petronas’ latest activity outlook, we have highlighted DAYANG to be one of the key beneficiaries, given the planned increase in offshore maintenance, construction and modification (MCM), and hook-up and commissioning (HUC) works. Meanwhile, we believe UZMA could also benefit from the increased level of brownfield activities – especially in an environment of higher oil prices as producers would be more incentivised to enhance well productions. Additionally, demand for jack-up rigs are also expected to improve in 2H 2022 (versus 1H 2022) – benefitting rig provider VELESTO, although on a full year comparison basis, 2022-2023 is still expected to see dampened demands compared to yesteryears. Maintain OVERWEIGHT on the sector, underpinned by the elevated oil prices, and anticipation of continued recovery in activity levels in the coming quarters. We maintain our 2022-2023 full-year Brent crude oil price average assumption of USD100- 110/barrel. Comparatively, Petronas foresees Brent crude oil prices to range between USD90 to USD95 per barrel in 2H 2022, with some correction to take place in 2023. Sector picks for the moment remain PCHEM and DAYANG. PCHEM (OUTPERFORM, TP: RM11.00): PCHEM is a beneficiary of the elevated crude oil and petrochemical prices. Given its arrangement with Petronas, PCHEM benefits from a favourable feed-cost structure against peers – i.e. most of PCHEM’s gas feed stock can be procured from Petronas at a fixed pre-agreed price, while others may be hampered by the volatile input cost environment. PCHEM also enjoys dominant market share regionally, which will be further cemented by the start-up of its Pengerang complex in 2H 2022 - increasing its capacity by ~15%. TP is pegged to 16x PER – in-line with other regional petrochemical giants (e.g. Formosa Chemicals, LG Chem). DAYANG (OUTPERFORM, TP: RM1.30): Being the best play on the recovery of local activities. DAYANG is the market leader within the MCM and HUC space, which is expected to see jump in demand in the coming 2-3 years, in accordance to Petronas’ latest activity outlook. Our valuation is pegged to a 15x PER, which is at a 25% discount versus the average valuation of offshore maintenance peers back in 2014 (being the last year in which Brent crude was trading above USD100/barrel, prior to the recent rally). Source: Kenanga Research - 1 Sept 2022 More articles on Kenanga Research & Investment >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|