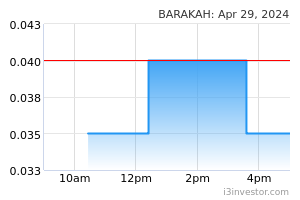

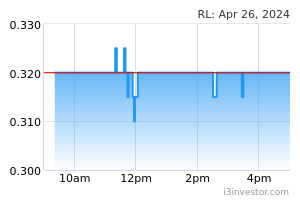

Date: 29/04/2022

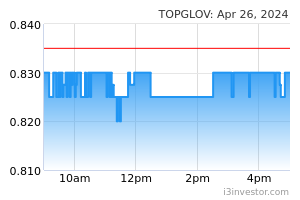

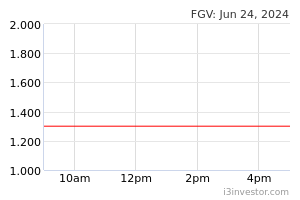

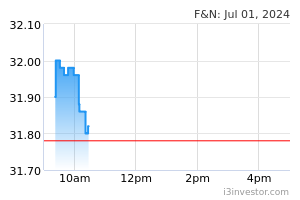

EconomyUS: Economy shrinks in 1Q; trade, inventories mask underlying strength. The US economy unexpectedly contracted in the 1Q amid a resurgence in COVID-19 cases and drop in pandemic relief money from the government, but the decline in output is misleading as domestic demand remained strong. The first decrease in GDP since the short and sharp pandemic recession nearly two years ago, reported by the Commerce Department, was mostly driven by a wider trade deficit as imports surged, and a slowdown in the pace of inventory accumulation. A measure of domestic demand accelerated from the 4Q’s rate, allaying fears of either stagflation or a recession. The Federal Reserve is expected to hike interest rates by 50 basis points. (Reuters) US: Jobless claims show another modest decrease. First-time claims for US unemployment benefits edged slightly lower in the week ended April 23rd, the Labor Department revealed in a report. The report showed initial jobless claims dipped to 180,000, a decrease of 5,000 from the previous week's revised level of 185,000. "We expect initial claims to remain around these levels, as employers, who continue to struggle to attract and retain workers, will keep layoffs to a minimum," said Nancy Vanden Houten, Lead U.S. Economist at Oxford Economics. She added, "Even as the economy slows in response to high inflation and rising interest rates, we expect employers will be more likely to slow the pace of hiring than to let go of workers. (RTT) EU: German inflation sets new high. Germany's inflation unexpectedly accelerated further in April to set a new high in over four decades, driven by runaway energy prices and increased production costs due to supply bottlenecks in the backdrop of the Russia's invasion of Ukraine. The flash consumer price index rose 7.4% YoY following a 7.3% increase in the previous month, preliminary estimates from Destatis. "A similarly high inflation rate was last recorded in Germany in autumn 1981 when mineral oil prices had sharply increased, too, as a consequence of the first Gulf war between Iraq and Iran," Destatis said. The harmonized index of consumer prices, or HICP, rose 7.8% annually in April after a 7.6% increase in March. (RTT) EU: German construction sector sentiment sinks amid material shortages. Germany's construction sector morale eroded sharply in April as an increasing number of firms face supply shortages due to the war in Ukraine, survey data from the ifo institute showed. The share of building construction companies reporting material shortages rose to 54.2% in April from 37.2% in the previous month. In civil engineering, the proportion climbed to 46.2% from 31.5%. "These are all-time highs since the start of the time series in 1991," ifo researcher Felix Leiss said. The business expectations index for building construction sank to minus 46.9 points, once again the lowest level since 1991. In civil engineering, the reading fell to minus 48.6 points. (RTT) UK: Public inflation expectations fall in April. The British public's expectations for inflation have fallen after rising for several months, according to a survey that the BOE keeps track of as it considers how fast it needs to keep raising interest rates. US bank Citi and polling firm YouGov said their gauge of expectations for inflation in five to 10 years' time fell to 4.2% in April from 4.4% in March, the first decline since Oct of last year. Public inflation expectations for the coming 12 months declined to 6.0% from March's record high of 6.1%. (Reuters) Japan: Retail sales jump 2.0% on month in March. The value of retail sales in Japan was up a seasonally adjusted 2.0% on month in March, the Ministry of Economy, Trade and Industry said - coming in at JPY13.628trn. That beat forecasts for an increase of 1% following the downwardly revised 0.9% decline in Feb (originally -0.8%). For the 1Q of 2022, retail sales fell 0.8% on quarter but rose 0.4% on year at JPY37.389trn. On a yearly basis, retail sales jumped 0.9% - again topping expectations for 0.4% following the downwardly revised 0.9% decline in Feb (originally -0.8%). (RTT) Japan: Industrial output rises 0.3% in March. Industrial production in Japan was up a seasonally adjusted 0.3% on month in March, the Ministry of Economy, Trade and Industry said in preliminary reading. That was shy of expectations for an increase of 0.5% and down from 2.0% in Feb. On a yearly basis, industrial production slipped 1.7%, also missing forecasts for a decline of 0.5% following the 0.5% increase in the previous month. Upon the release of the data, the METI maintained its assessment of industrial production, saying that it is showing signs of an upward movement. (RTT) Taiwan: GDP growth moderates in 1Q. Taiwan's economic growth moderated in the 1Q, according to advance estimates by the Directorate-General of Budget, Accounting and Statistics. GDP grew 3.06% in the 1Q, following the 4Q's 4.86% expansion. GDP advanced 6.39% on a QoQ seasonally-adjusted annualized basis after rising 7.63% in the preceding period. (RTT) MarketsTop Glove (Neutral, TP: RM1.48): Hong Kong listing application has lapsed. Top Glove Corp’s application for an initial public offering in Hong Kong lapsed on April 27, the second time in a year that its listing plans have stalled. The world's largest medical glove maker postponed a plan to raise USD347m (about RM1.51bn) in a Hong Kong listing due to heightened market uncertainty after Russia's invasion of Ukraine. (The Edge) FGV Holdings (Neutral, TP: RM1.71): To renew RSPO certification schedule. FGV Holdings (FGV) is looking forward to the renewal of its Roundtable of Sustainable Palm Oil (RSPO) certification schedule in the financial year 2022 (FY2022). It is also anticipating the lifting of restrictions on its exports by the United States (US) Customs and Border Protection (CBP), having taken all the necessary steps to address the issues highlighted by the CBP. (The Edge) F&N: Sees tough business environment to continue in 2H on rising freight costs, inflationary pressures. Fraser & Neave Holdings (F&N) expects the challenging environment for the group's business to continue in the second half of 2022 as high input prices, rising freight costs and geopolitical uncertainties weigh on its margins, while rising inflationary pressures could dampen discretionary spending. (The Edge) Jishan: Sued for alleged copyright infringement over egg tray. Jishan has been hit with a lawsuit for allegedly storing and selling egg trays which infringed the design features and configurations owned by two individuals. The egg trays have been registered with the Intellectual Property Corp of Malaysia. (The Edge) Barakah Offshore: Proposes rights issue with warrants, capital reduction as part of regularisation plan. PN17 company Barakah Offshore Petroleum has proposed to undertake a renounceable rights issue of new shares with free warrants to raise up to RM40m as part of its regularisation plan. The group has earmarked proceeds received from the proposed exercise to fund the Pan Malaysia maintenance, construction and modification contract for 2018 to 2023 for Jadestone Energy (PM) Inc, future projects and for working capital. It is also proposing a capital reduction of RM197.7m to reduce the share capital and accumulated losses of the company. (The Edge) Reservoir Link: Forms solar JV with Sunseap Energy. Reservoir Link will be collaborating with Sunseap Energy (M) SB (Sunseap) to ink a term sheet for joint venture (JV), with an initial paid-up share capital of RM1m. The JV will co-develop, build, own and operate rooftop and ground mounted solar PV projects (solar PPAs) in Malaysia. Both parties will use their best efforts to deliver approximately 20MWp worth of Solar PPAs to the JV by 2023. (BTimes) IPO: Unitrade to debut on Bursa ACE Market June 14. Unitrade Industries, which is set to be listed on Bursa Malaysia's ACE Market on June 14, plans to raise RM100m from its initial public offering. With the issue price of 32 sen per share and an enlarged share capital of 1.56bn shares, the group will have a market capitalisation of RM500m upon its listing. (BTimes) Market UpdateThe FBM KLCI might open higher today after Wall Street stocks rose on Thursday, with the Nasdaq and S&P indices notching their best day in a month, as traders expressed optimism about upcoming quarterly earnings from tech titans Apple and Amazon amid a bruising month of losses. The tech-focused Nasdaq Composite share index ended the day 3.1% higher, following better than expected earnings from Facebook owner Meta on Wednesday after the closing bell. The index is nevertheless on track to fall more than 9% in April, in what would be its worst monthly performance since March 2020. The S&P 500 added 2.5%, led by a 17.6% increase in Meta’s stock on Thursday. The blue-chip index is nevertheless is poised for a loss of more than 5% this month, also its worst performance since March 2020. In Europe, the Stoxx 600 share index closed 0.6% higher. Brent crude, the international oil benchmark, settled at USD107.59, up 2.2%. Back home, Bursa Malaysia ended broadly higher on Thursday due to improving market sentiment across the region. The benchmark FBM KLCI was 11.33 points, or 0.71% firmer at 1,597.31 from Wednesday’s close of 1,585.98. The benchmark index opened 7.64 points higher at 1,593.62 and moved between 1,590.17 and 1,600.6 throughout the day. Chinese markets regained their footing after tumbling on concerns that lockdowns in major cities would slow growth in the world’s second-largest economy. The Shanghai Composite Index edged up 0.6%. Hong Kong’s Hang Seng rose 1.7%. The Nikkei 225 gained 1.7% after the Bank of Japan reinforced its commitment to low interest rates despite rising inflation. The central bank said it would purchase 10- year Japanese government bonds at a yield of 0.25% every business day to ensure that the yield doesn’t exceed that level. Source: PublicInvest Research - 29 Apr 2022 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|