Date: 08/03/2022

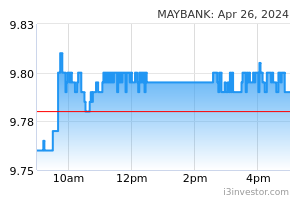

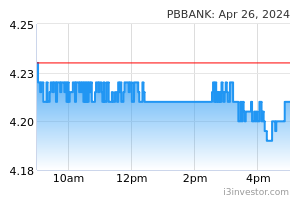

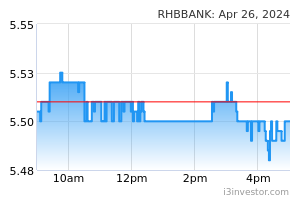

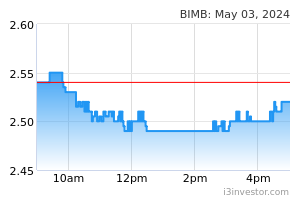

A fairly decent quarter since 4Q21 reporting season saw sector profit rising 42% YoY (lower loan loss provision) but declining 3% QoQ (negative Jaws, elevated NCC, and bond impairment). Overall, there were 3 earnings beat, 3 in line and 2 below. We still see recovery in CY21-23 with earnings growing at 2-year CAGR of 10.1%. In our view, the sector’s risk-reward profile is skewed to the upside as valuations are undemanding and OPR upcycle will benefit banks. Retain OVER WEIGHT; BUY calls include: Maybank, Public, RHB, BIMB, Affin. 4Q21 results round-up. This reporting season was a mixed bag as 3 out of 8 banks under our coverage beat estimates (Affin, Alliance, Maybank saw lower-than-expected impaired loan allowances ), 3 in line (CIMB, Public, RHB), and 2 below (AMMB, BIMB chalked in higher-than-expected loan loss provision). QoQ. 4Q21 sector earnings fell 3% given negative Jaws (opex grew 4ppt faster than total income), still fairly elevated net credit cost (stood at 40bp ex-Maybank), and bond impairment at some business centric banks. At the top, the weak non-interest income (NOII) was a drag (-4% primarily due to poor investment and forex showing) but was cushioned by better net interest margin (NIM, +5bp). We note that the profit increase at (i) Affin was driven by write-back of bad loans, (ii) BIMB was lifted up by better total income and reversal of deferred tax expense, while (iii) Maybank saw lower allowance for impaired loans. YoY. Despite negative Jaws (total income -1% vs opex +3%), sector bottom-line grew 42%, thanks to lower bad loans provision (-65%). At the top, widening NIM (+9%) and loans growth (+5%) helped to lessen the impact of sluggish NOII (-26%). Outliers with profit drop were AMMB and BIMB, because of higher loan loss allowances. Other key trends. Loans and deposits growth gained traction to +5.0% YoY (3Q21: +3.6%) and +6.2% YoY (3Q21: +4.5%) respectively. Based on these two categories, the top 3 fastest growing banks were Affin, BIMB, and RHB (+6-18%). Separately, for asset quality, it was resilient as GIL ratio trended down 5bp sequentially. Outlook. We expect sequential NIM to hold steady at current levels before contracting again due to deposit rivalry. That said, this is seen to expand when BNM hikes OPR later this year. Also, loans growth is expected to chug along given economic recovery. Separately, GIL ratio is likely to creep upwards but we are not overly worried as banks have made heavy pre-emptive provisioning in FY20-21 and in our view, credit risk has been adequately priced in by the market, looking at the still elevated NCC assumption applied for FY22 by both us and consensus (above the normalized run-rate but below FY20-21’s level). Forecast. After couple of profit revision this reporting season, we are now projecting 2-year aggregate earnings CAGR of 10.1% (CY21-23) for the sector. Maintain OVERWEIGHT. We believe the sector’s risk-reward profile is skewed to the upside as valuations are undemanding and we are only at the cusp of an OPR hike upcycle with economic recovery, which benefit banks. As such, we remain bullish and employ a rather broad stock buying strategy in 1H22. For large-sized banks, we like Maybank (TP: RM9.40) for its strong dividend yield and Public Bank (TP: RM4.80) for its large potential headroom to perform management provision overlay writebacks. For mid-sized banks, RHB (TP: RM7.00) is favoured for its high CET1 ratio and attractive price-tag. As for small-sized banks, BIMB (TP: RM3.45) and Affin (TP: RM2.35) are preferred; we like the former for its positive structural growth drivers and better asset quality while the latter has special dividends potential after concluding the disposal of its asset management arm. Source: Hong Leong Investment Bank Research - 8 Mar 2022 More articles on HLBank Research Highlights >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|