Date: 05/05/2022

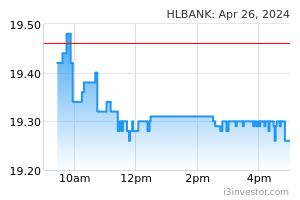

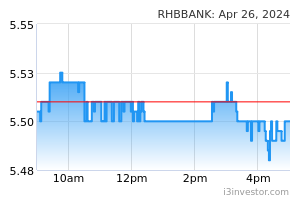

On 29th April 2022, BNM duly awarded digital banking licenses to five consortiums led by:- - Boost Holdings Sdn Bhd / RHBBANK; - GXS Bank Pte. Ltd. / Kuok Brothers Sdn Bhd; - Sea Limited / YTL Digital Capital Sdn Bhd; - AEON Financial Service Co., Ltd. / AEONCR / MoneyLion Inc. (Islamic license); and - KAF Investment Bank Sdn Bhd (Islamic license) As expected, the winners were skewed towards prevailing e-wallet/e-money players as their existing captive user-base and well-tested expertise could smoothen the implementation and adoption of new digital banking services. To recap, the key initiatives for digital banks are to enhance financial inclusion of un(der)banked and un(der) served communities and increase overall accessibility to financial services. With this award, the new licensees are subject to the condition that their respective proposed digital bank units shall commence operations within 24 months. We maintain our OVERWEIGHT call on the banking sector for now, as the new digital banks are not expected to result in any immediate competitive impact to the banking space. That said, we believe RHBBANK (OP; TP: RM6.95) could see boosted interest with investors keenly monitoring the development of its new digital banking unit. HLBANK (OP; TP: RM22.70) is also a favoured pick for asset quality safety. Winners mostly as expected, with some surprises.We had advocated for e-wallet/e-money players to be strong candidates in the bid for the digital banking licenses. Aside from well established capabilities to offer digital financial solutions, their pre-existing brand equity and consumer trust could better enable customers to seamlessly partake in budding digital banking offerings. Hence, we were not surprised to see Boost, GXS Bank (Grab-Singtel’s digital banking entity) and AEONCR amongst the awardees. That said, the inclusion of Kuok Brothers was a surprise albeit a pleasant one as backing from the conglomerate could provide comfort on the consortium’s medium-term financial sustainability. (Please refer to the overleaf for a refresher on the concept of Digital Banks and timeline.) KAF’s inclusion was an unexpected twist as information regarding the investment bank’s application and details of its consortium partners are scarce. We were also surprised to see MoneyLion joining hands with the AEON Group as they were thought to be a separate applicant, suggesting that BNM could have called for more partnerships to enhance the skillsets and longevity within each consortium. Thorough assessment conducted. In identifying the five best fit (out of 29 applications received) to be awarded the license, BNM had perused an intensive assessment criteria in determining the character and integrity of applicants, nature and sufficiency of financial resources, soundness and feasibility of business and technology plans as well as ability to meaningfully address financial inclusion gaps. Based on what available information that was publicly assessible, we gathered that all applicants had their own capabiliies, unique value propositions and captive users to present as strong pitches to BNM. That said, we reckon that one of BNM’s main concern would be the survivability of infant banks as potential failures could disrupt the stability and confidence in our national financial industry. According to past findings, in 2020 only 5% of global digital banks have broken even with an average horizon of 5 years required among them. (Please refer to the overleaf for further details on the list of winners and BNM’s assessment criteria.) Maintain OVERWEIGHT on the Banking Sector. We welcome the inclusion of digital banks into the financial sector as while it will likely stir the operating landscape of traditional banks in the long term, it is a necessary step in developing our national maturity in accepting new evolutions (and improvements) in collusion with global standards. That said, we do not believe they would undermine the investment sentiment of the existing banks as the digital banks would first need to launch into the market. According to the licensee conditions, the consortiums have up to 24 months to commence operations of the proposed digital banking units. Additionally, their eventual scale of operations would still fall shy in comparison to conventional banks given a total asset cap of RM3.0b during their 3-5 years foundational phase upon launch. The upliftment of the foundational terms is subject to BNM’s subsequent review. At the meantime, our Top Pick selection of RHBBANK (OP; TP: RM6.95) remains intact with its successful bid for the license. We also advocate HLBANK (OP; TP: RM22.70) as a solid pick for safety given its exemplary improvements in asset quality (outpacing its pre-Covid performance level). Source: Kenanga Research - 5 May 2022 More articles on Kenanga Research & Investment >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|