Date: 02/12/2021

A quarter of awe-inspiring results

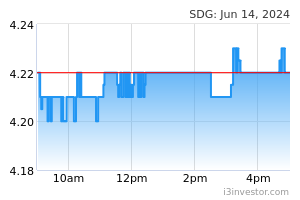

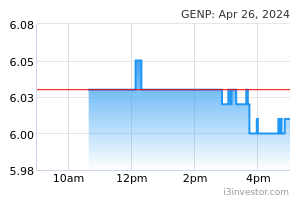

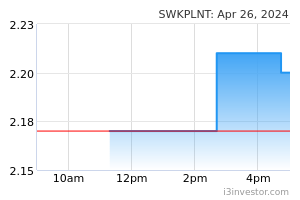

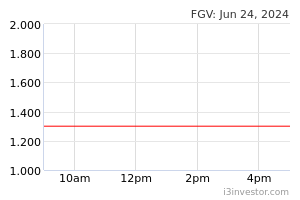

Performance was remarkable The recently concluded corporate earnings season was remarkable for plantation companies, based on our analysis. Out of ten stocks under our coverage, nine companies reported earnings that were above expectations, with one coming in within our expectation. Earnings were generally higher yoy as improvement in ASP of palm products realised negated the increase in production costs and operational costs as well as lower FFB and CPO production. Companies under our coverage realised ASP of CPO improved significantly to RM3,502/MT - RM4,490/MT in 3Q21 against RM2,355/MT - RM2,845/MT in 3Q20. Conversely, the improvement in qoq results was generally due to better palm product price realised as well as higher growth in FFB and CPO production during the period. Almost all of the companies in our stock universe recorded an improvement in FFB production growth except for SIME Plant, GENP and TSH which turned out to be negative qoq (Table 2) mainly driven by lower crop from Malaysia, added with some of the estates in Indonesia was impacted by flood that disrupted harvesting activities. Malaysian estates are still lagging as productivity is wedged by the lag impact of weaker yield from the dry weather experienced in 2019 and lower fertiliser application as well as hiccup in productivity due to labour shortage issues and replanting activities. Tight palm oil supply in Malaysia to continue up until 1Q22 Apart from declining yields due to adverse weather impact on climate change, ageing estates and diseases, palm oil production is expected to grow at a slower pace, possibly up until 1Q22 as harvesting and manuring activities is interrupted by continuous acute shortage of labour that is unlikely to ease anytime soon especially in Peninsular Malaysia and Sarawak. Besides, fertiliser availability and pricing are also at the forefront of concerns for farmers especially smallholders. Nonetheless, we do believe that the reopening of major economies which would take place sooner rather than later, as well as continued tight supply of edible oils and stockpiles compounded by improving demand scenario and rally in alternatives oil prices would keep CPO price supported. Earnings growth outlook is sustainable on the upside We expect plantation’s earnings for this year to be more visible given average CPO price achieved up to Nov 2021 averaging at RM4,358.14/MT against RM2,686.73/MT for the same period last year. Improved demand prospect and the tighter inventory level and supply of palm oil would add an upward pressure to CPO price and, thus, would continue to bolster price in the short-to-medium term, in our view, before moderating in the later part of 1Q2022. Although we might see margin contraction to continue for downstream players on demand and price (feedstock and selling price) concerns, the higher average selling price realized expected for CPO in 2021/22 against 2020 should see plantation segment fetching better margins in FY21 and FY22 – thus, negating the hiccup in downstream segments as well as anticipated increase in production costs and operational costs on the back of lower FFB and CPO production in upstream segments. However, we estimate that higher revenue and better margins expected from oleochemical division, would partially cushion the earnings volatility in the downstream segment. OVERWEIGHT the sector We predict that the average CPO price for this year would average at RM4,300/MT to RM4,500/MT - judging from the CPO price trend, currently trading at much higher than recent historical prices, ie above RM5,000/MT. We have raised our 2021 average CPO price forecast to RM4,400/MT from RM3,700/MT previously, and to RM3,500/MT from MYR2,950/MT initially forecast for 2022. These changes are already reflected in our earnings forecasts in the recent results released in November 2021 – refer Table 2. Our base case scenario is for CPO prices to continue their upward trajectory in the short-to-medium term – due to tighter supplies and improved demand as discussed earlier – and then moderate in the later part of 1Q22. In view of this, we expect plantation companies’ earnings to remain firmly on an uptrend for the upcoming results release. Maintain OVERWEIGHT on the sector as most stocks under coverage are currently carrying attractive valuations. We have BUY call on HAPL (RM2.36), SOP (RM4.75), TSH (TP: RM1.30), IOI (RM4.80), KLK (RM24.40), SIME Darby Plants (TP: RM5.00) and GENP (TP: RM9.00), Sarawak Plant (RM2.88), whilst HOLD recommendation on and FGV (TP: RM1.43); and non-rated for TH Plant. Variances in earnings forecast would be due to lower-than-expected production and sales volume, higher-than-expected ASP realised of palm products and higher-than-expected costs. Risk factors include 1) slower-than-expected economic growth and consumption of edible oils, 2) lower-than-expected demand due to changes in government policies of importing countries, 3) higher-than-expected supply and stockpiles of Soybean and SBO, 4) narrowing of the price differential between CPO and SBO, 5) weakening of crude oil prices, and 6) prolonged Covid-19 pandemic with new variant and another round of movement restriction worldwide. Source: BIMB Securities Research - 2 Dec 2021 More articles on Bimb Research Highlights >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|