Review

- Stripping out an exceptional net gain from forex amounting to RM3.1mn, TRC’s 9MFY22 core profit of RM9.7mn came in below expectations, accounting for 46.3% and 48.7% of ours and consensus’ full-year estimates. The variance was mainly due to the lower-than-expected profit contribution from the joint venture development project in Australia.

- YoY, 9MFY22 core profit fell 40.3% to RM9.7mn, while revenue was 1.7% lower at RM512.9mn. The softer earnings performance was mainly attributed to the share of losses from the joint venture compared to the previous share of profit. The weaker performance in the joint venture was primarily due to a delay in property handover due to a shortage of workers.

- QoQ, 3QFY22 core profit fell 39.5% to RM3.0mn while revenue dropped by 30.7% to RM137.8mn. The weaker earnings performance was mainly due to lower revenue and gross profit.

- Its net cash position eased from RM153.8mn a quarter ago to RM140.2mn.

Impact

- Given the weaker-than-expected results, we cut FY22 earnings forecasts by 28.6% after factoring in lower profit contributions from the joint venture in Australia.

Outlook

- As of end-Sept 2022, the group’s outstanding construction order book stood at around RM0.7bn, translating to about 1.0xFY21 revenue.

Valuation

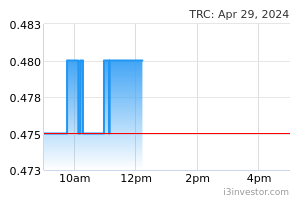

- No change to our target price of RM0.38, based on unchanged 8x CY23 earnings. Maintain a Buy call on the stock.

Source: TA Research - 30 Nov 2022