Review

- CJ Century Logistics Holdings’ (CJ Century) 9M22 core profit of RM22.8mn was within expectation at 76% our full-year forecast and 75% of consensus estimates.

- Excluding the discontinued courier operations, 9M22 core profit surged 90.8% YoY to RM22.8mn, underpinned by revenue growth of 13.6% YoY to RM725.9mn. The decent performance can be attributed to significant rise in revenue from the total logistics services segment (TLS) and procurement logistics services (PLS), which rose 13.8% and 13.2% YoY respectively. In TLS, the main revenue contributors were freight forwarding and warehousing services, which grew 13.8% and 19.6% respectively to RM302.9mn and RM133.4mn for 9M22.

- QoQ, 3Q22 revenue and adjusted PBT declined by 9.0% and 22.6% respectively. The decline was mainly due to lower revenue from both TLS (-5.0%) and PLS (-19.6) segments.

Impact

- No change to our FY22-24 earnings projections.

Outlook

- TLS revenue slipped 5% QoQ in 3Q22 due to: 1) normalisation in container freight rate, which marginally affected CJ Century’s freight revenue, and 2) temporary plant shutdown by one of the key customers in 3Q22. Meanwhile, the QoQ decline in PLS revenue was due to seasonal factor as exports of air-cons to Vietnam tend to slow in second half of the year.

- Looking forward, we expect 4Q22 earnings to grow sequentially as the key customer has resumed operations in 4Q22. For 2023, we expect China reopening to be one of the drivers to mitigate the recessionary risk in EU and US.

Valuation

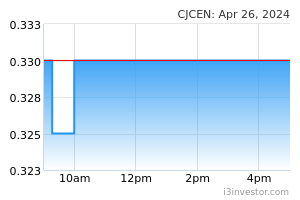

- We maintain CJ Century’s fair value at RM0.95/share, based on unchanged 16x CY23 EPS. We continue to believe that freight forwarder would benefit from the global supply chain disruption, thus CJ Century is a good hedge against global trade disruptions. Maintain Buy.

Source: TA Research - 25 Nov 2022