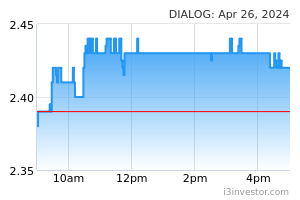

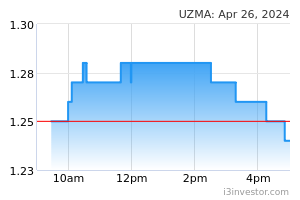

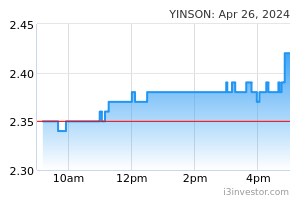

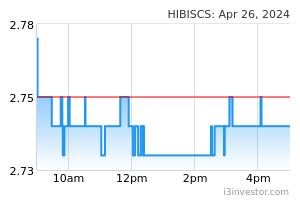

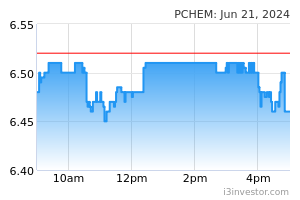

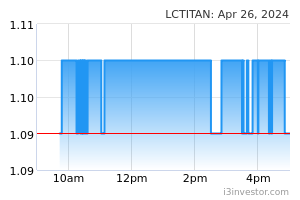

We upgrade the sector to OVERWEIGHT (from NEUTRAL previously). The KL Energy Index has been the worst performing sector in Bursa Malaysia since the start of 2020, with the sector now trading near trough valuations at -2SD below mean forward PER. In fact, throughout most of 2021, the sector has been trading at a divergence from the rally in crude oil prices. We believe this mispricing by the market may give rise to selective pockets of trading and bottom-fishing opportunities within the sector. Overall, local activity levels were severely hampered by the lockdown measures, and as such, we look forward for 2022 to be a recovery year – in tandem with a reopening theme amidst gradually increasing vaccination rates. Petronas, as well as global E&P companies, are looking to ramp up investments in the coming years after a 1–2-year period of under-investments; albeit spending will still be below pre-pandemic levels. Meanwhile, global oil demand is expected to recover back to pre pandemic levels in 2022, with demand-supply to rebalance above the 100m barrels per day mark. Nonetheless, we see growth in production (driven by OPEC+, U.S. oil and non-OPEC nations) potentially outpacing the slowing demand growth, and as such, may lead to a mild decline in oil prices. We maintain our 2021/2022 average Brent crude price assumption of USD70/65 per barrel. That said, we do not feel the potential pull-back in oil prices to be a cause for concern – an oil price of USD50 per barrel or above should be healthy enough to maintain current projections of investment and activities. As a comparison, Petronas is looking for Brent crude oil prices to hover between USD55-60 per barrel over the next five years in its budgeting and investment decisions. Top picks for the sector include DIALOG (OP, TP: RM3.50), UZMA (OP, TP: RM0.75) and YINSON (OP, TP: RM6.00). We also highlight HIBISCS (NR), PCHEM (MP, TP: RM8.55) and LCTITAN (NR) as potential trading proxies to oil prices – given the high correlation between their share prices and crude oil prices historically.

Sector currently trading near trough valuations. The KL Energy Index has been the worst performing sector in Bursa Malaysia since the start of 2020 – declining by 39% throughout this period. As a comparison, the FBMKLCI and the FBM100 index have only retreated 3% and 1%, respectively, during this same period. Triggered by the Covid-19 pandemic, this underperformance was caused by global lockdowns, leading to a huge collapse in energy demand. Meanwhile in more recent times, YTD the KL Energy Index further declined by 16%. While this only makes it the second worst performing sector (behind healthcare at -29%), this is a drastic contrast against the strength in Brent crude oil prices, which rallied 55% YTD. While we acknowledge that oil prices may not be a “be all end all” indicator of the sector’s overall health, this stark divergence does give rise to the point that the sector is currently trading at near trough valuations (at least on a market-cap weighted basis). In fact, the KL Energy Index is currently trading close to -2SD below its mean forward PER – similar levels to its March 2020 levels during peak lockdowns.

Source: Kenanga Research - 1 Oct 2021