Date: 01/10/2021

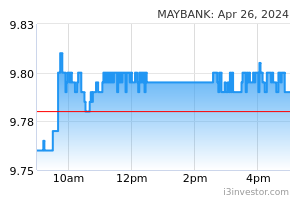

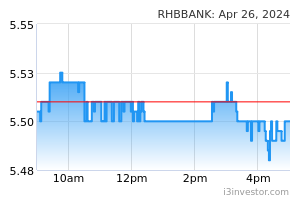

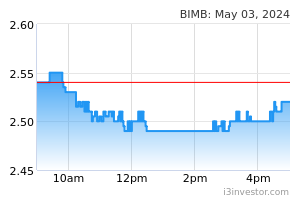

Aug 2021 system loan inched up at 2.5% YoY but saw a MoM decline of 0.2%, no thanks to softer business loans as household loans improved.This is still within our CY21 loans growth expectations of 3-4% as we believe a steady pick up to come in during the 4QCY21 period.However, the opposite is true on the loan repayment front where households likely took advantage of the opt-in moratorium. On the flipside, loan applications and approvals picked up MoM as both household and business accounts could be experiencing a greater spending appetite which could translate positively to Sept 2021 numbers and onwards. Industry-wide gross impaired loan (GIL) ratio was stable at 1.67% albeit is a peakish level. Deposits continued to grow with CASA still being favoured. Thanks to our improving vaccination rates, the progressive economic reopening is expected to translate favourably into the financial markets as consumption and investment trend is expected to be on the rise. We keep our systems loans and deposits growth expectations both at 3-4%, for now. We advocate MAYBANK (OP; TP: RM10.65) and RHBBANK (OP; TP: RM6.15) as our favourites within the sector, both being strong dividend yielders. MAYBANK is expected to benefit from a recovery phase given its market leading position while RHBBANK was tactically selected for its bid for a digital banking license. Meanwhile, we also rerate BIMB (OP) to a post-restructuring TP of RM3.65 (from RM5.10). Aug 2021 at a lull. YoY, system loans increased by 2.5% on the back of higher household loans (+3.4%) on vehicle and property spending whereas business loans (+1.2%) was mainly lifted by stronger manufacturing, mining and retail activities (both sectors which saw tighter restrictions in Aug 2020) but was generally offset by a decline in most other sectors. Loan disbursements saw a 20% spike YoY but possibly due to the continuously challenging climate, slid 0.2% MoM as banks behaved selectively. On the flipside, business loan repayments improved by 2.4% on clearer prospects in the manufacturing, construction and financial sectors, making up for the shortfall in retail, real estate and transportation services. Household repayments fell by 1.6%, which could be due to consumers opting in for the new moratorium (refer to Table 1-3 for breakdown of system loans). We maintain our CY21 system loans growth target of 3-4% for now, as we believe the impending recovery from easing restrictions would translate positively into demand for loans in 4QCY21, with signs of interstate movements soon to be permitted. Loan applications reinvigorated (-6% YoY, +12% MoM).While the preceding year’s loan applications was depressed by heavy uncertainties, the business climate is showing signs of improvement and incentivising companies to operate. Household and business loan applications grew 11% and 14% MoM, respectively. This is also reflected in an increase in loan approvals by 3% and 15% (refer to Table 4-5 for breakdown of system loan applications). Impairments still high but stable. In Aug 2021, total impairment was 22% higher than Aug 2020 but came in mostly flattish MoM. This could indicate that the harsh operating environment in Jul 2021 could be subsiding. In terms of GIL ratio, Aug 2021 came in at 1.67% (+0 bps MoM), with household loans reporting at 1.18% (+0 bps) and a marginal increase in business loans GIL at 2.38% (+2 bps). That said, banks are still exercising caution and continue to maintain prudent loan loss coverage levels at 113.3% (July 2021: 111.5%, Aug 2020: 98.4%) to serve as buffers in case of another downturn (refer to Table 6-7 for breakdown of system impaired loans). CASA remains buoyant. In terms of deposits, Aug 2021 grew 4.1% YoY and 0.1% MoM. CASA-to-deposit rose to 30.4% (July2021: 30.3%, Aug 2020: 28.3%) as cash liquidity remains to be important. This could also be due to the banks re-pricing their deposit products downwards, causing long-term deposits to be much less attractive to customers. We maintain our CY21 deposits growth target of 3-4% as we expect heavy withdrawals and spending to occur in the 4QCY21 period, in line with the expected re-opening of the economy. Meanwhile, system LDR came in at 83.1% (July 2021: 83.3%, Aug 2020: 84.4%) but we expect a rise in this ratio due to the abovementioned shifts. In terms of capital, industry CET-1 ratio stood at healthy at 14.67% (-11 bps) as banks prepare for half yearly dividend payments in Sept 2021. Maintain NEUTRAL on the banking sector. Although Aug 2021 numbers are not as perky as expected, we believe the subsequent months will make up for it as recent economic development and containment of the Covid-19 pandemic seems mostly positive. With Sept2021 seeing less restrictive movement controls, this should translate to better spending and health for the financial system. That said, we are cautious on the banks as we believe sentiment could be withheld by the entry of digital banks and the move towards a Standardised Base Rate in CY22. Our top picks are MAYBANK (OP; TP: RM10.65 )and RHBBANK (OP; TP: RM6.15). Both stocks are excellent dividend yieldersoffering6-8% and 5-6%, respectively, where MAYBANK is seen to be the favourite for its market leading position in both loans and deposits which makes it poised to enjoy the full leg of the recovery. RHBBANK was selected as a tactical pick given its affiliation with Axiata Digital (Boost) in a bid for one out of the five digital banking licenses on the table from Bank Negara. Meanwhile, we also re-rate BIMB (OP) to RM3.65 (from RM5.10) following the move to a sole PBV valuation from a SoP valuation post-completion of its restructuring exercise. Source: Kenanga Research - 1 Oct 2021 More articles on Kenanga Research & Investment >>

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|