Date: 04/04/2022

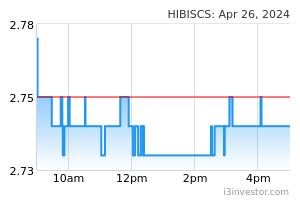

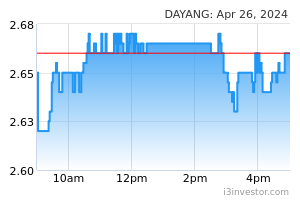

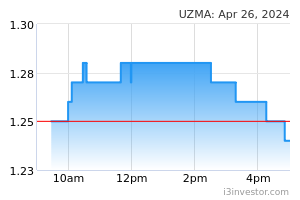

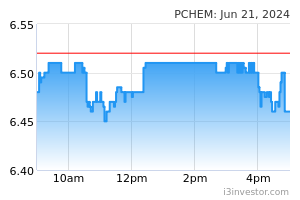

With the invasion of Ukraine by Russia causing significant uncertainties over potential oil supply disruptions, we are expecting oil prices to stay elevated for the time being, especially against the backdrop of low oil inventories coupled with aggressive stock draws amidst healthy demand and OPEC’s reluctance in reintroducing additional supply into the market. Overall, we are maintaining our 2022-2023 average Brent crude oil price assumption of USD90/barrel, which is also broadly in-line with market’s expectations. Meanwhile, recovery trajectory of activity levels is also expected to sustain. With Petronas capex having missed initial guidance and disappointed over the past two years, we are fully anticipating the group to normalise its capex spending to RM40-50b per annum this year (versus 2021/2022 capex of RM33b/RM31b), with local upstream still expected to be the largest area of investment although with increased emphasis in renewable energy. Globally, we are also expecting global E&P capex spend to continue its recovery ever since a low in 2020. We feel that the sector has still yet to fully price in positives, with rebound rallies still rather short-lived. The KL Energy index is still trading at -2SD below its mean valuation – similar to valuation levels seen in 1H 2020 during the peak of the oil price crash, and hence, we feel that this could be an opportunity for laggard plays. Maintain OVERWEIGHT on the sector, with PCHEM and HIBISCS highlighted as oil price beneficiary plays, and DAYANG and UZMA as recovery trading plays. Oil prices likely to stay elevated. With Brent crude oil prices having recently breached the USD100/barrel mark, we are continuing to expect oil prices to remain elevated, at least relative to levels seen in the previous few years. The invasion of Ukraine by Russia and subsequent sanctions on Russia has caused some significant market uncertainties over the potential for oil supply disruptions. Note that Russia contributes ~10% of global oil production, and ~40% of Europe’s gas supply. These events are occurring against a backdrop of low oil inventories as global crude oil stock levels are seeing a continued decline since mid-2020, while stock draws have also seen increased since 2021. In efforts to tame oil prices, the Biden administration had recently announced a US release of oil from the Strategic Petroleum Reserve (SPR) of 1m barrels per day (bpd) starting from May for the next six months. The move is reported to be the largest release of oil from the SPR in history, and may constitute one-third of the country’s SPR supply. As such, some argue that such drastic measures may turn out to be unsustainable in the longer run, especially under a scenario of prolonged Russian oil sanctions, with OPEC members still seemingly reluctant to increase productions despite external pressures. Overall, we are maintaining our 2022-2023 average Brent crude oil price assumption of USD90/barrel, which we feel is very much broadly in-line with market’s expectations (or even slightly towards the conservative side), comparing against EIA’s average Brent crude forecasts of USD105/89 and Bloomberg consensus of USD99/89. Nonetheless, with the situation still fluid, actual price outcomes will still be dependent on the degree on sanctions being imposed as well as responses from other oil producers. Recovery in spending and activity levels. After a prolonged period of under-investment over the past two years, we are expecting Petronas capex to normalise back to the range of RM40-50b per annum for the coming few years. Petronas had fell short of expectations in capex spending previously, with 2021 capex coming in at only RM30.5b versus its initial guidance of ~RM40b. Local upstream is still expected to remain as the group’s largest area of investment, although increased emphasis will also be placed on renewable energy. The prolonged lockdowns and movement restrictions had impacted the group’s ability in sanction capex activities as a result of logistical disruptions. Nonetheless , with the reopening of borders and resumption of economic activities, local activity levels are expected to recover throughout 2022-2023. In a readthrough of Petronas’ latest Activity Outlook, we have highlighted the offshore maintenance, construction and modification (MCM), as well as the hook-up and commissioning (HUC) subsectors as potential winners – which may stand to benefit DAYANG especially given its position as a market leader within these spaces. Globally, 2022-2023 is expected to see the continued trend of ramp-up in offshore exploration and production (E&P) capex since the low in 2020. All three of our Bursa-listed FPSO players (i.e. YINSON, MISC, ARMADA) are seen to have been in active participation in international job bids, with job opportunities emerging from Latin America, A sia Pacific and Africa. The FPSO space is starting to see a supply squeeze – i.e. many global FPSO players are already pre-occupied with jobs developing at hand, and hence, more recent bids have started to see very limited bidders, making it very much an operator’s market. Sector still yet to fully price in positives. Surprisingly, rallies in the larger oil and gas sector have been slow and yet to fully price in positives from the stronger crude oil prices. Despite some short-lived rebounds earlier in the year, the KL Energy Index is still trading at -2SD below its mean valuations – similar to valuation levels seen in 1H 2020 during the peak of the oil price crash. The energy sector has been the worst performing sector for the past two years since 2020. And notwithstanding the steep rebounds in crude oil prices since mid-2021, valuations of the sector are still trading at a divergence from the rally in underlying oil prices. While this could be partially explained through ESG concerns, we also believe that the undemanding valuations could give rise to selective laggard opportunities, especially for names with solid fundamentals and recovery potential. Maintain OVERWEIGHT on the sector, premised on undemanding sector valuations, recovery prospects of activity levels as well as elevated oil prices. Nonetheless, we still advocate selectiveness within the sector as many names are still dragged by deteriorated and weakened fundamentals. For stock picks, we have included: Oil price proxy plays: PCHEM (OP, TP: RM11.00), HIBISCS (Not Rated). Recovery trading picks: DAYANG (OP, TP: RM1.00), UZMA (OP, TP: RM0.68). Source: Kenanga Research - 4 Apr 2022 More articles on Kenanga Research & Investment >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|