UOB Asset Management chief investment officer Francis Eng

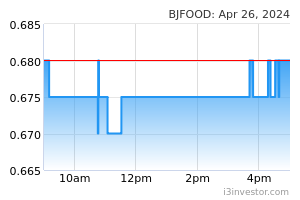

Berjaya Food operates Starbucks and Kenny Rogers Roasters (KRR) in Malaysia. There are 353 Starbucks outlets and 68 KRR restaurants nationwide. These two brands account for more than 95% of Berjaya Food’s sales.

Over the past two years, Berjaya Food has seen its profits more than double, surprising the market on the upside. The company revamped its store expansion strategy to focus on Starbucks drive-thru outlets, which tend to havae higher average ticket size and better margins. Secondly, Berjaya Food successfully turned around its previously loss-making KRR business.

Thirdly, the reopening of the economy after Covid-19 was positive for the business. The jump in profits helped underpin more than triple the share price of Berjaya Food from 2021 to 2022.

We see Berjaya Food’s earnings growth potential mainly underpinned by Starbucks. Besides underlying growth from its existing network, there is continued expansion in Starbucks outlets and, more importantly, about 40% to 45% of its new Starbucks stores planned in FY2023 will use the drive-thru format. Additionally, Starbucks would also enjoy the full-year impact in 2023 from recent price adjustments.

We see Berjaya Food as a quality proxy to consumption and believe that consensus is underestimating the company’s earnings potential.

TA Securities head of research Kaladher Govindan

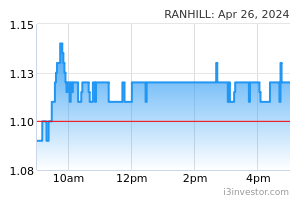

We like Ranhill Utilities for its compelling valuation, earnings growth from water tariff hike for non-domestic users, growing demand for its environmentally-friendly water technology solution, earnings contribution from its solar farm project in Perak, and possible rerating catalyst if it wins new projects locally and abroad.

Ranhill is currently trading at 14x calendar year (CY) 2023 price-earnings ratio (PER), which is significantly lower versus its historical average of 20x.

Earnings boost from water tariff hikes for the non-domestic segments is a near-term catalyst as the cabinet has approved an average increase of 25 sen per cubic metre for non-domestic categories and special categories in Peninsular Malaysia and Labuan from Aug 1, 2022. Currently, it is only awaiting state approval.

Economic recovery and improvement in water supply demand for the commercial segment will complement its earnings. We expect a 9% increase in blended tariff to RM2.43 per cubic metre and a 3% increase in volume to improve profit after tax and minority interest (Patami) by 10% in CY23.

Near-to-medium-term catalyst projects that may result in an earnings rerating consist of the Djuanda Water System Project in Indonesia and a 100MW gas plant on the west coast of Sabah. In particular, Djuanda entails development of a 605 million-litres-per-day water treatment plant and 99km of water transmission and distribution pipelines. It has a first-mover advantage that gives it the right to match any winning bid. It will likely require substantial capital expenditure of US$500 million to US$600 million (RM2.2 billion to RM2.6 billion) and boost Ranhill’s water capacity by more than 19%.

Besides, the group’s planned ventures into regional power markets in Thailand and Indonesia could finally bear fruit and add to long-term earnings catalysts.

We also anticipate growing demand for Ranhill Water Technology’s solutions that enable customers to improve and comply with environmental standards. This is via treatment of wastewater effluents from business operations, water reclamation to produce “grey water” and resource optimisation to reduce wastage. Additionally, Ranhill is also developing a 50MW large-scale solar plant in Perak that will be commissioned by December. Therefore, Ranhill benefits from twin catalysts comprising earnings growth and high environmental, social and governance ratings.

AHAM Capital deputy head of equity David Loh

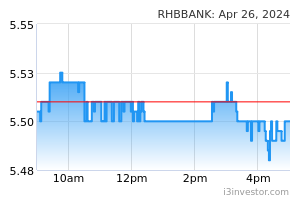

Overall, we like the banking sector, being a direct proxy to economic growth. Healthy loans growth and strong asset quality will drive earnings for the sector this year.

Bank Negara Malaysia has projected the economy to expand by 4% to 5% in 2023, supported by firm domestic demand amid continued improvements in the labour market.

Malaysia’s economic fundamentals remain strong, with our gross domestic product expected to be one of the strongest in Asean this year.

Banking sector earnings are also forecast to rebound sharply in 2023, after it was dampened by the one-off prosperity tax last year. In addition, the sector is highly liquid and will be the first port of call should foreign funds revisit Malaysia.

Our top pick in the sector is RHB Bank Bhd. The stock offers industry-leading 6% dividend yield, and has room to increase further, thanks to its comfortable capital position.

Valuations are also attractive relative to its peers, with RHB currently trading at a forward PER of 8.82 times and price-book value (PB/V) of 0.8 times.

Rakuten Trade head of equity sales Vincent Lau

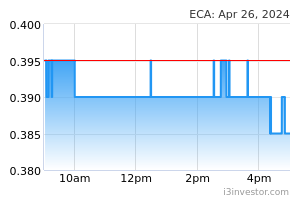

ECA Integrated Solution is likely to see record profits in 2023 and beyond, driven by strong demand for its customised process automation solutions from multinational corporation clients. The global trend of manufacturers is shifting towards automation and smart factories will benefit ECA.

The group, via a wholly-owned subsidiary, is principally engaged in the provision of integrated production systems and standalone automated equipment.

ECA has healthy profit after tax (PAT) margins of 28%. In November last year, the company raised RM25.5 million from its initial public offering (IPO), the bulk proceeds of which have been earmarked for expansion plans. We expect this will be the key catalyst for the company to graduate to the Main Board of Bursa Malaysia sooner than expected.

Of the RM25.5 million raised from the IPO exercise, RM7.7 million is allocated for the acquisition of machinery and RM14 million for working capital, while RM2.8 million has been earmarked to defray estimated listing expenses, and RM1 million for repayment of bank borrowings.

ECA’s IPO has done so well. Its share prices had surged almost five times to 80 sen per share as of last Thursday, compared to its IPO price of 17 sen apiece. At the last closing price of 80 sen per share, ECA has a market capitalisation of RM465 million.

While technology stocks have seen some correction in their share prices since the last quarter of 2022, we are sanguine on the sector especially with more companies and factories looking to automate their operations for cost optimisation.

Malacca Securities head of research Loui Low

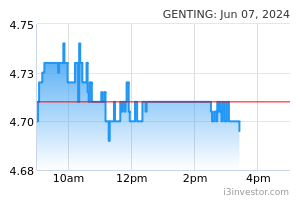

The reopening of business activities and international borders augurs well for Genting Bhd. Its business outlook is likely to turn positive with the reopening of China’s travel borders. The recent uptick in earnings suggests demand is building up after the slowdown in 2020 and 2021.

Genting posted first quarterly net earnings of RM128.02 million in the third quarter ended Sept 30, 2022 (3QFY2022), after six quarters of losses. Quarterly revenue jumped 74.79% year on year to RM6.12 billion from RM3.5 billion.

Compared with Genting Malaysia Bhd, Genting’s business is well diversified with better international exposure. Besides leisure and hospitality, the group is involved in oil palm plantation, power generation, oil and gas, property development, life sciences and biotechnology activities. It also has tie-ups with established names such as Universal Studios, Premium Outlets, Zouk, Hard Rock Hotel, Hilton and other brand partners.

Of the 13 analysts covering the stock, 10 have “buy” calls while three have “hold”. The upside is seen as attractive at 26% against the consensus target price of RM5.90 as tracked by Bloomberg.

After touching a low of RM4.01 in November 2022, Genting’s share price gained 16.7% to close at RM4.68 last Thursday.

Malacca Securities head of research Loui Low

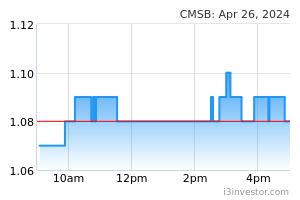

Cahya Mata Sarawak Bhd (CMSB) is a direct beneficiary of Sarawak’s growth, having evolved from a single-product manufacturer of cement to a portfolio of different segments including construction materials, trading, road maintenance, property development, financial services, smelting, telco infrastructure, education and other services.

It has ventured into the energy sector through the acquisition of Scomi Energy Services Bhd’s oilfield operations for RM21 million, which should bear fruit.

Also, CMSB will be able to take advantage of Sarawak Corridor Renewable Energy (Score)’s growth to help Sarawak achieve developed state status by 2030 through its experience in the past infrastructure works.

Closing at RM1.17 last Thursday, CMSB’s share price has surged 46.3% since its low of 80 sen in September 2022. Nonetheless, all five research houses covering the stock maintained their “buy” calls on the stock, with a consensus target price of RM1.48, suggesting an upside of 26.5%.

In its latest quarterly results, CMSB’s net profit for the third quarter ended Sept 30, 2022 (3QFY2022) almost tripled to RM154.36 million, from RM53.88 million a year earlier, helped by the recognition of negative goodwill of RM62.47 million arising from the acquisition of the Oiltools group.

The higher earnings were also due to the reversal of impairment of RM37.69 million on investment and loan to an associate.

MIDF Amanah Investment Bank Bhd research head Imran Yassin Yusof

The share prices of auto stocks under our coverage, including UMW Holdings Bhd, are currently still below pre-pandemic levels despite having seen significant earnings recovery.

The bulk of the share price upside last year was driven by upward revision in consensus earnings rather than a valuation reversion to historical mean, which has yet to materialise due to concerns over underlying demand momentum (beyond the tax holiday-driven demand) and cost pressures from a previously weakening ringgit trend, supply issues, and elevated commodity and logistics costs. We believe valuations will eventually catch up with the sustained earnings and balance sheet improvement.

MIDF’s target price of RM5 for UMW is among the highest on the back of strong revenue visibility underpinned by a large order backlog. The group recorded automotive sales of 93,972 units for 3Q2022, the highest quarterly performance for the year. In 2Q2022, it registered sales of 89,183 units.

For the cumulative nine months of 2022, the group delivered a total of 267,226 units, 62% higher than the 165,211 units registered a year ago. It is the distributor of the Toyota, Perodua and Lexus brands.

Besides automotive, UMW is also involved in the equipment as well as manufacturing and engineering segments.

According to Bloomberg, there are 12 “buy” calls and three “hold” for UMW, with a consensus target price of RM4.14, translating into an upside of 18.3%.

Auto players have built significantly large net cash reserves in the past two years, including UMW, which saw a jump to RM1.32 billion as at end-September 2022 from RM756.7 million as at end-June 2022.

https://www.theedgemarkets.com/node/651022