Date: 18/03/2022

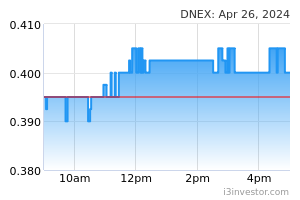

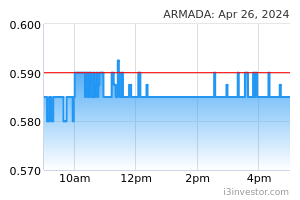

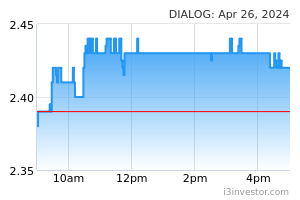

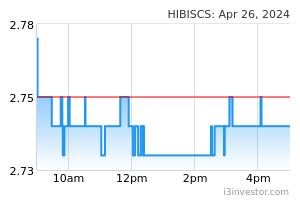

As a result of ESG mandates, activist shareholders proposals and difficulty in securing loans, US oil producers and western nations are not investing in expanding their production capacity, resulting in difficulty to scale up to meet the supply gap left behind from the Russian oil sanctions. We opine that countries and the investment community alike should revisit their ESG policies and strategies to ensure an equitable and smooth progression path both for the traditional oil industry and the clean energy in ensuring ample supply as we make the transition. Maintain OVERWEIGHT on the sector as we view that the current oil price will remain elevated above pre-war level supported by (i) the current strong global oil demand following economic reopening; (ii) supply constraint as a result of underinvestment; and (iii) pent-up demand from consumers and businesses that held back their purchases. Our top picks are DNeX (BUY; TP: RM1.64), Bumi Armada (BUY; TP: RM0.84) and Dialog (BUY; TP: RM3.32). A reality check on the clean energy industry. World’s richest man Elon Musk had on 5 March 2022 tweeted “hate to say it, but we need to increase oil and gas output immediately. Extraordinary times demand extraordinary measures. Obviously, this would negatively affect Tesla, but sustainable energy solutions simply cannot react instantaneously to make up for Russian oil & gas exports” (see Figure #1). This tweet gave the clean energy industry a long overdue reality check as it highlights the supply gap left behind as the US and western nations push for decarbonisation in the oil & gas industry. Putin’s gambit – sanctions on Russian oil intensify. As Russia’s war in Ukraine intensifies, the Biden administration has decided to ban Russian oil and natural gas purchases on 8 Mar 2022. Following suit on 14 March 2022, EU states will also tighten sanctions on Russian oil majors which is expected to freeze Russia’s funding from sources in the EU in new exploration and production (E&P) projects in all fossil fuels. Britain also said it will phase out the import of Russian oil and oil products by the end of 2022, giving the market and businesses time to find alternati ves. According to the Energy Information Administration (EIA), Russia is the third largest oil (and oil equivalents) producer in the world at 10.5m bpd or 11.2% of global output in 2020. As such, if targeted sanctions were to escalate upon Russian oil, this could send prices ascending further due to the anticipated supply crunch in the global oil markets. We highlight that Brent oil price has surged past the USD100/bbl, an increase of c.50% since December 2021 – when the Russia-Ukraine conflict started to build up. Feud between Biden administration and US oil producers. Russian oil makes up 8% of US oil imports. Biden has acknowledged that the Russian oil ban would likely drive up gasoline prices in the U.S, which led him to urge US oil companies to step up production. However, this plea underscores an ongoing tension between the Biden administration and the US oil industry as the former was known for his plans to fight climate change and aims to gradually phase out the traditional fossil-fuel source of energy and to invest more into renewables ever since his presidency campaign in 2020. The Biden administration thus, finds itself in an uncomfortable position as it pleaded to local US oil companies to boost crude oil production despite its long term goal of shifting the country away from the fossil fuels. Global decarbonisation push is a disincentive for E&P capex. The US shale oil industry was neglected for years by the Biden administration and demonized worldwide for exacerbating climate change. Due to ESG mandates from investment managers, activist shareholders proposals and difficulty in securing loans from the bank, oil producers are not incentivize to invest in expanding their production capacity but are instead returning their profits to investors in big dividends as they currently enjoy record high prices. The impact of the underinvestment in the industry is evident as seen in Figure #2 below where US crude oil output is still well below pre-pandemic levels despite recovering demand. Years of underinvestment in the industry means that the oil producers are having a tough time ramping up supply. In addition, US shale producers are also concerned that due to the time lag of 8-12 months between drilling and first oil, they are risking in producing oil only after the crisis has passed. Besides, there is also an overhanging concern that in the event that the war deescalates and the sanctions were lifted, the Biden administration may revert to its efforts to push for a transition away from the oil industry. Stagflation? Already the US consumers are feeling the pinch as ride-hailing services such as Uber and Lyft are adding temporary surcharge to their fares to deal with the rise in gas prices nationwide. In the longer term, consumer spending will be impacted as consumers spend more on gasoline (and less on other goods and services), while operating cost for businesses will increase (as transportation and input cost increase). In effect, a prolonged oil price increase will stifle the growth of the economy. In the past, five out of the last seven US recessions were preceded by increases in oil prices highlighting the correlation between oil price increase and economic downturn. Ensuring a smooth clean energy transition. The geopolitical risk from the current Russia-Ukraine war highlighted an underlying risk resulting from the divestment in the oil & gas industry as the world pushed for their decarbonisation initiatives. The US oil industry faced difficulty in increasing capacity to cope with soaring oil demand as a result of years of underinvestment in the industry. While the world inevitably will and should transition to cleaner energy, it should do so in a pace that ensures a systematic progression that minimizes transition risk. An oil crisis has far reaching and severe negative impacts which could lead to increased cost of living and economic slowdown as highlighted above. Thus, it is imperative that countries and the investment community alike should revisit their ESG policy and strategy to ensure an equitable and smooth progression path both for the traditional oil industry and the clean energy in ensuring ample supply as we make the transition. Tail risk events such as the current Russian-Ukraine war should also be accounted for in scenario analysis to minimize the disruptive impact from an oil supply disruption. Global upstream capex to remain modest. From our findings, we conclude that oil producers are not likely to invest in further supply as they enjoy record high prices that provide their investors with big dividends. Moreover, corporate interests on Wall Street are looking to grow production only modestly due to ESG mandates, activist shareholder proposals and banks avoiding loans to the industry. Investors are also urging oil majors to pay back capital burned during debt-fuelled production sprees in the lead-up to the pandemic oil crash instead of spending the big bucks on new drilling campaigns. Oil price to stay elevated above pre-war levels, but unsustainable above USD120/bbl. We gather that both US shale producers and OPEC are finding themselves to be on the same side of the coin – both are in no rush to rapidly boost production. Oil majors are fearful to chase prices in the short term, which would ultimately destroy value for shareholders. Ultimately, OPEC+ decided to stick to its plan to boost monthly output by 400k for April 2022. Throughout the Russia-Ukraine conflict, Brent oil price breached USD120/bbl in early Mar 2022, but retraced recently as oil demand from China eases following the lockdowns in its major cities due to Covid outbreaks. While Petronas has noted that current oil prices have steered away from fundamentals and expects Brent oil price to average at USD70-80/bbl in 2022, we note that Petronas has always been conservative in its statements and forecasts. Our current forecasts stands at USD85-90 for 2022 with an upside bias as we prefer to take a wait-and-see approach before revisiting our forecasts due to the fluidity of the Russian-Ukraine war (case in point: peace talks seem to have found common ground). Nonetheless, we are taking a view that oil prices are unlikely to return to pre war levels in the near to mid-term. In the event the war deescalates, we believe that prices will remain supported due to (i) the current strong global oil demand following global economic reopening; (ii) supply constraint as a result of years of underinvestment in expanding industry capacity; and (iii) pent-up demand from consumers and businesses that held back their purchases due to the elevated price. Home ground: Petronas increasing capex allocations in new energy initiatives. We expect Petronas capex spending to be at the RM40-45bn level annually over the next 5 years (2022-2027), with about 20% of its annual capex allocated to new energy and low carbon initiatives (from a guidance of 9% previously). This ultimately means that Petronas’ upstream planning portion has progressively been shaved from the entire capex budget pie. Petronas also aims to increase domestic spending to 55% of capex (RM22-25bn) and the remaining would be for international programmes. From ground checks with companies under our coverage, we think that indicated capex levels should be sufficient to help the sector recover in 2022, albeit still lower than its pre-pandemic 2018-2019 levels. Maintain OVERWEIGHT. Our top picks for the sector are: (i) DNeX (BUY; TP: RM1.64) as it stands to be a direct beneficiary of the elevated oil prices from their Anasuria oil-producing assets and strong wafer ASP growth from Silterra; (ii) Bumi Armada (BUY; TP: RM0.84) given its foothold in the FPSO business which provides steady recurring income, coupled with speedy enhancement in its debt profile; and (iii) Dialog (BUY; TP: RM3.32) for its recurring income type of business model and we deem it as one of the only listed secular growth stock in the local oil and gas space. While we highlight that there may be opportunities in Hibiscus (non-rated) amidst the volatility in oil prices, we recommend a cautious trading stance as we believe that most of the positives from potentially higher realised oil prices over the next few quarters and additional sales volume from its Repsol oil-producing asset acquisitions may have already been priced-in. Source: Hong Leong Investment Bank Research - 18 Mar 2022 More articles on HLBank Research Highlights >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|