Date: 01/03/2022

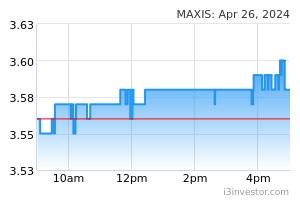

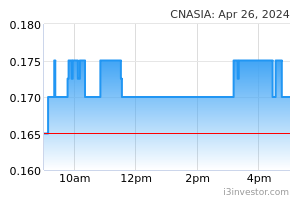

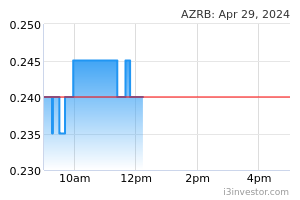

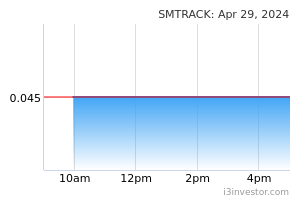

EconomyEU: Spain inflation highest since 1989. Spain inflation accelerated at the fastest pace in more than 32 years in Feb. Consumer price inflation rose to 7.4% in Feb from 6.1% in Jan. Economists had forecast inflation to rise moderately to 7.1%. A similar higher rate was last seen in July 1989. Excluding energy, underlying inflation increased to 3% from 2.4% a month ago. Inflation was driven by increases in prices of food and non-alcoholic beverages and fuel and oil. (RTT) Japan: Factory output hit by car production cuts, Ukraine crisis adds to risks. Japan’s factory output shrank for the second month in Jan as the auto sector grappled with production suspensions due to the pandemic, with Russia’s invasion of Ukraine intensifying pressure on an economy facing the risk of a contraction. (Reuters) Japan: Retail sales rise 1.6% on year in Jan. The value of retail sales in Japan was up 1.6% on year in Jan. That beat expectations for an increase of 1.4% and was up from the downwardly revised 1.2% gain in the previous month (originally 1.4%). On a seasonally adjusted monthly basis, retail sales tumbled 1.9% - missing forecasts for a fall of 1.5% following the downwardly revised 1.2% decline in Dec (originally -1.0%). (RTT) Japan: Housing starts growth eases in Jan. Japan's housing starts continued to increase but the pace of growth softened in Jan. Housing starts rose 2.1% yearly in Jan, following a 4.2% increase in Dec. Economists had forecast an annual growth of 1.7%. Annualized housing starts fell to a seasonally adjusted 820,000 in Jan from 838,000 in the previous month. (RTT) India: Growth slows in Dec quarter. India's economic growth slowed sharply in the three months to Dec. GDP grew 5.4% YoY following an 8.5% increase in the previous three months, which was revised from 8.4%. In the same quarter a year ago, the economy expanded 0.7%. The April quarter growth was revised to 20.3% from 20.1%. The growth estimate for the fiscal year 2021-22 was revised down to 8.9% from 9.2% announced on 31 Dec. (RTT) Australia: Jan retail sales climb 1.8%. The value of retail sales in Australia jumped a seasonally adjusted 1.8% on month in Jan - standing at AUD32.491bn. That exceeded expectations for an increase of 0.2% following the 4.4% contraction in Dec. Food retailing had the largest rise in sales this month up 2.2% which is the largest monthly rise since July 2021 with sales remaining elevated at their fourth highest level in the series. (RTT) Australia: Private sector credit jumps 7.6% on year in Jan. Private sector credit in Australia was up 7.6% on year in Jan - accelerating from 7.2% in Dec. On a monthly basis, private sector credit rose 0.6%, easing from 0.8% a month earlier. Housing credit was up 0.7% on month and 7.7% on year, while personal credit fell 0.8% on month and 3.8% on year and business credit gained 0.6% on month and 9.0% on year. (RTT) Singapore: Producer price inflation slows in Jan. Singapore's producer price inflation eased in Jan. The manufacturing producer price index rose 18.0% YoY in Jan, following an 18.9% increase in Dec. The oil index surged 58.3% annually in Jan and the non-oil indexes increased 13.0%. The Domestic Supply Price Index grew 22.7% YoY in Jan, after a 22.0% rise in Dec.. (RTT) MarketsMaxis (Neutral, TP: RM4.40): Slapped with RM107m additional tax bill. Maxis wholly-owned subsidiary, Maxis Broadband, was served with an additional tax bill amounting to RM107m for the year of assessment 2020 (Bursa) Comment : This was pursuant to the disallowance of Maxis Broadband’s deduction of interest expenses incurred during the year of assessment 2020. Maxis Broadband will initiate legal proceedings to challenge the basis and validity of the dispute. We do not expect any immediate financial impact pending the outcome of the legal proceedings, though we believe this would eventually be settled at a lower sum. In the past, Maxis Broadband had been served with additional assessment for the year 2016-2019. CN Asia: Signs HOA for JV in proposed O&G project in Kazakhstan. CN Asia Corporation has ventured into a construction and O&G operations facilities deal in Kazakhstan with Tan Sri Halim Saad and Abu Talib Abdul Rahman. The deal involves a proposed joint venture for the construction and facilities operation at the Rakushechnoye Oil and Gas Field in the Karakiyan District of the Mangistau Oblast, Kazakhstan. (Bernama) AZRB: Bags RM205m contract in Pahang. Ahmad Zaki Resources (AZRB) has been awarded a contract worth RM205.43m from the Pahang Islamic Religious Council for the proposed development of the city mosque institution and Islamic Centre Complex in Kota Sultan Ahmad Shah, Kuantan, Pahang. The works, slated to begin on March 21 and be completed within 24 months from the commencement date. (The Edge) SMTrack: A PMC frontrunner in RM1.2bn redevelopment project in Kampong Bharu. SMTrack is currently in the advanced discussion stage with the relevant parties for the RM1.2bn redevelopment project in Kampong Bharu. Negotiations with Jiankun International (JIB) on the potential bid to be the project management consultant (PMC) for the redevelopment project has entered into advanced stages. (The Edge) Nationwide Express: Bursa Malaysia rejects extension request, shares to be suspended from March 8. Bursa Malaysia has rejected Nationwide Express Holdings application for an extension of time to submit its regularisation plan. Hence, shares trading will be suspended with effect from March 8, 2022. The securities of the company will be delisted on March 10, 2022, unless there is an appeal on or before March 7, 2022. (BTimes) IPO: Farm Fresh sets IPO price at RM1.35, Malaysia's largest listing since June 2021. Farm Fresh has set its IPO price at RM1.35 per share. Based on the RM1.35, it would have a market capitalisation of RM2.5bn upon its listing debut from an enlarged share capital of 1.86bn shares. The IPO will raise about RM1bn to Farm Fresh and its major shareholders. (BTimes) Market UpdateThe FBM KLCI might open lower today as Wall Street and European stocks slipped, oil prices rose, the Rouble plunged and US government bonds rallied after new sanctions imposed on Russia reverberated through financial markets. The S&P 500 US stock index fell 0.2%in New York, with more than 70% of the companies within the benchmark declining in value. The technology-heavy Nasdaq Composite eked out a 0.4% advance, rebounding from an earlier loss of as much as 1.1%. In Europe, the regional Stoxx 600 share gauge closed 0.1% lower. The Stoxx banks sub-index fell 5.7% as traders responded to uncertainty about Western allies locking some Russian lenders out of the Swift payments system. Germany’s Xetra Dax lost 0.7%. The moves came after Russian President Vladimir Putin put his country’s nuclear forces on high alert and western powers imposed sanctions on Russia’s central bank in response to the invasion of Ukraine. Global equities had rallied on Friday as traders reacted to punitive measures against Russia that did not target the nation’s energy exports. But after financial sanctions against Russia were ratcheted up over the weekend, fund managers de-risked their portfolios, closing out strong bets on the global economy and future central bank policy while loading up on low-risk and easily tradeable assets. Back home, Bursa Malaysia ended firmer on Monday on persistent buying interest in blue chips as investors shrugged off the tensions between Russia and Ukraine. At closing, the FBM KLCI advanced 1.04% or 16.56 points to 1,608.28 from 1,591.72 at Friday’s close. In the region, stock markets were mixed, with major benchmarks gaining or losing less than 1%. Source: PublicInvest Research - 1 Mar 2022 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||

|