Date: 07/10/2021

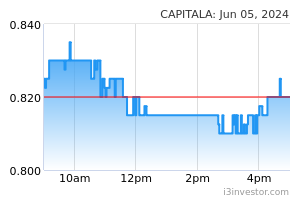

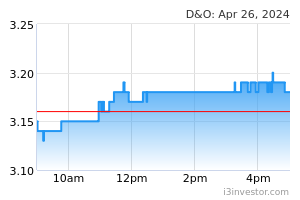

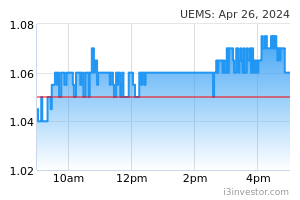

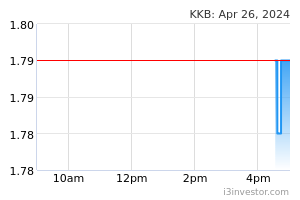

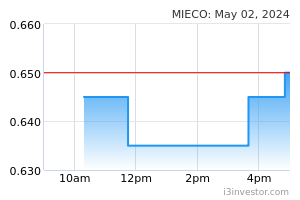

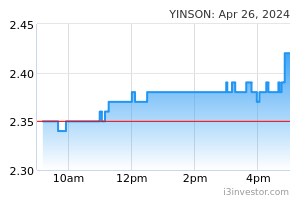

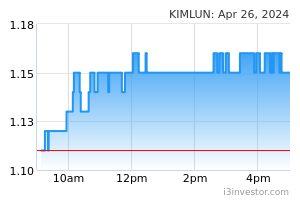

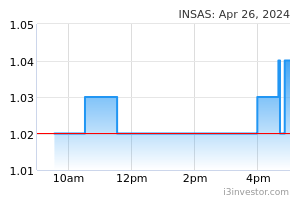

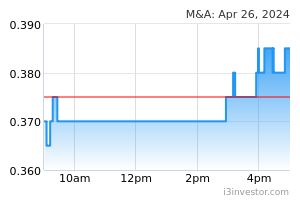

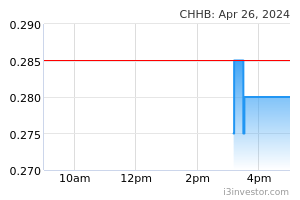

EconomyUS: Private sector job growth exceeds estimates in Sept. Employment in the US private sector increased by more than expected in the month of Sept, according to a report released by payroll processor ADP. The private sector employment jumped by 568,000 jobs in Sept after rising by a downwardly revised 340,000 jobs in Aug. Economists had expected private sector employment to climb by 428,000 jobs. (RTT) EU: German factory orders fall on weak auto sector. Germany's factory orders declined notably in Aug largely due to the weak demand in the auto sector, data from Destatis revealed. Factory orders fell 7.7% on a monthly basis, reversing a revised 4.9% rise in July. This was the biggest fall since April 2020. Orders were forecast to drop moderately by 2.1%. (RTT) EU: Construction sector continues to shrink. Germany's construction sector continued to contract in Sept with supply bottlenecks, capacity constraints and strong price pressures acting as headwinds to activity and new orders, survey data from IHS Markit showed. The construction Purchasing Managers' Index rose to 47.1 in Sept from 44.6 in Aug. (RTT) UK: Construction sector growth moderates in Sept. The UK construction sector growth weakened in Sept with the output rising to the smallest extent for eight months amid supply chain issues and softer demand, data published by IHS Markit showed. The Chartered Institute of Procurement & Supply construction Purchasing Managers' Index fell more-than-expected to 52.6 in Sept from 55.2 in Aug. The expected level was 54.0. (RTT) Japan: Labour practices keep wage pressures under control. Japanese firms have no pressing need to raise wages because they retained jobs during last year's pandemic-induced economic slump, and thus do not need to fill job vacancies as quickly as US companies. The surge in demand triggered by the re-opening of the US economy, and layoffs by US firms to deal with the pandemic's, have caused serious bottlenecks and labour shortages. (Reuters) South Korea: Has USD7.51bn current account surplus in Aug. South Korea had a current account surplus of USD7.51bn in Aug, the Bank of Korea said, down from USD8.21bn in July. The goods account surplus decreased to USD5.64bn, compared to USD7.08bn in Aug 2020. The services account recorded a USD1.0bn surplus, up from the USD0.88bn dollar deficit one year earlier, owing to an improvement in the transport account. (RTT) MarketsAirAsia (Neutral, TP RM0.86): Signs amendment agreement with Airbus. AirAsia Group has signed an amendment agreement with aircraft maker Airbus SAS to convert the budget airline’s remaining A320 aircraft orders to the A321neo. (The Edge) Comment: The higher-capacity (up to 236 passengers) and more fuel efficient (expect 10% fuel savings) A321neo will enable the group to increase capacity while benefiting from the lowest operating cost. While we are positive on the Group's continuing efforts to stay cost competitive in the long run, near term outlook of the Group hinges on the outcome of its lease restructuring and the pace of air passenger traffic recovery once travel restrictions are lifted. Maintain Neutral . D&O Green (Outperform, TP: RM6.31): Seeks higher margins from smart LED business. D&O Green Technologies is ramping up the business to garner higher margins by integrating the semiconductor integrated circuit (IC) and LED as a single component, which can cut down on the wiring and simplify the design. It helps make the cars more attractive and create a value proposition for our customers. (The Edge) UEM Sunrise (Neutral, TP: RM0.55): Undertakes sukuk programmes with combined limit of RM4bn. Property developer UEM Sunrise has lodged information with the Securities Commission regarding its Islamic Medium-Term Notes (IMTN) and Islamic Commercial Papers (ICP) programmes with a combined aggregate limit of up to RM4bn in nominal value. (The Edge) KKB: Partners Samsung Engineering for job tenders. KKB Engineering has inked a MoU with Samsung Engineering Co Ltd to collaborate in the bidding of tenders for projects worldwide. It said in a filing with Bursa Malaysia that such projects may involve a specialised scope of work and supply. (StarBiz) Mieco Chipboard: Plans private placement to raise up to RM75.1m to acquire SYF Resources unit. Mieco Chipboard is seeking to undertake a fundraising exercise via a private placement of which the proceeds will be to finance the proposed acquisition of Seng Yip Furniture SB (SYFSB). (The Edge) Yinson: Invests in Canadian firm to reduce reliance on fossil fuels. Yinson Holdings is set to lower or eliminate dependence on fossil fuels in marine and industrial applications by investing in Canada-based energy storage solutions provider Sterling PBES Energy Solutions Ltd. (BTimes) Kimlun: To set up sukuk murabahah programmes of up to RM800m. Kimlun Corp is setting up an Islamic commercial papers (ICP) programme and an Islamic medium-term notes (IMTN) programme with a combined limit of up to RM800m. The ICP programme would have a tenure of up to seven years commencing from the date of the first issuance of the ICP. (The Edge) Insas: To inject M&A Securities into SYF Resources in RM222m deal. Insas has proposed to inject M&A Securities SB into SYF Resources under a backdoor listing for its wholly-owned brokerage firm. Under the proposal, Insas will dispose of its 100% stake in M&A to SYF. (BTimes) Country Heights: Buys assets from executive chairman Lee Kim Yew. Country Heights Holdings has entered into five heads of agreements to acquire assets from the private investment holdings of executive chairman Tan Sri Lee Kim Yew. The deals are to delineate a clearer line of operations between the private interests of the controlling shareholder and Country Heights. (The Edge) Market UpdateThe FBM KLCI might open higher today after stocks on Wall Street rebounded from an early morning sell-off on Wednesday as Republicans appeared to offer a path, albeit temporary, to ending the US debt ceiling stand-off in Congress. The benchmark S&P 500 reversed its early losses of as much as 1.3%, closing up 0.4%. The technology-heavy Nasdaq Composite climbed 0.5%. On Wednesday President Vladimir Putin said Russia was prepared to supply more natural gas to Europe, prompting a sharp turnaround in prices. Stagflation risk returns for investors as gas prices surge Brent crude, the international oil benchmark which rose as high as USD83.47 a barrel on Wednesday, declined 1.8% to USD81.08. The decline hit stocks across Europe, with the region-wide Stoxx 600 falling 1% driven by a 2% drop in its energy subsector. London’s FTSE 100 index slipped 1.1% as the share prices of weighty constituents BP and Royal Dutch Shell, the oil producers, lost about 2.5% each. Back home, persistent buying momentum for plantation and oil and gas stocks amid growing optimism about a global economic recovery pushed Bursa Malaysia to close on a firm note on Wednesday, with the benchmark index ending at almost a one month high. The benchmark FBM KLCI rose 29.0 points or 1.9% to end the day at the day’s high of 1,559.42, compared with 1,530.42 at Tuesday’s close. Hong Kong’s Hang Seng fell 0.6% to its lowest level since October 2020. Mainland Chinese markets were closed for a public holiday, and MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.8%. Source: PublicInvest Research - 7 Oct 2021 More articles on PublicInvest Research >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|