Date: 14/04/2022

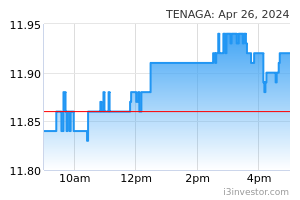

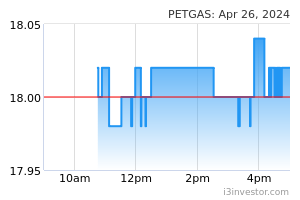

Governments have been facing an Energy Trilemma, needing to balance between: (i) energy security; (ii) energy accessibility; and (iii) environmental sustainability. The recent Europe energy crisis has heightened the awareness of achieving the right balance and accelerated investments into R&D to develop more viable alternative resources. EC along with Tenaga has developed a long term strategy to achieve carbon neutrality by 2050. We reckon the roadmap is realistic and achievable as Malaysia should only gradually phase out coal generation given that current RE technologies are not viable yet to fully replace coal generation while gas costings are higher than coal (raising inflationary pressures and political concerns). We maintain OVERWEIGHT on the Utilities sector, with BUY for TNB (TP: RM13.60); PGB (TP: RM19.00) and YTLP (TP: RM0.75), on the companies’ stable earnings and sustainable dividend payouts. Energy Trilemma. Energy sustainability has always been the main objective of any governments’ long term energy policy. Energy is the heart of everything, powering a nation’s economic activities and people’s daily life. Henceforth, policy makers continue face the daunting task in striking a right balance between (i) energy security, (ii) energy accessibility (costing), and (iii) environmental sustainability (ESG) – aptly termed “the Energy Trilemma”. Without the right balance, countries would risk an energy crunch crisis, which would have negative ramifications on the economy. Europe energy crisis. A confluence of interconnected factors has resulted on-going turmoil in Europe’s energy market. Ultimately, policies focusing exclusively on emission reductions have compounded the situation. The crisis was first driven by under-investment in gas productions/supply and de-stocking during the pandemic in 2020, resulting in shortage to meet the surging demand when the economy recovered towards 2H21. Moreover, the less-than-reliable RE generation due to suboptimal conditions of wind/solar, have exacerbated the situation, amplifying the demand for conventional electricity generation, especially gas power (after years of reducing/decommissioning coal power and nuclear power and replacing with environmentally friendly RE – see Figure #1). The crisis was further aggravated by the current Russia-Ukraine conflict (started end Feb 2022). Now EU has started to realise its over-reliance of a single type and source of energy as base load and the potential issues of RE, which is now affecting the supply (availability) and cost of electricity, subsequently affecting political support and economic activities (both business and consumer). Source: Hong Leong Investment Bank Research - 14 Apr 2022 More articles on HLBank Research Highlights >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|