Date: 10/12/2021

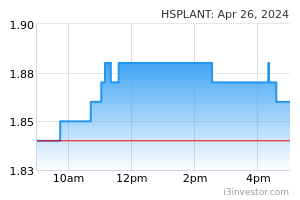

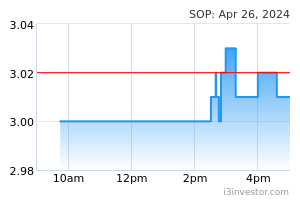

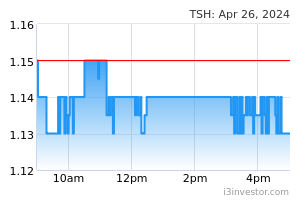

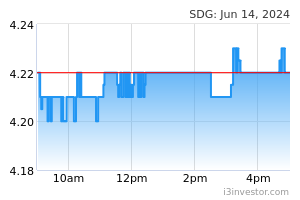

Closing stocks improved 1.0% mom to 1.82m tonnes in November Malaysia’s palm oil stocks improved 0.96% mom to 1.817m tonnes in November as production weakened while export strengthen 3.3% mom to 1.467m tonnes on higher palm oil intake from major importing countries, which we believe could be due to the reopening of economies as Covid-19 vaccination rate has risen worldwide. Overall, the improvement in inventory was due to lower stocks for CPO which improved by 4.4% to 942,354 tonnes during the period. Nonetheless, PPO (processed palm oil) increased 3.1% mom to 874,525 tonnes against 848,329 tonnes registered in Oct21. As of end-Nov 2021 versus a year ago, the stockpiles were relatively higher, up by 16.29% yoy to 1.82m tonnes against 1.56m tonnes recorded in Nov20. We expect stocks level in the next couple of months to hover in the region of 1.80m tonnes to 1.85m tonnes, in view of slower growth in production while export is expected to sustain to satisfy demand for festivities i.e., Chinese New Year, as well as to cater for improve demand from the reopening of global economy. Production declined 5.3% mom to 1.63m tonnes. CPO production declined 5.27% mom (+9.65% yoy) to 1.635m tonnes in Nov 2021 as FFB yield and oil extraction rate (OER) weakened across the country on low cycle of production months. Conversely, year-to-date CPO production decreased 6.4% yoy to 16.67m tonnes as production is wedged by the lag impact of weaker yield from the unfavourable weather, diseases and older trees as well as by the acute labour shortage especially from the skilled harvester in Peninsular and Sarawak. Maintain average CPO price forecast of RM4,400/MT for 2021 and RM3,500/MT for 2022 Crude palm oil price for the month of November saw mixed trading, tracking the performance in CBOT and Dalian Commodity Exchange market on concerns over falling demand. Nonetheless, given a continuous concern over tight palm oil supply from Malaysia, average CPO price at Bursa Derivatives Market (BMD) closed relatively higher at RM4,903.86/MT (+0.4% mom) with CPO price for local delivery skyrocketing to an average of RM5,341/MT against RM5,051/MT recorded in the previous month. As for Jan-Nov 2021 period, the MPOB average CPO price of RM4,358/MT was higher by RM1,671/MT or 62.25% against RM2,687/MT recorded in the same period last year. We are of the view that a higher near-term CPO price is possible, as improved demand prospect and the tighter inventory level and supply of palm oil would add an upward pressure on CPO price. This would continue to bolster price in the short-to-medium term, before moderating in the later part of 1Q2022. In light of these developments, we foresee that price (local delivery) for Dec21/Jan22 would trade within a range of RM5,300/MT and RM4,500/MT as opposed to RM3,986.50/MT and RM3,474/MT during the same period last year. We believe the possible negative factors for CPO price are 1) slower-than-expected economic growth and consumption of edible oils, 2) lower-than-expected demand due to changes in government policies of importing countries, 3) higher-than-expected supply and stockpiles of Soybean and SBO, 4) narrowing of the price differential between CPO and SBO, 5) weakening of crude oil prices, and 6) resurgence of new variant of Covid-19 virus with another round of movement restriction worldwide. Maintain “Overweight” Maintain Overweight on the sector as most stocks under our coverage are currently carrying attractive valuations. We have BUY call on HAPL (RM2.36), SOP (RM4.75), TSH (TP: RM1.30), IOI (RM4.80), KLK (RM24.40), SIME Darby Plants (TP: RM5.00) and GENP (TP: RM9.00), Sarawak Plant (RM2.88), whilst HOLD recommendation on and FGV (TP: RM1.43); and non-rated for TH Plant. Source: BIMB Securities Research - 10 Dec 2021 More articles on Bimb Research Highlights >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|