Date: 28/02/2022

EconomyUS: Robust consumer spending, core capital goods orders highlight US economic strength. US consumer spending increased more than expected in Jan, offering the economy a strong boost at the start of 1Q, but price pressures continued to mount, with annual inflation surging at rates last experienced four decades ago. Growth prospects were further brightened by other data showing solid demand by businesses for equipment last month. The reports suggested underlying strength in the economy that could sustain the expansion as the Federal Reserve starts raising interest rates to quell inflation, and provide a shield against the fallout from Russia's invasion of Ukraine. (Reuters) US: Pending home sales unexpectedly plunge 5.7% in Jan. The National Association of Realtors released a report showing a continued slump in pending home sales in the US in the month of Jan. Its pending home sales plunged by 5.7% to 109.5 in Jan after tumbling by 2.3% to a revised 116.1 in Dec. The continued decrease came as a surprise to economists, who had expected pending home sales to jump by 1.0%. A pending home sale is one in which a contract was signed but not yet closed. Normally, it takes four to six weeks to close a contracted sale. With inventory at an all time low, buyers are still having a difficult time finding a home. Given the situation in the market - mortgages, home costs and inventory - it would not be surprising to see a retreat in housing demand. (RTT) US: Durable goods orders jump 1.6% in Jan, much more than expected. New orders for US manufactured durable goods increased by much more than expected in the month of Jan. The durable goods orders surged by 1.6% in Jan following a significantly revised 1.2% jump in Dec. Economists had expected durable goods orders to climb 0.8% compared to the 0.7% drop that had been reported for the previous month. Solid goods demand and plenty of backorders will keep manufacturing on a very healthy course even as spending tilts in favor of in-person services. And we should see better supply-side news as shipping bottlenecks slowly clear, input shortages diminish, and Americans return to the job market. (RTT) EU: Germany import price inflation strongest since 1974. Germany's import price inflation reached its highest level since 1974 on surging energy prices. Import price inflation advanced to 26.9% in Jan, the strongest since Oct 1974, from 24.0% in Dec. Inflation was forecast to ease slightly to 23.7%. On a monthly basis, import prices grew 4.3%, following a 0.1% gain in Dec and the economists' forecast of +1.6%. Import prices of energy posted a sharp 144.4% increase, especially due to increase in the price of natural gas. Excluding energy prices, import prices were 14.5% higher than in Jan 2021 and 2.5% higher than in Dec 2021. (RTT) EU: France inflation rises further in Feb. France consumer price inflation increased further in Feb due to higher energy prices. Overall producer price inflation reached a record high in Jan. Consumer price inflation advanced more-than-expected to 3.6% in Feb from 2.9% in Jan. The rate was forecast to rise moderately to 3.2%. This annual increase resulted from the acceleration of energy, service, manufactured good and food prices. EU harmonized inflation also increased in Feb, to 4.1% from 3.3% in Jan. The expected rate was 3.6%. On a monthly basis, consumer prices gained 0.7%, following a 0.3% rise a month ago. (RTT) EU: Italy non-EU trade balance swings to deficit. Italy's trade balance with non-EU countries swung to deficit in Jan from the previous month. The non-EU27 trade balance registered a deficit of EUR4.174bn in Jan versus a surplus of EUR4.741bn in Dec. In the same period last year, the surplus was EUR1.775bn. Exports to non-EU27 countries increased 19.0% annually in Jan, following a 12.7% rise in Dec. Imports surged 65.5% in Jan, following a 45.9% jump in the previous month. On a MoM basis, exports rose 5.3% and imports increased 10.1% in Jan. (RTT) EU: Spain producer price inflation strongest since 1976. Spain producer prices increased at the fastest pace on record in Jan. Producer prices grew 35.7% on a yearly basis in Jan, following Dec's 35.2% increase. This was the biggest annual growth since the series began in Jan 1976. Excluding energy, producer price inflation advanced to 12.0% from 10.9% in the previous month. Among components of PPI, energy prices posted the biggest increase of 91.4%, followed by a 21.7% rise in intermediate goods prices. Prices of consumer and capital goods were up 6.1% and 4.2%, respectively. (RTT) UK: Britain's car output slumps by 20% in worst Jan since 2009. The number of cars made in Britain fell by 20% in Jan from already weak output levels in the same month last year as the industry struggled with ongoing shortages of components, a plant closure and the change to new models. The Society of Motor Manufacturers and Traders (SMMT) said 68,790 cars were made in Britain last month, the weakest start to any year since 2009. The combined effect of the current problems for the industry was greater than the disruption in Jan 2021 when Britain left the European Union's single market. (Reuters) Japan: Leading index rises more than estimated. Japan's leading index rose more than initially estimated in Dec. The leading index, which measures the future economic activity, rose to 104.8 in Dec from 103.9 in the previous month. In the initial estimate, the reading was 104.3. The coincident index that measures the current economic situation, declined to 92.7 in Dec from 92.8 in the previous month. According to the initial estimate, the reading was 92.6. The lagging index rose to 94.1 in Dec from 93.4 in Nov. The initial reading was 94.2. (RTT) Japan: Inflation in Japan's capital accelerates in Feb. Consumer price inflation in Japan's capital accelerated in Feb. The consumer price index for Tokyo advanced 1% YoY in Feb, faster than the 0.6% increase in Jan. Excluding fresh food, consumer price inflation advanced to 0.5% from 0.2% a month ago. The rate also exceeded the economists' forecast of 0.4%. Higher inflation in Feb was driven by the 24.2% surge in energy prices. Excluding fresh food and energy, consumer prices dropped 0.6%, following a 0.7% decrease a month ago. (RTT) Singapore: Industrial production growth slows in Jan. Singapore's industrial production growth eased in Jan. Industrial output rose 2.0% YoY in Jan, after a 16.7% rise in Dec. Economists had forecast a growth of 10.0%. Excluding biomedical manufacturing, industrial production rose 4.7% yearly in Jan, after a 5.9% increase in the preceding month. On a monthly basis, industrial production dropped 10.7% in Jan, after a 3.0% rise in the previous month. General manufacturing increased 17.4% in Jan and transport engineering rose 16.2%. Precision engineering and electronics increased by 11.6% and 0.1%, respectively. (RTT) MarketsTenaga (Outperform, TP: RM12.42): TNB, MARii in strategic partnership to develop EV ecosystem . Tenaga Nasional Bhd (TNB) and the Malaysia Automotive, Robotics and IOT Institute (MARii) have entered into a strategic partnership to create a platform to address comprehensively the challenges related to electric vehicle (EV) usage in line with the nation’s energy transition. The collaboration is for the development of the EV ecosystem, enabling the implementation of Mobility as a Service (MAAS) and related initiatives in the Malaysian automotive market. (StarBiz) Pharmaniaga: Inks two MoUs with Thailand-based technical partners on vaccine R&D and product development . Pharmaniaga has inked MoU with two biotechnology companies based in Thailand for vaccine research & development (R&D) and bioequivalence solutions as well as pharmaceutical product development innovation. The pharmaceutical company said the signing was a step up in its efforts to become a major regional pharmaceutical player by partnering with technical firms in Thailand. (The Edge) BCM Alliance: Disposes of entire stake in BSL Corp at a loss due to market uncertainty, Russia-Ukraine conflict. BCM Alliance has disposed of its entire stake in printed circuit board (PCB) company BSL Corp at a RM5.51m loss, citing" market uncertainties" and the conflict between Russia and Ukraine as its rationale. This comes after the group had spent an aggregate sum of RM7.13m in cash to acquire a 4.38% stake or 4.29m shares in BSL from the open market between Aug 25, 2021 to Nov 2, 2021, according to its filing with the bourse. (The Edge) Serba Dinamik: Appoints Ahmad Amryn, Felix Chin as independent directors. Serba Dinamik Holdings has announced the appointment of Ahmad Amryn Abd Malek and Felix Chin Wui Choong as independent directors effective Feb 25. The oil and gas engineering services company said that Chin and Ahmad Amryn have also been appointed to its audit and risk committee, while Ahmad Amryn was also appointed to the company’s nomination and remuneration committee. (The Edge) GDEX: Posts net profit of RM43m for 18M21 . GDEX reported a net profit of RM43m for the 18-month financial period ended Dec 31, 2021 (18M21) on revenue of RM638.1m. There are no comparative financials due to the change in the express delivery services provider’s financial year end to Dec 31 from June 30. (StarBiz) Frontken: Achieves record annual, quarterly profit amid strong demand from customers; declares 2.5 sen dividend . Frontken Corp’s net profit for 4QFY21 rose 26.9% to a record high of RM29.55mn from RM23.29m in the corresponding quarter a year earlier, mainly attributable to improved revenue, strict cost management and continual process enhancements that led to better production efficiency. Frontken declared a second interim dividend of 2.5 sen per share, with the entitlement and payment dates to be announced later. (The Edge) Market UpdateThe FBM KLCI might open higher today after US and European stocks rallied on Friday as war in Ukraine raged, with investors watching for signs that the conflict with Russia would be contained to the two countries. The S&P 500 stock index, which had swung wildly on Thursday, advanced 2.2%. The Wall Street benchmark had dropped as much as 2.6% on Thursday before closing 1.5% higher, as hedge funds unwound earlier bets that stocks would fall. Many investors had sought to reduce their positions given the uncertainty in the market and an uptick in volatility. The technology-focused Nasdaq Composite gained 1.6% on Friday. Both Wall Street indices eked out moderate advances for the week. As Russian troops advanced on Kyiv, the US and EU imposed a range of sanctions on Moscow that stopped short of curbing energy exports, calming market jitters that a rising oil price would exacerbate already high levels of global inflation. In Europe, the regional Stoxx 600 share index gained 3.3%, after dropping 3.3% in the previous session and briefly entering a technical correction. Meanwhile, London’s FTSE 100 closed 3.9% higher — recovering the previous day’s declines in its biggest single-day advance since November 2020. Back home, Bursa Malaysia ended the week on a higher note, supported by persistent buying momentum in selected financial services stocks, industrial products and services, as well as technology counters. At closing, the benchmark FBM KLCI rose 1.13% or 17.83 points to 1,591.72 from 1,573.89 at Thursday’s close. Japan’s Nikkei 225 rose 1.9%, and the CSI 300, which comprises the largest stocks listed in Shanghai and Shenzhen, both rose 1% after falling Thursday. Hong Kong’s Hang Seng Index slipped 0.6%. Source: PublicInvest Research - 28 Feb 2022 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||

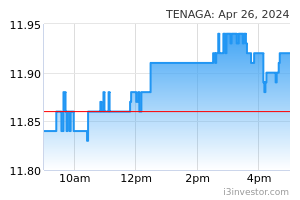

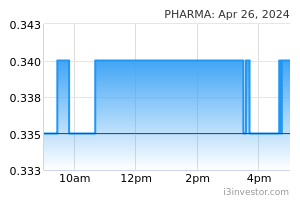

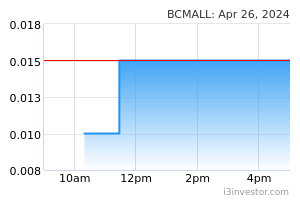

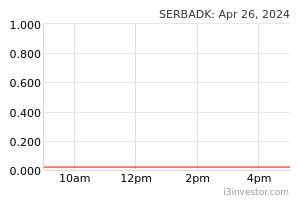

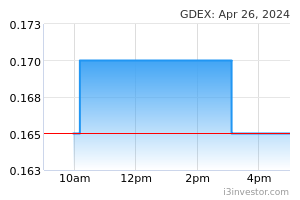

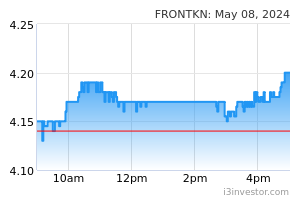

|