Date: 26/07/2022

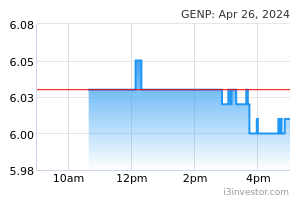

MIDF cuts Genting Plantations’ target price by 21% to RM8 KUALA LUMPUR (July 25): MIDF Research has cut its target price (TP) for Genting Plantations Bhd by 21% to RM8, from RM10.10 previously. “We are maintaining our ‘buy’ call with revised TP of RM8 (from RM10.10) by pegging its FY23 EPS [earnings per share] of 52.46 sen to PER [price-earnings ratio] of 15 times nearly -1SD of its four-year historical forward. “We changed our valuation from SOP [sum-of-parts] to PE [price-earnings] since its property sales contribution is only 3% and does not offer value accretive to the company,” said MIDF in a note on Monday (July 25). MIDF forecasts the group to post sustained double-digit growth in profit before tax of 15% over the financial year ending Dec 31, 2022 (FY22) as it posits cost to remain under control with 40% fertiliser and 30% labour structure, in anticipation of higher average selling prices of crude palm oil (CPO) to be able to compensate rising input cost. “We believe elevated CPO price will amplify its topline to grow +24% year-on-year (y-o-y) and -6% y-o-y to RM3.9 billion/RM3.7 billion [in FY22/FY23], while bottom-line to increase +18% and -14% to RM547 million/RM470.9 million [in FY22/FY23]. “Following more maturity age profile circa 117,329 ha (hectare) and 18,084 ha coming into Malaysia/Indonesia estates this year, we anticipate group matured area to improve to 135,413 ha in 2022 resulting [in] fresh fruit bunch yield to touch 17.3/mature ha in FY22. This would aid production to register at 2,342,645 mt/ha,” said MIDF. In addition, Genting Plantations' planted area now stood at 159,318 ha in FY21, with matured area at 134,313 ha and immature area around 25,005 ha, according to MIDF. “The average oil palm age profile of 11.9 years of the group is relatively ideal in FY21 with approximately 58% prime mature and 48% of past prime age, while the remaining is young mature [at] 12%. We believe that this is [a] fairly matured profile that may provide visible revenue and earnings growth moving forward,” it added. Genting Plantations has eight ‘buy’, six “hold” and three “sell” calls, with target prices ranging from the lowest of RM5.20 and the highest of RM15, Bloomberg data showed. At the time of writing on Monday, Genting Plantations’ share price had risen two sen or 0.31% to RM6.56, valuing the group at RM5.89 billion. It is currently trading at a historical price-earnings ratio of 12.13 times, offering a dividend yield of 2.29%. Source: TheEdge - 26 Jul 2022 Labels: GENP More articles on CEO Morning Brief >>

| |||||||||||||||||||||||||||||||||||||||||||||||||

|