M+ Online Morning Market Buzz - 4 Jan 23

Dow Jones: 33,136.37 pts (-10.88pts, -0.03%)

⬆️ Resistance: 34100

⬇️ Support: 32200

FBM KLCI: 1,473.99 pts (-21.50pts, -1.44%)

⬆️ Resistance: 1540

⬇️ Support: 1440

HSI Index: 20,145.29 pts (+363.88pts, +1.84%)

⬆️ Resistance: 20700

⬇️ Support: 19000

Crude Palm Oil: RM4,236 (-RM17, -0.40%)

⬆️ Resistance: 4370

⬇️ Support: 3930

Brent Oil: $82.10 (-$3.81, -4.43%)

⬆️ Resistance: 88.80

⬇️ Support: 79.70

Gold: $1,839.48 (+$15.46, +0.85%)

⬆️ Resistance: 1890

⬇️ Support: 1770

Market update: The FBM KLCI kicked off the first trading day in 2023 in the negative territory as market digested recent gains buoyed by year-end window dressing activities. We believe the pullback could be deemed as a healthy pullback and bargain hunting activities should pick up in undervalued stocks despite worries over the Covid-19 sub-variants may continue to weigh on investors’ sentiment. Still, we believe the reopening of China’s travel borders may provide decent growth for most of the global economies with another round of pent-up demand. Commodities wise, the Brent crude oil traded around USD82, while the CPO price hovered above RM4,200.

Sector focus: We remain positive stance on the oil & gas and plantation sectors as both the underlying commodity prices remain firm and should lift the sectors, respectively. Besides, tourism sector may see a turnaround with traveling activities picking up amid the reopening of China’s borders. Besides, the healthcare sector could see some trading interest on anxiety over the Covid-19 variants.

Stocks to watch:

Transportation and logistics: AAX, CAPITALA

Building material: AYS, CMSB, LBALUM

Tourism: GENM, OWG

Chemical: ANCOMNY, LCTITAN

Technology: SCICOM, SFPTECH

Others: JSB, JTIASA, MHB, UMW, YEWLEE

Source: M+ Online

M+ Online Technical Trading Stocks - 4 Jan 23

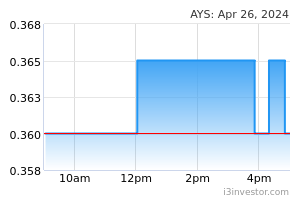

Stock Name: AYS (5021)

Entry: Buy above RM0.43

Target: RM0.455 (5.8%), RM0.47 (9.3%)

Stop: RM0.415 (-3.5%)

Shariah: Yes

Technical: Impending flag-formation breakout

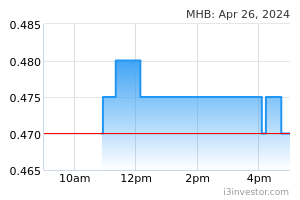

Stock Name: MHB (5186)

Entry: Buy above RM0.615

Target: RM0.65 (5.7%), RM0.67 (8.9%)

Stop: RM0.595 (-3.3%)

Shariah: Yes

Technical: Flag-formation breakout

Source: Bloomberg, M+ Online

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.