Date: 12/10/2021

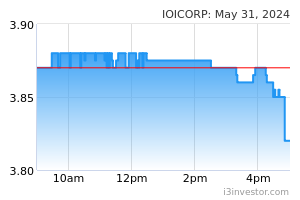

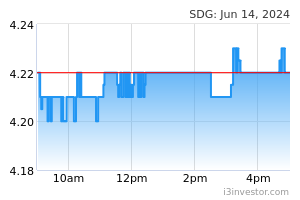

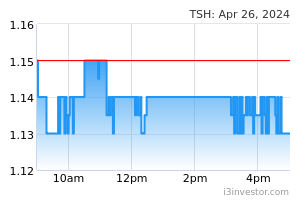

Palm oil stockpile shrank 7.0% MoM to 1.75m tonnes in Sep-21 (lower than Bloomberg consensus median estimate of 1.87m tonnes), on the back of lower output and a strong rebound in exports. Maintain 2021 -23 CPO price assumptions of RM3,800/mt, RM2,900/mt and RM2,800/mt, respectively. We see upside risk to our CPO price assumption for 2021, as the bullish price sentiment will likely be sustained into the near term. In our view, potentially weak near term exports demand from major palm oil consuming countries (namely, China and India) will likely be mitigated by seasonally low palm oil production cycle and increasing likelihood of La Nina episode in coming months. Maintain OVERWEIGHT stance on the sector. Top picks are IOI Corp (BUY; TP: RM4.44), KLK (BUY; TP: RM25.33), Sime Darby Plantation (BUY; TP: RM4.99) and TSH Resources (BUY; TP: RM1.31). DATA HIGHLIGHTSStockpile declined on lower output and exports rebound. Palm oil stockpile shrank 7.0% MoM to 1.75m tonnes in Sep-21, on the back of lower output (particularly from Peninsular estates) and a strong rebound in exports. The stockpile came in below Bloomberg consensus median estimate of 1.87m tonnes, due mainly to lower than-expected output. Lower output in Peninsular Malaysia dragged total output. Output fell 0.4% MoM to 1.70m tonnes in Sep-21, dragged mainly by lower output in some states in Peninsular Malaysia (namely, Johor, Perak and Selangor), while output in Sabah and Sarawak registered MoM output growth of 5.6% and 4.2%, respectively. Cumulatively, output fell 8.8% to 13.3m tonnes in 9M21, dragged mainly by labour shortfall arising from border closure (which in turn was due to Covid-19 pandemic). Exports rebounded in Sep-21. Exports rose by 36.8% MoM to 1.60m tonnes in Sep- 21, boosted mainly by higher exports to China (+70.5%), India (+21.4%), EU (+24.8%) and Pakistan (+24.1%). We believe strong exports to India (which has risen for the second consecutive month) was due to restocking activities ahead of festive season and on low inventory levels). Exports fell for the first 10 days of Oct-21. According to Amspec (cargo surveyor), palm oil exports fell 7.5% MoM to 500k tonnes during the first 10 days of Oct-21, dragged by lower exports to China and India. HLIB’s VIEWForecast. Maintain 2021-23 CPO price assumptions of RM3,800/mt, RM2,900/mt and RM2,800/mt, respectively. We see upside risk to our CPO price assumption for 2021, as the bullish price sentiment will likely be sustained into the near term, with potentially weak near-term exports demand from major palm oil consuming countries (namely, China and India, on the back of the absence of major festive season and winter season) will likely be mitigated by seasonally low palm oil production cycle and increasing likelihood of La Nina episode in coming months (which will likely result in a delay in soybean planting in Argentina and Brazil). Maintain OVERWEIGHT stance. We maintain our Overweight stance on the sector, underpinned by good near term earnings prospects (arising from high CPO prices). Top picks are IOI Corp (BUY; TP: RM4.44), KLK (BUY; TP: RM25.33), Sime Darby Plantation (BUY; TP: RM4.99) and TSH Resources (BUY; TP: RM1.31). Source: Hong Leong Investment Bank Research - 12 Oct 2021 More articles on HLBank Research Highlights >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|