Date: 14/04/2022

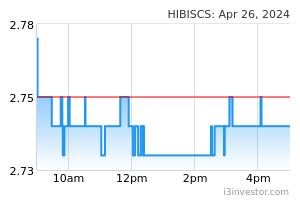

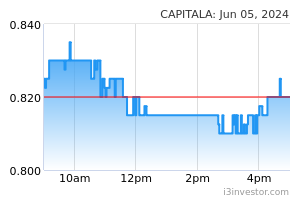

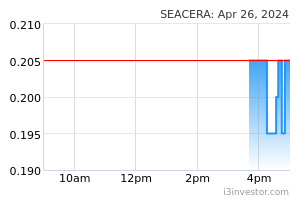

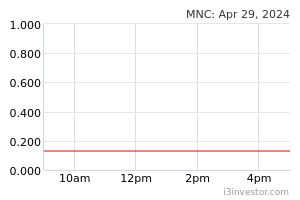

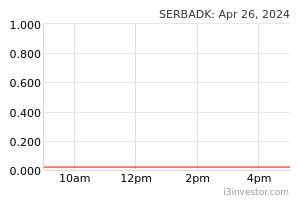

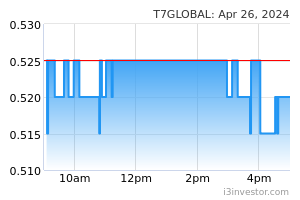

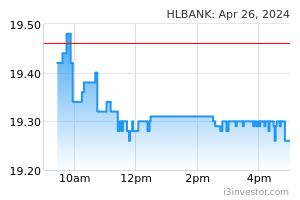

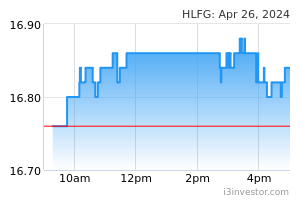

EconomyUS: Producer price growth accelerates to record high in March. After yesterday's report showing a jump in US consumer prices, the Labor Department released a report showing US producer prices also surged in the month of March. The Labor Department said its producer price index for final demand shot up by 1.4% in March after advancing by an upwardly revised 0.9% in Feb. Economists had expected producer prices to jump by 1.1% compared to the 0.8% increase originally reported for the previous month. Energy prices led the way higher, skyrocketing by 5.7% during the month, while food prices also spiked by 2.4%. With the bigger than expected monthly increase, the annual rate of producer price growth accelerated to a record high 11.2% in March from 10.3% in Feb. (RTT) US: Mortgage interest rates top 5%, buyers look to lock in rates. The average interest rate on the most popular US home loan rose to more than 5% last week, the highest level since Nov 2018, and homebuyers hurried to make purchases before costs rise further, the latest weekly survey from the Mortgage Bankers Association (MBA) showed. The average contract rate on a 30-year fixed-rate mortgage increased to 5.13% in the week ended April 8 from 4.90% a week earlier. It is up more than 1.5 percentage points since the start of the year as the Fed has begun to tighten financial conditions to cool demand in the economy amid high inflation. (Reuters) EU: Key market euro zone inflation gauge hits highest since 2012. A key market gauge of long-term euro zone inflation expectations briefly rose above 2.40%, scaling a 10-year peak with a higher-than-expected inflation reading in Britain adding to signs of persisting price pressures. It is the highest the five-year five-year breakeven forward has risen since 2012, according to data from the ECB, and far above the 2% target of the bank, which meets on Thursday. “It will definitely be testing their resolve and their stance. It’s definitely a problem. There’s a lot of arguments that they’ve put forward to diminish the importance of this indicator,” said Antoine Bouvet, senior rates strategist at ING. The gauge has risen from around 2.20% before Russia’s invasion of Ukraine and around 2% at the start of the year. (Reuters) UK: Inflation at 30-year high of 7% in March, adding to pressure on govt. British consumer price inflation leapt to its highest level in three decades last month, intensifying the pressure on embattled Prime Minister Boris Johnson and Finance Minister Rishi Sunak to ease the cost-of-living squeeze. The annual inflation rate climbed to 7% in March from 6.2% in Feb, its highest since March 1992 and by more than expected by most economists in a Reuters poll, official data showed. The MoM rise was the highest for the time of year since the Office for National Statistics' (ONS) records began in 1988. Broad-based price rises, ranging from vehicle fuel to food and furniture, were behind the increase. (Reuters) China: Will use timely RRR cuts to support economy, state media cites cabinet. China will use timely cuts in banks' reserve requirement ratio (RRR) and other policy tools to support the economy, state media quoted the cabinet as saying, as headwinds increase amid outbreaks of Covid-19. China will step up financial support for the real economy, especially industries and small firms hit by the Covid-19 pandemic, and will lower financing costs, state media quoted the cabinet, or State Council, as saying after a regular meeting. "In light of changes in the current situation, we will encourage large banks with higher provisions to lower provision ratios in an orderly manner and will use monetary policy tools, including RRR cuts, in a timely way," it was quoted as saying. (Reuters) South Korea: Jobless rate steady in March. South Korea's unemployment rate remained stable in March, after easing in the previous two months, data from Statistics Korea showed. The jobless rate was a seasonally adjusted 2.7% in March, same as seen in Feb. In the same month last year, the unemployment rate was 3.8%. On an unadjusted basis, the unemployment rate declined to 3.0% in March from 3.4% in the previous month. The number of unemployed decreased to 873,000 in March from 954,000 in the preceding month. Compared to a year ago, the figure decreased by 342,000 persons. The number of employed persons increased by 831,000 YoY to 27.754m in March. (RTT) MarketsHibiscus (Outperform, TP: RM1.31): Explores Singapore SPAC listing, sources say. Hibiscus Petroleum is considering listing a special purpose acquisition company in Singapore that could raise as much as SGD200m (RM620.38m), according to people familiar with the matter. The blank-check company, which could raise SGD150m to SGD200m, will look for acquisition targets in the renewable energy sector, the people said. (The Edge) Capital A (Neutral, TP: RM0.69): AirAsia Malaysia to reinstate flights to India. AirAsia Malaysia said that the budget airline is preparing to reinstate flights from the country to India starting from May to cater to an expected increase in travel demand in line with Covid-19 vaccination-driven reopening of international borders. (The Edge) Seacera: Gets winding up notice of demand for RM34.64m. Seacera Group said it has received a winding up statutory notice demanding a sum of RM34.64m in connection with a share sale agreement (SSA). The notice was issued by solicitors acting for Ismail Othman, who signed the SSA with the group's subsidiary, Seacera Properties SB, in 2016. Ismail is claiming the sum, which is inclusive of interests as of April 11, from Seacera as the group was the guarantor under the SSA. (The Edge) MNC Wireless: Kick starts lifestyle e-commerce ops. MNC Wireless has inked a Memorandum of Understanding (MoU) with Hot TV Entertainment SB to kick-start its lifestyle e-commerce platform. MNC said it would be investing RM5.5m for the development of the platform in the next 18 months and allocating RM2.8m as its working capital. This capital was raised from MNC's 30% private placement, which was completed early this year. (BTimes) Serba Dinamik: SC compounds top execs RM3m each for submitting false revenue that KPMG flagged. Serba Dinamik Holdings and four top executives have been compounded RM3m each by the Securities Commission Malaysia (SC) for submitting a false statement involving a revenue of RM6.01bn for its financial period ended Dec 31, 2020 (FY20), which was previously red-flagged by the company's external auditor, KPMG. (The Edge) Parkson: Auditor flags material uncertainty over its ability to continue as going concern. Parkson Holdings said its external auditor has reported a material uncertainty that may cast significant doubt on the group's ability to continue as a going concern. This is in respect of the retailer's audited financial statements for the 18-month period ended Dec 31, 2021 (FY21), Parkson said in a filing with Bursa Malaysia. (The Edge) T7 Global: Secures RM6m manpower contract from Hess. T7 Global has bagged a RM6m contract from Hess Exploration and Production Malaysia BV for the provision of technical and non technical manpower for the latter’s North Malay Basin integrated gas development project. (The Edge) Market UpdateThe FBM KLCI might open higher today after US government debt extended a rally on Wednesday as traders pared back their bets on an aggressive series of interest rate rises from the Federal Reserve this year. The two-year Treasury yield, which is highly sensitive to monetary policy expectations, sank as much as 0.14 percentage points to 2.27%, its lowest level this month. Yields fall when prices rise. It later reversed some of the move to trade at 2.35%, down 0.06 percentage points for the day. The US benchmark S&P 500 index added 1.1%, while the tech-heavy Nasdaq Composite rose 2%. Kicking off bank earnings season, JPMorgan Chase on Wednesday reported a 42% year-on-year drop in net income for the first quarter, after a slowdown in dealmaking, a rise in reserves to protect against a US recession, and a USD524mn loss suffered amid market turbulence following Russia’s invasion of Ukraine. In Europe, the regional Stoxx 600 share index closed the session flat. Germany’s Dax fell 0.3% and France’s Cac 40 added 0.1%. London’s FTSE 100 added 0.1%. Back home, Bursa Malaysia pared some of its early gains to end the day marginally higher on bargain hunting in selected heavyweights led by Hong Leong Bank Bhd, Telekom Malaysia Bhd (TM) and Hong Leong Financial Group Bhd (HLFG). At 5pm, the benchmark FBM KLCI rose 0.05 of-a-point to end at 1,597.18, compared with Tuesday’s close of 1,597.13. In the region, Hong Kong’s Hang Seng index added 0.3% and China’s CSI 300 fell 1%. Japan’s Topix rose 1.4% and South Korea’s Kospi gained 1.9%. Source: PublicInvest Research - 14 Apr 2022 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|