M+ Online Morning Market Buzz – 2 Feb 23

Dow Jones: 34,092.96 pts (+6.92pts, +0.02%)

⬆ Resistance: 34900

⬇ Support: 32700

FBM KLCI: 1,485.50 pts (-13.89pts, -0.93%)

⬆ Resistance: 1540

⬇ Support: 1470

HSI Index: 22,072.18 pts (+229.85pts, +1.05%)

⬆ Resistance: 23200

⬇ Support: 21600

Crude Palm Oil: RM3,815 (-RM117, -2.98%)

⬆ Resistance: 4080

⬇ Support: 3650

Brent Oil: $82.84 (-$2.62, -3.07%)

⬆ Resistance: 90.80

⬇ Support: 82.00

Gold: $1,950.14 (+$22.26, +1.15%)

⬆ Resistance: 1990

⬇ Support: 1880

M+ Online Technical Focus - 2 Feb 23

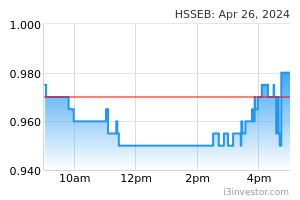

HSS Engineers Bhd: Supported by long term earnings visibility

Trading Catalyst

• One of the leading engineering consultancy groups in Malaysia, involved in major notable large-scale projects.

• Engaging in several projects such as MRT 3, East Coast Rail Line (ECRL), Bus Rapid Transit 3, Pan Borneo Sabah and data centre campus and its electric substation in Sedenak Tech Park, Johor.

• Outstanding orderbook at RM1.47bn and tenderbook of RM350.0m as at end 3Q22 will sustain earnings visibility until 2033.

• Technically, traders may anticipate for a potential breakout above RM0.475 to target the next resistances at RM0.495-RM0.52 with long term target at RM0.575.

Technical View

(i) HSSEB (S: RM0.445, R: RM0.495-0.52, LT TP: RM0.575, CL: RM0.44)

S: Support, R: Resistance, LT TP: Long term target price, CL: Cut loss

Source: Bloomberg, M+ Online

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.