Date: 17/02/2022

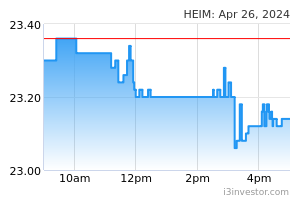

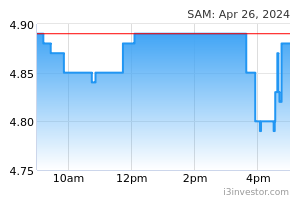

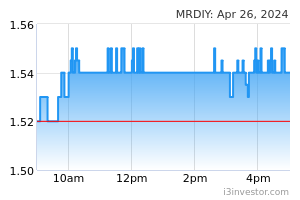

EconomyUS: Retail sales rise most in 10 months in broad-based rebound. US retail sales rebounded by more than forecast with the biggest gain since March, illustrating resilient demand despite soaring inflation. The value of overall purchases rose 3.8% in Jan after a downwardly revised 2.5% drop in the prior month, Commerce Department figures showed. The figures are not adjusted for inflation. The median estimate in a Bloomberg survey called for a 2% advance in overall retail sales from the prior month. The broad-based advance in sales underscores a steady appetite for merchandise including cars and furniture. While the Omicron variant and related surge in Covid-19 infections likely dampened services spending in the month, an improving labour market has helped consumers continue to spend despite decades-high inflation and a collapse in confidence. (Bloomberg) US: Import prices jump much more than expected in Jan . Reflecting a substantial rebound in prices for fuel imports, the Labor Department released a report showing US import prices increased by much more than expected in the month of Jan. The Labor Department said import prices surged up by 2.0% in Jan after falling by a revised 0.4% in Dec. Economists had expected import prices to jump by 1.0% compared to the 0.2% dip originally reported for the previous month. The report showed export prices also spiked by 2.9% in Jan after tumbling by a revised 1.6% in Dec. Export prices were expected to advance by 1.3% compared to the 1.8% slump originally reported for the previous month. (RTT) US: Industrial production rebounds strongly as utilities output spikes . After reporting a modest decrease in US industrial production in the previous month, the Fed released a report showing production rebounded by much more than anticipated in the month of Jan. The Fed said industrial production jumped by 1.4% in Jan after edging down by 0.1% in Dec. Economists had expected industrial production to rise by 0.4%. The much bigger than expected rebound in industrial production was led by a spike in utilities output, which skyrocketed by 9.9% in Jan after tumbling by 1.8% in Dec. Utilities output soared as the demand for heating surged amid the arrival of significantly colder-than-normal temperatures. (RTT) US: Business inventories increase solidly in Dec. US business inventories increased strongly in Dec, with motor vehicle stocks accelerating, a sign that the worst of the global semiconductor shortage was probably behind. Business inventories increased 2.1% after rising 1.5% in Nov. Inventories are a key component of GDP. Dec’s increase was in line with economists’ expectations. Inventories shot up 10.5% on a YoY basis in Dec. Retail inventories surged 4.2% in Dec, instead of 4.4% as estimated in an advance report published last month. That followed a 2.0% increase in Nov. Motor vehicle inventories accelerated 6.8% as estimated last month. They increased 4.2% in Nov. (Reuters) EU: Eurozone industrial production growth slows in Dec . Eurozone industrial production growth halved in Dec, data released by Eurostat showed. Industrial output grew 1.2% on a monthly basis, following Nov's 2.4% increase. Nonetheless, this was faster than the economists' forecast of 0.5%. The slowdown was driven by the weakness in energy and durable consumer goods production. Output of intermediate goods gained 0.5% and that of capital goods by 2.6%. Non-durable consumer goods output moved up 0.4%. Meanwhile, energy output and durable consumer goods output decreased 0.8% and 0.3%, respectively. YoY, industrial production was up 1.6%, in contrast to the 1.4% decline in the previous month. Industrial production in the EU27 grew 0.7% on month, taking the annual growth to 2.5%. (RTT) UK: Inflation overshoot adds to brutal cost of living squeeze . UK inflation unexpectedly accelerated for a fourth straight month in Jan, highlighting a cost-of- living crisis that’s set to worsen dramatically this year. Prices grew 5.5% over the year, a new three decade high, driven by clothing and footwear, the Office for National Statistics said. Both economists and the BOE had expected inflation to remain unchanged at 5.4%. An index that excludes volatile items quickened to a record 4.4%. The figures raise the stakes for the BOE, with investors not ruling out a 50 basis-point interest-rate increase in March, an unprecedented move since it gained independence in 1997. The Central Bank is predicting inflation will peak at around 7.25% in April — more than triple its target — when a 54% surge in energy bills is due to take effect at the same time as taxes go up. By contrast, wages are increasing at less than 4%. (Bloomberg) China: Inflation eases further in Jan. China's consumer price inflation as well as factory gate inflation moderated further in Jan, giving space for the central bank to ease its policy to support economic recovery. Consumer price inflation slowed to 0.9% in Jan from 1.5% in Dec, the National Bureau of Statistics. The rate was forecast to ease to 1.0%. Following a 1.2% decrease in Dec, food prices dropped 3.8% due to the sharp 41.6% decline in pork prices. On a monthly basis, consumer prices gained 0.4%, slightly slower than the 0.5% rise expected by economists. Core inflation that excludes volatile food and energy prices, remained unchanged again, at 1.2% in Jan. Another report from the NBS revealed that factory gate inflation came in at 9.1% in Jan, down from 10.3% a month ago. This was also weaker than the economists' forecast of 9.5%. (RTT) South Korea: Jobless rate falls in Jan. South Korea's unemployment rate decreased in Jan, data from Statistics Korea showed. The jobless rate fell to a seasonally adjusted 3.6% in Jan from 3.8% in Dec. In the same month last year, the unemployment rate was 5.2%. On an unadjusted basis, the unemployment rate increased to 4.1% in Jan from 3.5% in the previous month. The number of unemployed increased to 1.143m in Jan from 979,000 in the preceding month. Compared to a year ago, the figure decreased by 427,000 persons. The number of employed persons increased by 1.135m YoY to 26.953m in Jan. (RTT) MarketsCapital A (Neutral: TP: RM0.79): Unit signs non-binding MOU with Avolon to create transformational ride-sharing platform. Capital A has entered into a non-binding MOU with international aircraft leasing company Avolon Aerospace Leasing to establish a joint working group to study the feasibility of urban air mobility in the ASEAN region and evaluate the possibility of leasing up to 100 VX4 electric vertical take-off and landing aircraft. (The Edge) GCAP: Commences operation of 3.0 MWp solar PV system for Muda Paper Mills. G Capital's (GCAP) 70% owned subsidiary Solarcity Malaysia SB (SMSB) completed the installation and commenced operation of a 3.0 MWp solar photovoltaic electric power generation system for Muda Paper Mills SB (MPM) in Simpang Ampat, Pulau Pinang. (BTimes) Chin Hin Group Property: To diversify into water infrastructure construction works. Chin Hin Group Property Bhd (CHGP) has proposed to acquire a 60% stake or 15m shares in Asia Baru Construction SB for RM30m cash, to diversify into water infrastructure construction works. The acquisition, which is expected to be completed by the second quarter of 2022, will enable it to diversify and tap into the water infrastructure construction works, which it noted are complementary to its existing property development and construction business. (The Edge) Sunzen Biotech: Proposes bonus issue of 409m warrants. Sunzen Biotech has proposed to undertake a bonus issue of up to 408.93m warrants on the basis of one warrant for every two existing ordinary shares in the company held by entitled shareholders on an entitlement date to be determined and announced later. (The Edge) Scomi: Unit secures letter of intent for RM24m solar PV plant project. Scomi Group said its 51%-owned subsidiary Scomi SGSB SB has accepted a letter of intent (LOI) for an engineering, procurement, construction and commissioning project valued at RM23.9m. The project involves the development of a 7.992 MWp rooftop photovoltaic (PV) plant for a local educational institution. (The Edge) Heineken Malaysia: To study if price adjustments needed amid rising input costs. Heineken Malaysia is set to study whether its products require price adjustments to address increased input costs, said its managing director Roland Bala. (The Edge) SAM Engineering: 3Q net profit doubles as aerospace, equipment business see higher demand. SAM Engineering & Equipment (M) net profit soared 102.87% to RM25.2m for its 3QFY22 from RM12.42m a year earlier, on the back of an increase in demand at its aerospace and equipment divisions. (The Edge) Mr DIY: Quarterly profit jumps 24% to record high, group declares 0.9 sen dividend. Mr DIY Group (M) net profit for the 4QFY21 grew by 24.28% to a record high of RM134.55m from RM108.26m in the same period of the previous year, on the back of a RM10.7m gain in operating income during the quarter. (The Edge) Market UpdateThe FBM KLCI might open higher as US stocks rebounded into positive territory after the Federal Reserve released the minutes from its latest policy meeting on Wednesday. The minutes highlighted the determination at the US central bank to combat stubbornly high inflation, but some officials also warned about the risks of damaging markets and the wider economy by tightening policy too quickly. The fact a large group of Fed policymakers did not rally around the view of a half-a-point rate rise, a move some officials have suggested, also stood out to traders. The S&P 500 index closed 0.1% higher, having fallen 0.7% earlier in the day. The Nasdaq Composite slipped 0.1% for the day, having fallen 1.2% before the central bank’s update. Pessimistic updates on the situation in Ukraine had already been weighing on stock markets earlier on Wednesday. Jens Stoltenberg, Nato secretary-general, warned that Russian troop numbers near the border continued to rise, saying “we have not seen any de-escalation”. The comments helped reverse some of the gains that had followed an apparent easing of tensions on Tuesday. Europe’s Stoxx 600 share index moved between small gains and losses, and closed broadly flat. London’s FTSE 100 lost 0.1%, while Germany’s Dax also shed 0.3%. France’s blue-chip Cac 40 stock index fell 0.2%. Back home, Bursa Malaysia has extended its upward trajectory to close higher, rising above the 1,600 threshold due to continuous buying support in selected heavyweights, coupled with improving sentiment. At 5pm, the FBM KLCI gained 3.59 points to 1,603.2 compared with 1,599.61 at Tuesday's close. Major indices in Asia also closed higher. Japan’s Nikkei 225 jumped 2.2%, and South Korea’s Kospi gained 2%. Hong Kong’s Hang Seng added 1.5%, and mainland China’s Shanghai Composite rose 0.6%. Source: PublicInvest Research - 17 Feb 2022 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||

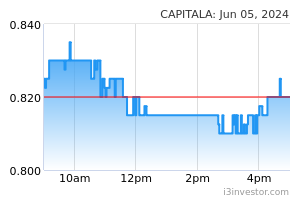

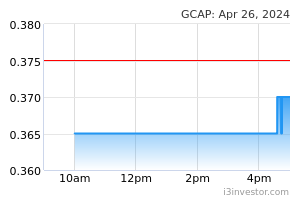

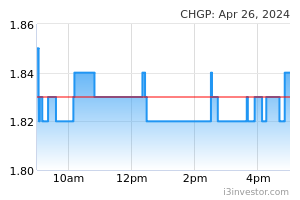

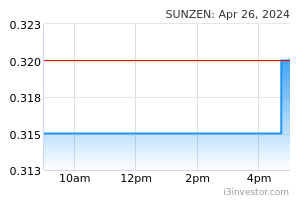

|