M+ Online Morning Market Buzz - 19 Jan 23

Dow Jones: 33,296.96 pts (-613.89pts, -1.81%)

⬆️ Resistance: 35100

⬇️ Support: 32700

FBM KLCI: 1,495.50 pts (-3.88pts, -0.26%)

⬆️ Resistance: 1530

⬇️ Support: 1460

HSI Index: 21,678.00 pts (+100.36pts, +0.47%)

⬆️ Resistance: 22400

⬇️ Support: 20800

Crude Palm Oil: RM3,884 (+RM17, +0.44%)

⬆️ Resistance: 4050

⬇️ Support: 3710

Brent Oil: $84.98 (-$0.94, -1.09%)

⬆️ Resistance: 89.70

⬇️ Support: 80.80

Gold: $1,904.11 (-$4.58, -0.24%)

⬆️ Resistance: 1970

⬇️ Support: 1840

M+ Online Technical Trading Stocks - 19 Jan 23

Stock Name: UMC (0256)

Entry: Buy above RM0.70

Target: RM0.75 (7.1%), RM0.80 (14.3%)

Stop: RM0.675 (-3.6%)

Shariah: Yes

Technical: Flag-formation breakout

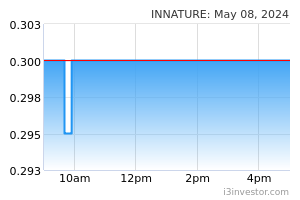

Stock Name: INNATURE (5295)

Entry: Buy above RM0.635

Target: RM0.68 (7.1%), RM0.72 (13.4%)

Stop: RM0.605 (-4.7%)

Shariah: Yes

Technical: Flag-formation breakout

Source: Bloomberg, M+ Online

Market update: The FBM KLCI slid as the cautious trading sentiment emerged ahead of the BNM MPC meeting, bucking the positive regional markets performances; the bullish sentiment on the regional markets was supported by the unchanged Bank of Japan’s monetary policy and optimism over China’s reopening. We believe the traders may take a cautious approach following the weaker trading tone on Wall Street overnight and ahead of the BNM OPR decision. Commodities wise, the Brent crude oil traded above USD84, while the CPO settled higher above RM3,850; gold price remained above USD1,900.

Sector focus: As the Brent oil remains positive above the USD80 mark, we believe investors may position themselves into the energy sector ahead of the earnings season. Meanwhile, we like consumer, transportation and logistics stocks following the reopening of China’s borders. However, traders may take a step back from selected technology stocks as Nasdaq retreated below the key 11,000 level.

Stocks to watch:

O&G: COASTAL, DELEUM

Consumer: BJFOOD, CYL, INNATURE, MFLOUR, SEM

Building material: AJIYA, BIG, KSSC

Technology: FRONTKN, NOTION

Transport & Logistics: AIRPORT, TNLOGIS

Others: APB, CFM, OPTIMAX, PECCA, REDTONE

Source: M+ Online

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.