Date: 12/05/2022

EconomyUS: Consumer price growth slows less than expected in April. A highly anticipated report released by the Labor Department showed the annual rate of US consumer price growth slowed by less than expected in the month of April. The Labor Department said consumer prices in April were up by 8.3% compared to the same month a year ago. While the annual rate of growth slowed from a 40-year high of 8.5% in March, economists had expected the pace of growth to slow to 8.1%. Energy prices skyrocketed by 30.3% YoY, while food prices spiked by 9.4%, reflecting the largest yearly increase since the period ending April 1981. The annual rate of growth in core consumer prices, which exclude food and energy prices, also slowed to 6.2% in April from 6.5% in March, although the rate was expected to decelerate to 6.0%. (RTT) US: Treasury reports record budget surplus in April as revenues soar. The US government posted a USD308bn surplus in April - a record for any month - as receipts nearly doubled from a year earlier amid a strong economic recovery from the COVID-19 pandemic, the Treasury Department said. The April surplus compared to a USD226bn deficit for April 2021, when receipts were reduced by a one-month delay in the annual tax filing deadline. The previous record monthly surplus was USD214bn in April 2018. April has traditionally been marked by budget surpluses due to the traditional April 15 tax filing deadline, but deficits for that month were recorded in 2009, 2010 and 2011 after the financial crisis, and in 2020 and 2021 due to the pandemic, a Treasury official told reporters. Receipts last month rose 97% from the year-earlier period to USD864bn, also a record for any month, the Treasury said. (Reuters) EU: Germany inflation hits record high as estimated. Germany's consumer price inflation hit a record high as estimated in April, final data from Destatis showed. Consumer price inflation rose to 7.4% in April from 7.3% in March. The inflation rate hit an all-time high since German reunification and also came in line with the flash estimate published on April 28. Destatis cited the development in energy prices as the one of the major cause for the record increase in overall prices. The above average increase in food prices also lifted consumer prices. The impact of the war in Ukraine is becoming more and more visible, the statistical office said. Prices of goods were up 12.2% from the last year. Energy product prices advanced 35.3% and food prices gained 8.6%. At the same time, services cost increased 3.2%. Excluding energy prices, consumer price inflation rate stood at 4.3% in April, data showed. On a monthly basis, consumer price inflation slowed to 0.8%, in line with estimate, from 2.5% in March. (RTT) China: Inflation rises; PPI inflation slows in April. China's consumer price inflation rose more-than-expected in April on rising food prices, while factory gate inflation slowed moderately. Consumer price inflation rose to 2.1% in April from 1.5% in March, the National Bureau of Statistics said. Economists had forecast inflation to rise to 1.8%. The government targets around 3% inflation for the whole year of 2022. Food prices moved up 1.9%, in contrast to the 1.5% fall in March. The increase partly reflects higher cost of transportation and the rising need for stockpiling of food products. Non-food prices increased 2.2%. Core inflation that excludes energy and food prices eased to 0.9% from 1.1% in March. On a monthly basis, consumer prices climbed 0.4%. Although the increase was slower than the 0.6% rise in March, the rate exceeded the expected 0.2%. (RTT) China: Vehicle sales plunge 48% but EVs strong as BYD gains. China’s overall vehicle sales for April plunged almost 48% from a year earlier as COVID-19 lockdowns hit factories and showrooms, but sales of electric vehicles surged and Chinese brands took share from global rivals. The monthly sales volume was the lowest for the month in a decade, underscoring the economic toll of the tough restrictions China put in place in April in Shanghai and other cities to control the spread of COVID. The tally released by the China Association of Automobile Manufactuers (CAAM) includes sales to dealers of passenger cars and commercial vehicles. Retail sales of passenger cars alone dropped almost 36% in April, data released by a separate trade group showed. Overall, vehicle sales in the first four months of 2022 were down 12% from the same period a year earlier in the world’s biggest car market, the CAAM said. (Reuters) Japan: Leading index rises in March. Japan's leading index increased in March after easing in the previous month, preliminary data from the Cabinet Office. The leading index, which measures the future economic activity, rose to 101.0 in March from 100.1 in Feb. The coincident index that measures the current economic situation, increased slightly to 97.0 in March from 96.8 a month ago. This was the highest since Sept 2019. The lagging index rose to 95.7 in March from 95.1 in the previous month. This was the highest since April 2020. (RTT) South Korea: Jobless rate steady at 2.7%. South Korea's unemployment rate remained stable for a second month in April. The jobless rate was a seasonally adjusted 2.7% in April, same as seen in Feb and March. In April last year, the unemployment rate was 3.7%. On an unadjusted basis, the unemployment rate remained unchanged at 3.0% in April. In the same month last year, unemployment rate was 4.0%. The number of unemployed decreased to 864,000 in April from 873,000 in the preceding month. Compared to a year ago, the figure decreased by 283,000 persons. The number of employed persons increased by 865,000 YoY to 28.078m in April. (RTT) MarketsTop Glove (Neutral, TP: RM1.48): Accelerates bond buyback, says will continue to do so at right amount, pricing. Top Glove Corp's wholly-owned subsidiary TG Excellence has accelerated the latter’s bond buyback under its RM3bn perpetual sukuk programme as part of the world’s largest rubber glove manufacturer’s continuous capital and balance sheet management to optimise its capital position and reduce funding cost. (The Edge) KPower: Wins bid to develop SEDA’s 40.4MW hydro power plants in Kelantan. KPower has been selected as one of the successful bidders under the feed-in tariff (FiT) e-bidding exercise conducted by Sustainable Energy Development Authority (SEDA) for the development of small hydro power plants in Malaysia. KPower was notified that it was a successful bidder under SEDA’s e-bidding mechanism for the development of small hydro power plants with installed capacities of 13.1 megawatt (MW) and 27.3MW. (The Edge) AME Elite: Gets shareholders’ approval to list AME REIT in the Main market of Bursa Malaysia. AME Elite Consortium has received its shareholders' approval for listing its real estate investment trust (AME REIT), which entails the listing of 520.0m undivided interest on the main market of Bursa Malaysia. At an illustrative offer price of RM1 per unit, AME is estimated to potentially raise RM254.8m in proceeds from the listing of AME REIT. (BTimes) Nestcon: Secures letter of award for job worth RM85m in Terengganu. Nestcon has received a letter of award (LoA) for a job worth RM85m to design and build an integrated offsite scheduled wastes recovery facility in Kerteh, Terengganu. The company said its unit Nestcon Builders SB has received the LoA from Greenverse SB for the job at Kerteh Biopolymer Park. (The Edge) Yinson: Fixes two-for-five rights issue at RM1.41. Yinson Holdings has fixed its rights issue price at RM1.41 apiece on an entitlement basis of two rights shares for every five existing shares held, to raise gross proceeds of up to RM1.21bn. The rights issue comes with free detachable warrants, on the basis of three warrants for every seven rights shares subscribed, with an exercise price of RM2.29 apiece. (The Edge) Straits Energy: Unit completes first STS crude oil transfer operation in Labuan. Straits Energy Resources' unit, Victoria STS (Labuan) SB, has completed a ship-to-ship (STS) crude oil transfer operation for the first time at Victoria Bay, Labuan. (BTimes) IPO: LGMS Inks underwriting agreement with UOB Kay Hian for listing exercise. LGMS has inked an underwriting agreement with its sole underwriter, UOB Kay Hian Securities (M) SB, for its listing on the ACE Market of Bursa Malaysia. LGMS and its subsidiaries and associate company are primarily involved in cybersecurity assessment and penetration testing, cyber risk management and compliance, and the provision of digital forensics and incident response services. (BTimes) Market UpdateThe FBM KLCI might open lower today as US stocks resumed their slide on Wednesday after unexpectedly hot “core” inflation data raised expectations for aggressive policy tightening, pushing the tech-heavy Nasdaq Composite down nearly 30% from its record high. Growth stocks that are seen as particularly sensitive to rising rates led the declines, with the Nasdaq falling 3.2%. The blue-chip S&P 500, which had rallied as much as 1.2% earlier in the trading session, ended the day 1.6% lower. Consumer prices in the world’s largest economy rose at an annual rate of 8.3% in April, down from 8.5% in March but remaining at a historically elevated level. The figure surpassed economists’ expectations for a cool down to 8.1%. The month-on-month change in core inflation — which excludes food and energy prices and is closely watched by economists — also exceeded forecasts at 0.6%. Rising costs of new cars, food, airline fares and housing were the biggest drivers of the increase in consumer prices, the US labour department said. Elsewhere in markets, Europe’s Stoxx 600 share index rose 1.7%. Brent crude, the international oil marker, climbed 4.9% to $107.51 a barrel. Back home, Bursa Malaysia ended marginally higher on Wednesday with the FTSE Bursa Malaysia KLCI rising by 0.09% as investors continued to bargain-hunt stocks, particularly plantation and banking heavyweights. At 5pm, the barometer index rose 1.35 points to 1,555.93 from Tuesday’s close of 1,554.58. In the region, Hong Kong’s Hang Seng gained 1% and the Shanghai Composite Index added 0.8%. Source: PublicInvest Research - 12 May 2022 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||

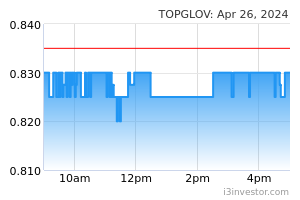

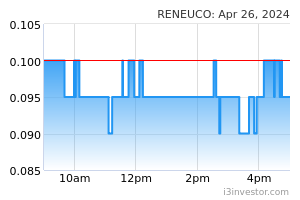

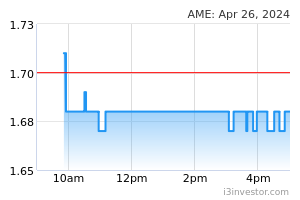

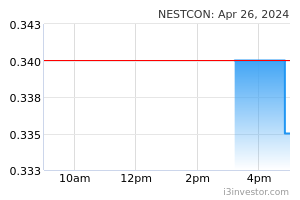

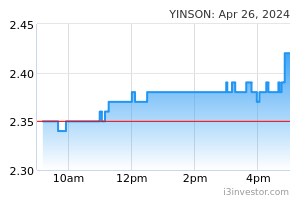

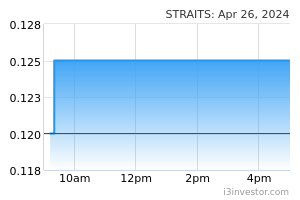

|