Date: 11/03/2022

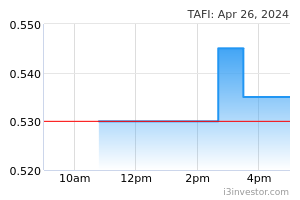

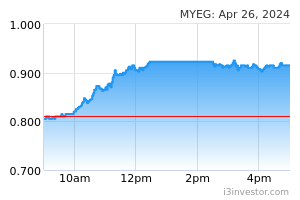

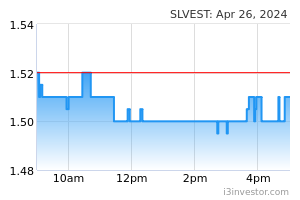

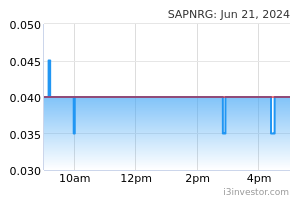

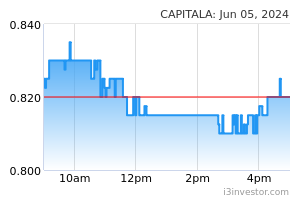

EconomyUS: Feb budget deficit falls 30% as economy recovers. The US government posted an USD217bn deficit in Feb, a 30% reduction from a year ago as receipts grew and outlays fell, largely as a result of economic recovery from the COVID-19 pandemic, the Treasury Department said. The Treasury said that receipts in Feb reached USD290bn, up 17% from Feb 2021, when the government posted a USD311bn deficit -- a record high for the month as federal unemployment supplements and other support payments to individuals and businesses were being disbursed. (Reuters) US: Households squeezed as US consumer prices accelerate; more pain coming. US consumer prices surged in Feb, forcing Americans to dig deeper to pay for rent, food and gasoline, and inflation is poised to accelerate even further as Russia’s war against Ukraine drives up the costs of crude oil and other commodities. The broad rise in prices reported by the Labour Department led to the largest annual increase in inflation in 40 years. Inflation was already haunting the economy before Russia’s invasion of Ukraine on Feb. 24, and could further erode President Joe Biden’s popularity. The Fed is expected to start raising interest rates next Wednesday.. (Reuters) US: Weekly jobless claims show modest increase. First-time claims for US unemployment benefits saw a modest increase in the week ended March 5th, according to a report released by the Labour Department. The report showed initial jobless claims crept up to 227,000, an increase of 11,000 from the previous week's revised level of 216,000. Economists had expected jobless claims to tick up to 216,000 from the 215,000 originally reported for the previous week. The Labour Department said the less volatile four week moving average also inched up to 231,250, an increase of 500 from the previous week's revised average of 230,750. (Reuters) EU: ECB unveils gradual normalization plan. The ECB stuck to its earlier announcements to wind down monetary stimulus and charted out a policy normalization plan, which economists said was gradual and hawkish. The Governing Council, led by ECB President Christine Lagarde, called the Russian invasion of Ukraine "a watershed for Europe" and expressed full support to the people of Ukraine. The bank said it will ensure smooth liquidity conditions and implement the sanctions decided by the EU and governments. (RTT) Japan: Producer prices jump 9.3% on year in Feb. Producer prices in Japan accelerated 9.3% on year in Feb, the Bank of Japan said. That exceeded expectations for an increase of 8.7% and was up from the upwardly revised 8.9% in Jan (originally 8.6%). On a monthly basis, producer prices jumped 0.8% - again beating forecasts for 0.6% but unchanged from the previous month following an upward revision from 0.6%. Export prices were up 0.9% on month and 7.5% on year in Feb, the bank said, while import prices rose 1.7% on month and 25.7% on year. (RTT) South Korea: Current account surplus falls to USD1.81bn. South Korea had a current account surplus of USD1.81bn in Jan, the Bank of Korea said - down from USD6.06bn in Dec. The goods account surplus decreased to USD0.67bn, compared to the USD5.58bn figure in Jan 2021. The services account deficit decreased to USD0.45bn, from USD0.93bn in Jan last year, owing to a large surplus in the transport account. The primary income account surplus decreased from USD2.57bn the year previously to USD1.88bn in Jan 2022, in line with a decrease in the income on equity. (RTT) Indonesia: Retail sales growth slows in Feb. Indonesia's retail sales rose at a softer pace in Feb led by weaker sales of spare parts and accessories, and food, beverages and tobacco, data from Bank Indonesia showed. The retail sales index increased 14.5% yearly in Feb, after a 15.2% rise in Jan. In Dec, sales grew 13.8%. Retail sales grew for a fifth straight month. On a monthly basis, retail sales declined 3.2% in Feb, following a 3.1% drop in the previous month. Sales fell for the second straight month. The monthly sales deteriorated as broad declines were seen in sales of cultural and recreational goods, spare parts and accessories, automotive fuels in the backdrop of lower public demand, limited supply and inclement weather conditions. (RTT) MarketsCapital A (Neutral, TP: RM0.69): Can’t get RM500m Danajamin loan as founders refuse to be guarantors. Capital A (formerly known as AirAsia Group) is unable to obtain the RM500m club facility under Danajamin Nasional Bhd’s Prihatin Guarantee Scheme as its founders, Tan Sri Tony Fernandes and Datuk Kamarudin Meranun, have refused to become guarantors. (The Edge) Comments : The Group announced that it will not proceed with the Club Facility under the Danajamin Prihatin Guarantee Scheme as it is unable to accept and/or fulfill certain conditions. While this development is a setback to its fundraising initiatives, total funds already raised to-date is still within its targeted range of RM2.0bn. We remain wary over near-term challenges though imminent reopening of our borders is much welcomed. We maintain our Neutral call. Sapura Energy (Neutral, TP: RM0.05): Obtains court orders to restructure debt, settle payments. The Kuala Lumpur High Court has granted Sapura Energy and 22 of its wholly-owned subsidiaries two orders under Section 366 and 368 of the Companies Act 2016 to restructure its debts and settle outstanding payments. The order under Section 366 will enable it and its subsidiaries to summon meetings with its creditors to consider and approve a proposed scheme of arrangement and compromise as part of its debt restructuring plan. (The Edge) Resintech: Inks MoU to buy 30% stake in healthcare products retailer. Resintech plans to buy a 30% stake in Bionutricia Holding (BHSB), which is mainly engaged in the retail and wholesale of healthcare products and nutritional supplements, to expand its business. The manufacturer of polyvinyl chloride (PVC) products has signed a memorandum of understanding (MoU) with BHSB's major shareholders, who are also co-founders of the group. (The Edge) Solarvest: Bags three solar contracts for RM154.4m. Solarvest Holdings has secured three engineering, procurement, construction, and commissioning (EPCC) contracts to develop large-scale solar photovoltaic (LSSPV) plants under the large scale solar 4 (LSS4) scheme for RM154.4m. The clean energy specialist said the three projects would be in Kampar and Kinta in Perak. (BTimes) MyEG: Ventures into NFT space. MY E.G. Services (MYEG) announced its entry into the non-fungible token (NFT) space with the launch of NFT Pangolin. The global NFT marketplace supported the issuance and trading of NFTs and was set to operate on the soon-to-be-launched Zetrix Layer 1 blockchain network which serves as a parallel chain to the International Backbone and Supernodes of Xinghuo, China's national blockchain infrastructure. (BTimes) Tafi: To net RM5.71m gain from disposal of factory. Tafi Industries is expected to realise a gain before tax of approximately RM5.71m following the disposal of a factory. TAFI had entered into a sale and purchase agreement to dispose of one of its industrial premises in Muar, Johor to Duthai Trading for a cash consideration of RM9m. (StarBiz) Market UpdateThe FBM KLCI might open down today after global equities and government bonds sank on Thursday, as investors braced for central banks to tighten monetary policy despite Russia’s invasion of Ukraine. The European Central Bank surprised market participants after it said that it would reduce its bond-buying scheme earlier than initially planned, damping expectations of continued support to safeguard economies from the fallout of the war in Ukraine. In the US, fresh inflation data paved the way for the Federal Reserve to raise interest rates when its officials meet next week. The yield on Germany’s 10-year Bund, a barometer for eurozone borrowing costs, rose 0.06 percentage points to 0.27%, reflecting a sharp fall in the price of the debt. The benchmark 10- year US Treasury yield rose 0.04 percentage points to 1.99%, having earlier moved above 2% for the first time in two-weeks. In equity markets, the European regional Stoxx 600 index lost 1.7% on Thursday. Germany’s Xetra Dax, which jumped almost 8% on Wednesday, fell 2.9% on Thursday. In the US, tech stocks led the fall, with the S&P 500 dropping 0.4% and the Nasdaq Composite declining 1%. Back home, Bursa Malaysia extended earlier gains to finish higher on Thursday due to improving market sentiment across the region and the broadly positive cues overnight from Wall Street. At 5pm, the FBM KLCI rose 1.16% or 18.2 points to 1,580.53 from 1,562.33 at Wednesday's close. In the region, Japan’s Topix rose 4% in its best day since June 2020, while Australia’s S&P/ASX 200 gained more than 1%. China’s benchmark CSI 300 index advanced 1.6% while in Hong Kong the Hang Seng index climbed 1.3%. Source: PublicInvest Research - 11 Mar 2022 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||

|